Energy & Economics

Korean Soft Power: How K-Food is taking over the global stage

Image Source : Shutterstock

Subscribe to our weekly newsletters for free

If you want to subscribe to World & New World Newsletter, please enter

your e-mail

Energy & Economics

Image Source : Shutterstock

First Published in: Nov.10,2025

Nov.10, 2025

Seoul South Korea Apr 5 2023 Stock Photo 2350709469 | Shutterstock

A decade ago, Korean cuisine was largely unfamiliar to international audiences. However, the growing influence of Hallyu, with its K-pop and K-Dramas, sparked interest in Korean food among fans and admirers of Korean culture. This expansion of Korean cultural soft power directly contributed to the increased global interest and demand for K-Food, transforming it from a niche phenomenon to a major component of international food markets.

In 2018, The Economist published an article on the Korean food industry and called it a promising and very prospective sector. Initially, this was a somewhat ambiguous statement, as it seemed an already established market would be too exposed and face excess supply. Nonetheless, Korea continued to gain popularity. The global attention generated by K-POP and K-dramas directly boosted state tourism and positioned Korea as a growing soft-power house with extensive influence, especially among youth, similar to how Japan leveraged its Anime culture. Consequently, as global attention increased, the country was able to expand its dominance in exports, leading to the South Korean food market growing alongside the recognition of its culture over several years.

During the COVID-19 pandemic, Korean culture experienced a renaissance, gaining the world’s attention through music and dramas like Squid Game. Crucially, alongside this cultural peak, Korean food's popularity rose significantly among the younger generation. With lockdowns, people spent their time making Korean Dalgona coffee and creating trending TikToks. This period served as a turning point that accelerated the popularity and recognition of K-Food.

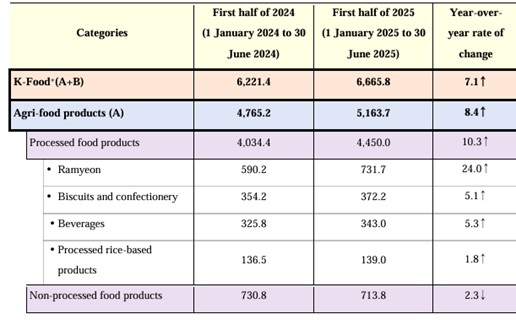

In 2025, Korea saw an increase of almost 10% in agri-food sector exports compared to the 2024 indicator.

• The U.S. USD 440 million in Q1 of 2025, up by 25.1% year over year → USD 493.7 million in Q2 of 2025, up by 28.6% year over year

• China USD 317.5 million in Q1 of 2025, up by 1% year over year → USD 424.5 million in Q2 of 2025, up by 9.4% year over year

• Japan USD 332.1 million in Q1 of 2025, up by 0.8% year over year → USD 365.6 million in Q2 of 2025, up by 6.9% year over year

Processed K-Food: The Rise of Ramyeon and Snacks

K-Food can be divided into two major groups: processed and non-processed. The rapid rise in K-food exports can be largely explained by the explosive popularity of Korean ramyeon and snacks. Ramyeon exports alone grew more than 24% compared to 2024.

Most of the popular ramyeon brands overseas are:

Buldak Ramyeon

Jin Ramyeon

Samyang Ramyeon

Shin Ramyeon

(Source: Kuala Lumpur Malaysia Dec 24 2024 Stock Photo 2572271189 | Shutterstock)

Buldak Ramyeon, a brand under the Samyang Food Conglomerate, is one of the most popular Korean foods globally. It gained popularity due to its captivation, addictive taste and superior marketing. On social media like TikTok and Instagram, people created a trend where they tried to make an almost restaurant-level version of ramyeon. Moreover, its several spice levels brought significant attention to the brand, accompanied by memorable advertisements.

The well-known “mukbang” industry, which has crossed borders, is also a major factor in the popularity of K-Food, especially ramyeon. This content is particularly popular in the USA. USA-based mukbangers are one of the reasons Buldak Ramyeon is so popular, as viewers find ramyeon mukbangs enjoyable to watch. Additionally, compared to other Korean food, ramyeon is practical and easier to buy. Samyang Food leveraged this success, expanding within five years to reach global dominance with new establishments in China and the USA in 2021 and Europe in 2024. In fact, more than 70% of the firm’s revenue is accounted for by its exports, signifying the company's global grip.

Other notable brands include Nongshim and Ottogi. Nongshim, well known for its collaborations and wide range of flavors, also experienced a huge sales increase. Earlier in 2025, a new Netflix cartoon, Kpop Demons x Hunters, was a worldwide sensation. The instant noodle conglomerate quickly announced a collaboration with the hyped series, which was a success for Nongshim, resulting in a sold-out release of the cartoon collaboration ramyeon. Unlike Samyang, Nongshim had a bigger foundation and, within a year, increased its worldwide recognition even more. According to Nongshim’s 2023 annual report, the company accounted for 53% of total Korean instant noodle sales.

