Energy & Economics

The European smartphone market: premium loyalty, Chinese competition, and tariff pressure

Image Source : Shutterstock

Subscribe to our weekly newsletters for free

If you want to subscribe to World & New World Newsletter, please enter

your e-mail

Energy & Economics

Image Source : Shutterstock

First Published in: Oct.01,2025

Oct.01, 2025

Summary

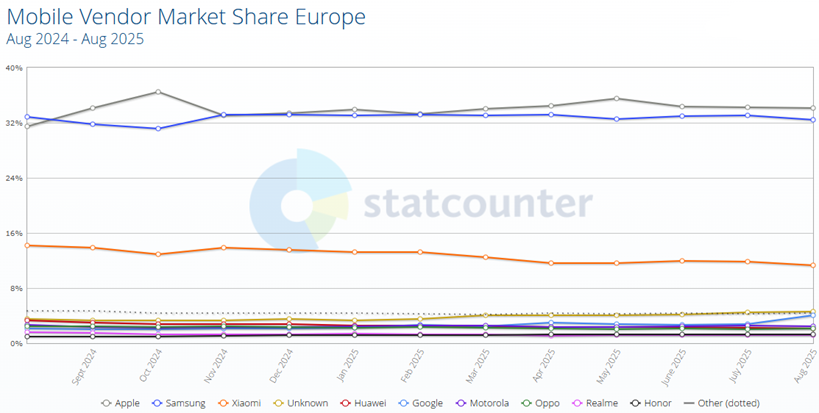

Apple and Samsung remain the dominant forces in the European smartphone market, but Chinese brands are moving up the ranks and capturing market share - especially in the mid-range and premium segments. Trade measures and new EU regulations (eco-design) as well as regional economic weaknesses will influence demand and pricing in 2025.

Source: https://gs.statcounter.com/vendor-market-share/mobile/europe?

A look at Apple in Europe

Apple holds a unique position in Europe, as it focuses less on pure delivery volume and more on anchoring itself in the premium segment. About one in three active smartphones in Europe is an iPhone [1], a number that matters more than quarterly shipment fluctuations. Even as shipments in Europe fell by nine percent in mid-2025, Apple's large installed base and trade-in programs helped maintain momentum [2].

Germany is a telling case in point. Apple's market share here is just over thirty percent, due to a mix of price-sensitive Android buyers and a strong premium niche who opt for iPhones due to the stability of the ecosystem, resale value, and perceived better privacy [3]. Penetration is higher in the more affluent northern and western markets, from the Nordics to the UK, underlining why Apple's marketing and retail strategy is heavily focused on these regions.

Loyalty binds these markets together: almost nine out of ten iPhone users stay with the brand when they upgrade [4]. Combined with the high resale value, this reinforces the benefits of ownership. The iPhone 17 offers subtle but strategic updates - more base storage, improved cameras, and a slimmer 'Air' edition - aimed at retaining existing users rather than shaking up the market [5].

Behind the scenes, Apple is also quietly shifting supply chains and expanding iPhone assembly in India to be less vulnerable to tariff shocks and geopolitical risks [6]. For Europe, this means more stable pricing in the medium term, even as the EU tightens its regulations on eco-design and repairability.

In short, Apple's strength in Europe comes not from chasing every segment, but from cultivating a premium base that rarely deviates. This base is both its shield and its springboard as competitors aggressively push into the mid-range and even the premium segment.

Source: Shutterstock/Elvard project - BSD City, Indonesia, August 21, 2025 Back of an orange iPhone 17 Pro and an orange Samsung S22 Ultra

A look at Samsung in Europe

Samsung continues to be a consistent powerhouse in the European smartphone market. Unlike Apple, which is firmly anchored in the premium segment, Samsung's influence extends across all segments. From the high-end Galaxy S/Ultra series to the growing range of foldable devices and the hugely popular mid-range Galaxy A devices, Samsung ensures that there is a flagship-quality option in every price segment. This range is one of the reasons why the company consistently is the largest smartphone supplier in Europe by volume, claiming around 36% of the European market in the second quarter of 2025 [2].

