Diplomacy

Digital Soft Power: Reinvention of the Spanish-Speaking World

Image Source : Shutterstock

Subscribe to our weekly newsletters for free

If you want to subscribe to World & New World Newsletter, please enter

your e-mail

Diplomacy

Image Source : Shutterstock

First Published in: Dec.15,2025

Dec.12, 2025

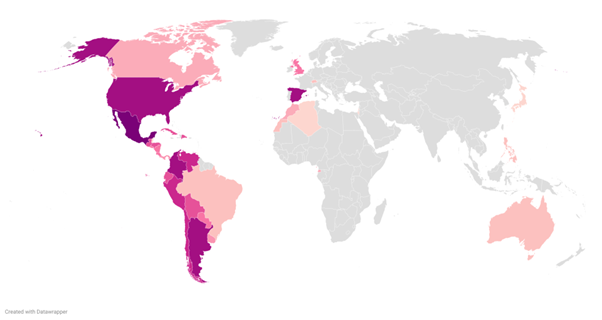

Soft-power dynamics have gained importance in the global arena. Moving from the classical cultural approach to the digital realm, soft power has now the ability to shift and transform geopolitics through technological influence. In the age of AI – where digital competitiveness across language blocs determines access to innovation, data, and influence – the emergence of a robust, multilingual digital ecosystem has become essential. Within this landscape, Spanish has become a key player. Spanish is a Romance language from the Indo-European language family that is spoken by around 636 million people worldwide. This number represents 7.6% of the global population and makes it the third most widely spoken mother tongue, after Mandarin and Hindi. Therefore, holding that position, Spanish has rapidly become one of the most influential languages in the digital sphere, this can be seen in the fact that Spanish ranks as the second most used language on the web, surpassed only by English. In fact, this digital presence is not a coincidence, it is part of a rapid digital reinvention driven by demographic strength, expanding connectivity, regional and local policies modernization, and a growing tech-savvy diaspora. Therefore, this transformation can be said to be reshaping Spanish-speaking economies, is enabling new digital ecosystems, and is positioning several Spanish-speaking countries as emerging innovation and digital hubs. As the transformations unfold, the digital reinvention of the Spanish-speaking world presents a powerful case of how linguistic, demographic, and technological forces converges to reshape geopolitical and economical power through digital soft-power.

For a better understanding, there are multiple forces that can explain why this shift is happening now. In economic terms, the demand for fintech, e-commerce, and mobile-based services has grown as Latin America’s expanding middle class accelerates the shift toward digital consumer habits. In demographic terms, with over 60% of the region’s population under 35 years old, it has one of the world’s youngest digital workforces. In addition, the large Spanish-speaking diaspora in the U.S. and Europe further amplifies cross-border entrepreneurship, remittances, and cultural-technological exchange. Moreover, global connectivity — expanded through fiber, 4G/5G networks, the widespread smartphone adoption and including digital transformation projects and financing — has enabled digital inclusion and remote-work globalization. While governments have also introduced strategic initiatives, such as digital identity programs, fintech sandboxes, and AI policies, helping structure the ecosystem.