Other popular choices are Korean snacks, which even surpassed ramyeon in yearly growth. The popularity of snacks goes beyond ChocoPie. With strong marketing and idol-featuring advertisements, products like Pepero and Turtle Chips are highly popular. Most snacks are often featured in Top Korean Dramas; for fans, eating them is a simple way of trying Korean culture. Furthermore, some companies adapt original snacks to local tastes and follow global trends. With the rise of “matcha” popularity, Korean brands converted original flavors into new “matcha” variations to capture the “hype.” The elasticity of snack brands and their fast adaptation to changing regions made them highly promising and growing.

(Source: Penang Malaysia 22 Feb 2023 Various Stock Photo 2274778451 | Shutterstock)

Korean processed food is not the only category that has grown. The popularity of Korean street food and Hansik (traditional Korean cuisine) is also noticeable. Korean bean paste, or Jang, was listed as a UNESCO Heritage, which also brought attention to the food market.

In the USA, Hansik gained traction with K-BBQ, tteokbokki, and all kinds of stews. Similar to Chinese Hot-Pot, Korean BBQ is very adaptable to local tastes and serves as a common social spot. Tteokbokki is also popular, especially among younger generations. However, compared to the Chinese Food Restaurant market, there’s no dominant national franchise, and the majority of K-Food restaurants are run by locals who moved to the area long ago, before the global surge of K-culture.

As mentioned, Nongshim Foods accounts for about 54% of total instant noodle sales across the world. To establish itself as the main ramyeon company, Nongshim opened a pop-up store in Times Square, the world’s most popular tourist destination. Digital billboards brought attention to the brand, strengthened by engaging games and social media events. Clearly, this shows the brand's eagerness to position itself in the USA market. As the Nongshim representative says, “This campaign went beyond simple digital advertising to become a festival where global consumers could directly taste and enjoy Shin Ramyun. Starting from New York Times Square, we will continue to connect directly with consumers worldwide and actively spread Shin Ramyun's global slogan, 'Spicy Happiness In Noodles.'"

(Source: A Nongshim Shin Ramyun advertisement in collaboration with Netflix’s KPop Demon Hunters is displayed on a digital billboard in New York, Friday (local time). Courtesy of Nongshim)

In Europe, Korean food has just started to grow its potential. Samyang Food opened branches in Europe only in 2024, which makes this market new and full of potential compared to the saturated USA market. The market is steadily growing and is especially in high demand in the Eastern part. Particularly during the Olympics in Paris, K-Food brands established themselves as a healthy and convenient alternative to traditional cuisine. Pop-up stores with Korean dumplings and rice cakes brought attention to K-Food and beverages, allowing brands like Bibigo and Cass to strongly position the Korean food industry in the European market.

In Russia, the situation is different. In 2020, a Russian entrepreneur started a successful business with Korean street food. Chiko has almost monopolized the K-food market in Russia with dozens of restaurants. Chiko successfully adapted Korean food to local taste and products, resulting in dishes that are less spicy but much brighter in color due to food colorings. This business is highly profitable, with the first restaurant able to fully cover its expenses within 6 months of opening.

In the Middle East, Korean companies are actively trying to make a halal version of their products to enter this highly anticipated market. This effort is noticeable when Islamic tourists visit Korea, as there are more restaurants offering halal food. For instance, the chicken burger brand Mom’s Touch offers suitable burgers and fried chicken. With this strategy and the growing popularity of Korean Food, they have emerged as a highly rated brand. Furthermore, they recently opened a branch in Uzbekistan, one of the Islamic regions in Central Asia, suggesting a clear intention to establish the brand in the wider Middle East.

Korean Food established itself as a healthy alternative to fast food. Yet, with the high interest in street food, there is a legitimate question about whether we can still broadly call Korean food healthy.

Overall, Korean cuisine has grown from a cultural niche into a global food phenomenon, driven by cultural trends, digital media, and clever branding. Whether through ramyeon, street snacks, or K-BBQ, Korea has turned food into an export of identity and lifestyle. The next challenge for K-Food will be balancing authenticity with localization—while adapting to health trends, halal markets, and evolving consumer tastes. What is clear, ultimately, is that K-Food is no longer a trend. It has become a permanent player in the global culinary market, and its influence is still expanding.

References

Ministry of Agriculture, Food and Rural Affairs. (2025, July 14). Exports of K-Food Plus in the first half of 2025: USD 6.67 billion, up by 7.1% year over year Pressrelease.

Foreign Agricultural Service, U.S. Department of Agriculture. (2024, September). Retail foods annual: Republic of Korea (Report No. KS2024-0020). https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Retail%20Foods%20Annual_Seoul%20ATO_Korea%20-%20Republic%20of_KS2024-0020.pdf

First published in :

World & New World Journal

Unlock articles by signing up or logging in.

Become a member for unrestricted reading!