The Galaxy A series, which includes models such as the A16 5G and the A56, has played a special role in this. These mid-range devices offer a good balance of performance, camera quality, and affordability, making them particularly appealing to price-sensitive consumers. The A56 alone recorded a 12% increase in sales compared to its predecessor, despite a slight decline in Western European smartphone sales overall [7].

Samsung's appeal goes beyond hardware. Through close partnerships with carriers and retail chains, the company has a reach that few rivals can match, enabling promotions, bundles and financing offers that appeal to buyers from all demographics. Android's flexibility is another draw - customers who value customization, connectivity with non-Apple devices or advanced camera and display features often choose Samsung.

Samsung's multi-tiered approach gives the company versatility and resilience. While Apple focuses on customer loyalty and premium margins, Samsung covers both the high-end and mid-range segments. Foldables and advanced mid-range devices are particularly popular in the tech-savvy cities of Europe, where buyers like to experiment with features and form factors.

In short, Samsung's European approach is broad rather than exclusive - covering premium aspirations, mainstream demand, and everything in between. This ensures that the brand has a strong presence across all consumer segments, from students seeking reliable mid-range phones to professionals looking for innovative flagships.

Other brands in Europe

While Apple and Samsung dominate the European smartphone landscape, other brands are quietly reshaping the market. Chinese manufacturers, including Xiaomi, HONOR, realme, OPPO and OnePlus, have been steadily gaining ground, especially in the mid-range segment where value for money is most important. Some of these brands are even making inroads into the premium segment, experimenting with foldable devices and advanced camera features, trying to establish themselves as credible alternatives to the established giants. Their approach is a balanced mix of aggressive pricing to attract first-time buyers and selective launches at the high end to build prestige and brand awareness [8][1].

In the meantime, smaller vendors continue to carve out their niches. Google's Pixel phones, for example, appeal to consumers who value a clean Android experience, consistent software updates, and high-quality cameras. Motorola and Sony have a smaller but loyal following, often among buyers who value reliable hardware at a fair price. In Eastern Europe and emerging markets, brands such as Transsion have started to offer very affordable devices tailored to specific regional needs, further increasing consumer choice.

These players are making the European smartphone market increasingly dynamic, offering consumers more choice - from advanced cameras to flexible Android software and competitive pricing. While Apple and Samsung continue to dominate the premium and mass market segments, other brands are steadily changing the perception of what a European smartphone can offer.

Source: Shutterstock/ICXd Thailand,Bangkok - August 27, Collection of popular mobile phone logo apple, huawei, samsung, nokia, realme, oneplus, lenovo, lava, sony, LG, Xiaomi, Motorola,oppo, vivo, ZTE

Global problems with tariffs on smartphones

The smartphone world is not just about innovation, but also about politics. In 2024-25, tariffs on Chinese goods made headlines. The US threatened to impose high tariffs on electronics, which could have driven up the prices of smartphones and laptops. Industry lobbying softened the blow: key categories such as smartphones were exempted from the strictest reciprocal tariffs, which could have mitigated a massive price shock, although uncertainty in global supply chains remains a major problem [9][10].

Europe, on the other hand, has avoided blunt tariffs on smartphones. Instead, manufacturers are navigating regulatory changes - eco-design requirements, repair standards, and trade barriers - that subtly increase costs. The result is less dramatic headlines, but no less tension for OEMs who are closely watching trade measures between the U.S. and China as they affect sourcing and assembly globally.

Companies like Apple and Samsung are hedging against this uncertainty by diversifying their production. Apple has ramped up iPhone assembly in India, while other brands are spreading their production to Vietnam, Malaysia, and other countries. Impending tariffs and changing regulations may affect lead times and profit margins, even if European consumers are not yet feeling the direct impact [10].

Slower economic growth makes mid-price alternatives and competitive Chinese brands more attractive. Flagship smartphones, which often cost more than €1,500, raise the question of whether ultra-premium devices still fit into everyday life in times of rising living costs.

Consumer preferences in Europe

European smartphone buyers are not a monolith. Broadly speaking, the market is split into two camps. Premium buyers value ecosystem integration, software updates and build quality and opt for Apple and Samsung. Value-conscious buyers focus on value for money and are increasingly opting for brands such as Xiaomi, realme and HONOR. Financing options, carrier subsidies and trade-in programs often influence when and how customers upgrade [11].