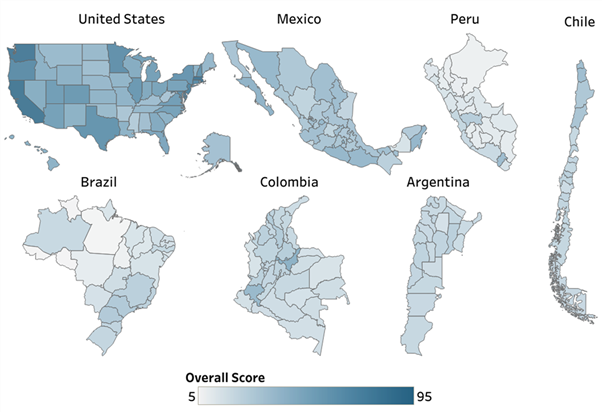

Spain has become a European gateway for Spanish-speaking startups by providing access to EU-wide digital infrastructure, funding programs, and regulatory harmonization. For instance, Barcelona and Madrid – usually ranked among Europe’s top tech hubs –, and initiatives like ‘España Digital 2026’ or the AI Strategy 2020 have played an important role in supporting Spain in this regard. In addition, Spain is also home of one of the European Blockchain Service Infrastructure (EBSI) nodes and has hosted major innovation events like 4YFN or the Mobile World Congress, which help Latin American founders integrate into the EU market In the Americas, Argentina stands out for its strong AI talent pipeline and world-class developer community. The country produces one of the highest numbers of software engineers per capita in Latin America – just behind Brazil and Mexico –, and some Argentinian Universities – like the UBA and UTN – are constantly top-ranked in math and computer sciences in the region. In addition, Argentina is home to pioneering companies such as Auth0 or Mural, while its AI scene has also contributed to multilingual datasets and early experimentation with Large Language Models (LLM) fine-tuning tailored to Spanish and regional dialects. Argentina’s neighbor, Chile, has taken a leadership role in digital governance, cybersecurity, and regulatory modernization. In 2021, Chile became the first Latin American country to pass a National AI Policy, and it is among the first to establish a Fintech Law and regulatory sandbox, enabling companies like NotCo, Fintual, and Betterfly to scale with legal clarity. In terms of digital governance, Chile’s Digital Government Division is internationally recognized for its interoperability standards and cybersecurity strategy aligned with OECD recommendations. Colombia is another key player in the region as it is rapidly scaling its digital workforce and fintech ecosystem, becoming one of the fastest-growing digital economies in Latin America. For instance, companies such as Rappi, Addi, and Mercado Pago Colombia have turned the country into a logistics and payments innovation center. In addition, the Colombian government has boosted initiatives like Misión TIC 2022 – which objective was to train over 100,000 citizens in software development – or GovTech Colombia – aiming to accelerate digital procurement – to strength its young-tech talent base. Finally, Uruguay is known for having built one of the strongest digital infrastructures in the hemisphere. In this context, Uruguay – ranked among the top in digital connectivity worldwide – has a universal fiber-optic coverage and nearly 100% of households connected to high-speed internet through the public telecom company ANTEL. In addition, its digital ID system, Ceibal, and its national e-government platform, AGESIC, are considered global benchmarks for digital public infrastructure in the region.

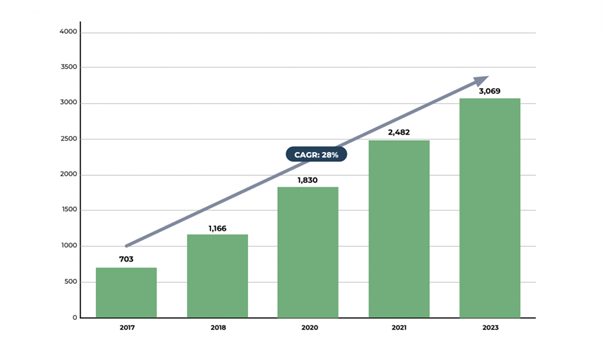

As read in the previous section, innovation is happening already across different key sectors. For instance, AI and LLMs are rapidly being adapted to Spanish, Indigenous languages, and regional contexts. At the same time, the region’s fintech and digital banking sectors are expanding at remarkable speed, positioning Latin America as one of the world’s most dynamic fintech environments. On the other hand, smart cities and digital public infrastructure — such as digital IDs, online government portals, and interoperable public services — are being deployed across major urban areas. In parallel, the EdTech sector is training millions of new professionals and turning the region into an exporter of digital-skilled talent. Finally, e-commerce and logistics innovations are also undergoing transformation, they are evolving introducing blockchain and Web3 frameworks, enabling new forms of decentralized marketplaces and governance. Together, these developments reveal how the Spanish-speaking world is building a connected and technologically adaptive innovation landscape.