Trust and perception also play a role - especially in Germany. Privacy concerns and political sentiment towards China weigh heavily. German consumers, both individuals and businesses, are wary of Chinese-made devices in sensitive areas, giving Apple and Samsung an advantage when it comes to security and brand awareness [12].

Source: Shutterstock/Anatoliy Cherkas Customer comparing various mobile phones in a tech store, selecting the ideal device tailored to her unique needs and preferences

The upgrade rhythms differ depending on the ecosystem. iPhone owners show strong loyalty, while Android buyers - especially in mid-range segments - switch brands more frequently due to better features or price. This behavior explains the rapid growth of Chinese OEMs and mid-range models and illustrates how ecosystem and satisfaction lead to repeat purchases [13].

In short, European consumers weigh price, performance, ecosystem, and trust - factors that vary depending on whether the buyer is a premium enthusiast or a value seeker. This nuanced behavior influences how brands position devices, launch models and plan for long-term growth on the continent.

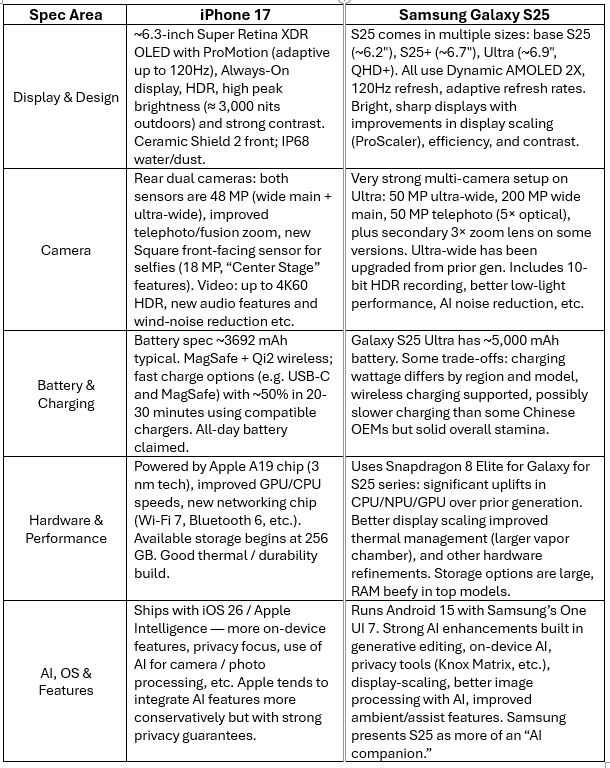

iPhone 17 vs Galaxy S25 — Tech Comparison

Source: Shutterstock/Sashkin Modern lens of smartphone double camera structure. New features for a smartphone camera concept. 3d illustration

Observations: Where Each Excels & Trade-Offs

• Cameras: Samsung (especially Ultra) wins on sheer versatility (more lenses, higher MP, better telephoto) and possibly low-light/detail thanks to sensor size and AI noise reduction. iPhone 17 shines in video consistency, processing, and front-facing “Center Stage” improvements.

• Display & Brightness: Both are strong; iPhone probably edges ahead in outdoor brightness/visibility with peak luminance claims; Samsung wins in display size options (Ultra, plus), scaling, and maybe smoother animations thanks to their hardware + adaptive refresh tech.

• Battery & Charging: Samsung has larger batteries in its high-end models; iPhone balances good battery with durability and efficient hardware. Charging speeds might favor Samsung in some markets, but Apple now supports faster wired/wireless + MagSafe maintained.

• Hardware / Performance: Samsung’s chipset leap shows up in raw power + AI task support. Apple’s A19 is very efficient, tightly integrated, often delivering real performance with lower power draw. Apple also tends to offer longer software support.

• AI & OS: Samsung pushes more aggressively into “AI companion” territory, making more tasks on-device that used to require cloud. iPhone focuses on privacy, on-device intelligence, camera/AI tools, and a more closed ecosystem. Preference depends on how much a user values customization versus privacy and integration.

What about European brands?

In Europe, there are no longer many smartphone manufacturers that cover the entire spectrum. Most local activities focus on software, components, or niche manufacturers such as Fairphone, which emphasize sustainability, modular design and repairability. These brands appeal to consumers for whom ethics and environmental responsibility are more important than innovative technical specifications.

Even large corporations such as VW and BMW are only tentatively dabbling in this area and have yet to launch devices for the mass market. The reality is that global giants such as Apple, Samsung and increasingly aggressive Chinese OEMs dominate the European smartphone market, while domestic brands occupy specialized niches [14].

Market outlook

In the short term - i.e., over the next 12 months - smartphone shipments in Europe could stagnate or decline due to economic restraint, the rising cost of living and stricter EU eco-design regulations. The premium segment remains resilient: Apple, high-end Samsung models and top Chinese devices continue to appeal to buyers seeking quality, design, and ecosystem benefits. Chinese brands are steadily gaining traction in the mid-price segment, especially in markets that are less sensitive to country-of-origin concerns [2].

Looking ahead to the next 24 months, several forces will change the landscape. Supply chains will diversify, with more assembly in India and Southeast Asia reducing dependence on China. Competition will intensify with AI features, voice assistants, and foldable devices as brands differentiate beyond hardware. Regulatory pressure on repairability, durability and sustainability could increase prices or shift the perception of value towards software and services. Apple's service ecosystem could gain traction, while Samsung's breadth and Chinese OEMs' aggressive pricing ensure a dynamic market for European consumers [15].

Source: Shutterstock/Sayan Puangkham Timeline to 2026 – Business Growth and Future Strategy, A futuristic business timeline concept moving from 2020 to 2026. A hand points toward the glowing year 2026.

Sources:

[1] StatCounter, Mobile Vendor Market Share Europe, Aug 2025 https://gs.statcounter.com/vendor-market-share/mobile/europe

[2] Canalys, Europe smartphone shipments Q2 2025 https://canalys.com/newsroom/europe-smartphone-market-q2-2025

[3] StatCounter, iOS share Germany 2025

https://gs.statcounter.com/os-market-share/mobile/germany

[4] CIRP, iPhone loyalty and resale value 2024–25

https://appleworld.today/2025/08/cirp-apple-loyalty-depends-on-carrier-loyalty/

[5] TechRadar/Macworld, iPhone 17 launch coverage, Sept 2025

https://www.techradar.com/news/new-apple-event

[6] Reuters, Apple expands India assembly, 2025 https://www.reuters.com/world/china/apple-aims-source-all-us-iphones-india-pivot-away-china-ft-reports-2025-04-25

[7] SamMobile, Samsung mid-range phones success in Europe, https://www.sammobile.com/news/guess-which-samsung-mid-range-phone-is-a-massive-hit-in-europe/

8] Financial Times, Chinese smartphone brands target Europe with mid-range and premium launches, 2025, https://www.ft.com/content/a982abf2-9564-4a8c-b8df-9e614ecd2151

[9] Reuters, U.S. exempts key electronics from severe tariffs after industry lobbying, 2025, https://www.reuters.com/technology/us-exempts-electronics-tariffs-2025-06-15

[10] Avalara, Global tariff landscape and smartphone supply chain impact, 2025, https://www.avalara.com/blog/en/2025/05/global-tariff-impact-smartphones.html

[11] Financial Times, European consumers split between premium and value smartphones, 2025, https://www.ft.com/content/consumer-smartphone-trends-europe-2025

[12] Emerald Insight, Country of origin and consumer electronics perception in Europe, 2024, https://www.emerald.com/insight/content/doi/10.1108/XXXXX/full/html

[13] Backlinko, iOS vs Android loyalty in European smartphone users, 2025, https://backlinko.com/ios-android-loyalty

[14] Patently Apple, European smartphone brands and market presence, 2025, https://www.patentlyapple.com/patently-apple/2025/02/european-smartphone-brands.html

[15] Reuters, Smartphone industry outlook: supply chains, AI, and regulatory pressure, 2025, https://www.reuters.com/technology/smartphone-outlook-2025

Unlock articles by signing up or logging in.

Become a member for unrestricted reading!