However, despite the rapid progress shown, several issues continue to limit the digital transformation of the Spanish-speaking world. First, the digital divide remains a major challenge, particularly between urban centers with high-speed connectivity and rural or low-income areas where access to broadband, devices, and digital skills is still limited. Therefore, the resulting gap is visible in education, financial inclusion, and the ability of smaller communities to participate in the digital economy. The second challenge is the regulatory lag, which is also slowing the adoption of emerging technologies such as AI, cryptocurrency, and automation. This can be visible in the fact that many countries are still developing comprehensive frameworks for data protection, AI ethics, and digital asset oversight, usually leaving innovators operating in uncertain legal environments in the meantime. The third challenge is talent mobility. The region continues to experience significant brain drain as skilled workers tend to migrate to the U.S. and Europe. Even though there is an emerging countertrend of “brain return” thanks to remote-work global hiring, competitive salaries in tech, and new government incentives aimed at retaining or repatriating talent, still is not enough and is a challenge to be addressed. Finally, the fourth challenge is the cybersecurity risks, which have also become a big problem. Latin America has become one of the regions most targeted by ransomware and phishing attacks, vulnerabilities in public infrastructure, small businesses, and critical sectors have been highlighted in most of these attacks. In addition, the spread of misinformation and weak data-governance systems further threaten trust in digital services and democratic institutions.

Although significant challenges remain, addressing them requires aligning technological growth with stronger governance, skilled talent, sustained investment in human capital, and resilient digital infrastructure. Therefore, the next phase of digital reinvention will likely focus on region-wide AI standards, cross-border digital markets, and stronger public-private collaboration to scale infrastructure, talent pipelines, and cybersecurity. Thus, countries that successfully integrate education reforms, innovation incentives, and robust digital institutions will position themselves as global players in emerging technologies.

Spanish, as the third most spoken language in the world, provides a unique base for building a shared digital ecosystem that could connect people across continents – or the world. This linguistic advantage – combined with a young population, a growing connectivity, and a wave of technological innovation – has positioned the Spanish-speaking world at a pivotal moment of digital reinvention. Countries within the Spanish-speaking sphere are not only adapting new tools or technologies; they are building digital public infrastructure, developing and exporting tech talent, and contributing and participating in the global development of AI, fintech, and smart-city solutions. Still, innovation on its own is not enough. Consequently, closing the gap in the digital divide, strengthening cybersecurity, modernizing regulations, and finding ways to retain and reverse brain drain remain the main challenges. If governments and private actors succeed in building resilient digital institutions and harmonizing regional standards, the Spanish-speaking world could emerge as a major center of global technological influence. Ultimately, this transformation has the potential not just to modernize economies, but to redefine how more than 600 million Spanish speakers participate – and shape – in the digital age.

AGESIC (Agencia de Gobierno Digital) (2023). Digital Government Strategy of Uruguay 2020–2025. https://www.gub.uy/agesic/ BIS (Bank for International Settlements) (2022). Fintech Regulation and Payment Systems in Latin America and the Caribbean. https://www.bis.org/publ/bppdf/bispap124.pdf CAF (2022). GovTech Index for Latin America — Colombia Chapter. https://scioteca.caf.com/handle/123456789/1916 CAF (2022). Urban Mobility Observatory: Digital Public Infrastructure in Latin American Cities. https://www.caf.com/en/knowledge/ CB Insights (2023). Global Fintech Report: Q4 2023 — Latin America Section. https://www.cbinsights.com/research/report/fintech-trends-q4-2023/ CMF Chile (2022). Ley Fintech y Marco Regulatorio para Innovación Financiera. https://www.cmfchile.cl ECLAC (2022). State of Digital Development in Latin America and the Caribbean. https://www.cepal.org/en/publications ECLAC (2023). Status of Digital Infrastructure in Uruguay. https://www.cepal.org/en European Commission (2023). Spain Digital 2026: Spain’s Digital Transformation Strategy. https://espanadigital.gob.es/ Fira Barcelona (2023). Smart City Expo LATAM Congress Report. https://www.smartcityexpolatam.com GSMA (2023). Mobile World Capital Barcelona: Digital Talent Overview. https://www.mobileworldcapital.com GSMA (2023). The Mobile Economy: Latin America 2023. https://www.gsma.com/mobileeconomy/latin-america/ Government of Chile (2021). National Artificial Intelligence Policy. https://www.ciencia.gob.cl/ia/ IDB (2021) Accelerating the Digitization of SMEs in Latin America and the Caribbean. https://www.iadb.org/en/project/RG-T3902#:~:text=and%20the%20Caribbean-,Accelerating%20the%20Digitization%20of%20SMEs%20in%20Latin%20America%20and%20the,the%20digital%20transformation%20of%20MSMEs. IDB (2022). The Digital Transformation of Latin America and the Caribbean: Opportunities, Challenges and Policy Priorities. https://flagships.iadb.org/en/MicroReport/digitalizing-public-services-opportunities-for-latin-america-and-the-caribbean IDB (2023). Argentina’s Digital Talent and Innovation Ecosystem. https://www.iadb.org/en IDB (2025) IDB Approves Financing to Support Digital Transformation and Use of Artificial Intelligence in Piauí, Brazil. https://www.iadb.org/en/news/idb-approves-financing-support-digital-transformation-and-use-artificial-intelligence-piaui-brazil#:~:text=The%20expansion%20of%20connectivity%20is,co%2Dfinancing%20is%20$12.5%20million.&text=The%20Inter%2DAmerican%20Development%20Bank%20(IDB)%20is%20devoted%20to,well%2Dbeing%20in%2026%20countries. Instituto Cervantes (2025). Anuario del Instituto Cervantes 2025: El Español en el Mundo. https://www.cervantes.es/sobre_instituto_cervantes/informes_actividad/anuario.htm MIT Technology Review (2023). AI Innovation in Latin America: Spanish-Speaking Ecosystems. https://www.technologyreview.com/ Ministerio TIC (2022). Misión TIC — Informe de Resultados. https://mintic.gov.co OECD (2020). Digital Government Review of Chile: En Chile, hacia un Estado Digital. https://www.oecd.org/en/publications/digital-government-in-chile_9789264258013-en.html OECD (2020). Latin American Economic Outlook 2020: Digital Transformation for Building Back Better. https://doi.org/10.1787/20725140 OECD (2022). OECD Digital Government Review of Spain: Enhancing the Digital Transformation of the Public Sector. https://www.oecd.org/content/dam/oecd/en/publications/reports/2021/07/enhancing-digital-diffusion-for-higher-productivity-in-spain_8b97078e/ce12270a-en.pdf Poorte, Marielle (2025) How many people speak Spanish in the world? 42 Statistics. Speak easy. https://www.speakeasybcn.com/en/blog/how-many-people-in-the-world-speak-spanish#:~:text=42%20statistics%20about%20Spanish%20speakers,most%20widely%20spoken%20Romance%20language. Stanford HAI (2024). AI Index Report 2024 — Regional Spotlight: Latin America. https://aiindex.stanford.edu/report/ Statista (2023). Fintech in Latin America – Market Insights and Outlook. https://www.statista.com/topics/5123/fintech-in-latin-america/?srsltid=AfmBOorQcdxpAWPuf6g7Ojqbg8Yb_bQtZZmsl--OxOL29w4nQxKsI8lp#topicOverview UNESCO (2021). Latin America and the Caribbean: Artificial Intelligence Needs, Challenges and Opportunities. https://unesdoc.unesco.org United Nations (2022). World Population Prospects 2022 — Latin America & Caribbean Profile. https://population.un.org/wpp/ World Bank (2020). Argentina: Fostering Technology and Innovation for Productivity. https://documents.worldbank.org World Bank (2021). Digital Economy for Latin America and the Caribbean (DE4LAC) Report. https://www.worldbank.org/en/topic/digitaldevelopment World Bank (2022). GovTech Maturity Index 2022 — Uruguay Profile. https://www.unesco.org/ethics-ai/en/uruguay World Bank (2023). Colombia Digital Economy Country Assessment (DECA). https://www.worldbank.org

First published in :

World & New World Journal

Unlock articles by signing up or logging in.

Become a member for unrestricted reading!