Energy & Economics

by World & New World Journal Policy Team

First Published in: Feb.02,2026

Feb.02, 2026

I. Introduction

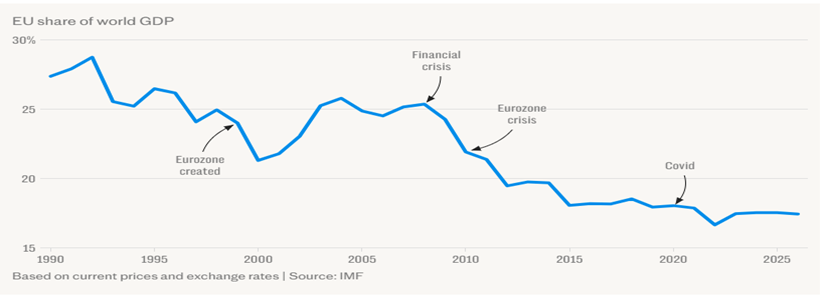

The European economy is in big trouble. Szu Ping Chan and Hans van Leeuwen, the economics editors of the Telegraph, a British daily newspaper, claim that the European Continent is stuck on a path of disastrous decline. [1] As Figure 1 shows, EU share of world GDP has continued to decline from 27% in 1990 to 17% in 2024.

Figure 1: EU share of World GDP (source: IMF)

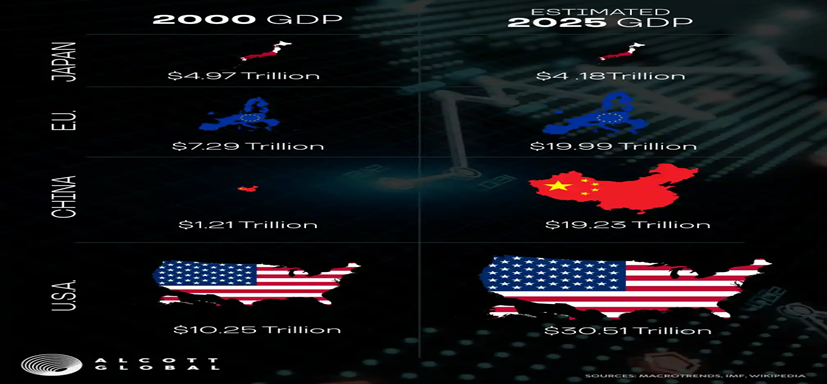

As a result, EU’s GDP in 2000 was six times larger than Chinese GDP, but EU’s GDP in 2025 is expected to reach the similar level of China’s GDP as Figure 2 shows. EU’s GDP in 2000 was $3 trillion smaller than US GDP, but EU’s GDP in 2025 is expected to be over $ 10 trillion smaller than US GDP.

Figure 2: EU, US, China, Japan GDP, 2000 & 2025 (source: Alcott Global)

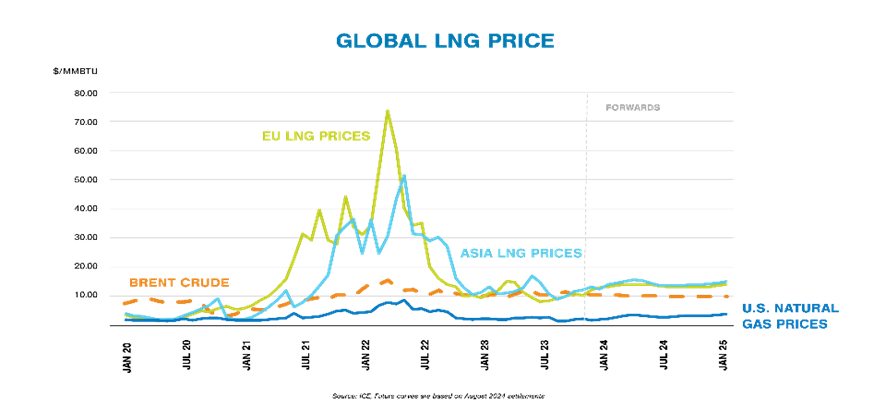

Moreover, the Ukraine war in 2022 brought more uncertainty to Europe by creating energy problems for the European economy. Europe’s reliance on external energy sources has been a long-standing issue. The energy crisis that began in 2021, fueled by the Ukraine war and climate change, has exposed how fragile the region’s energy infrastructure remains. Skyrocketing LNG prices, unreliable renewable energy production, and Russia’s strategic use of fossil fuels as leverage have left the European continent struggling with record-high energy costs.

With this information in background, this paper explores why the European economy has under-performed and fallen behind. This paper first describes the current economic situation of Europe and explains why the European economy has failed.

II. The Current Situation of European Economy

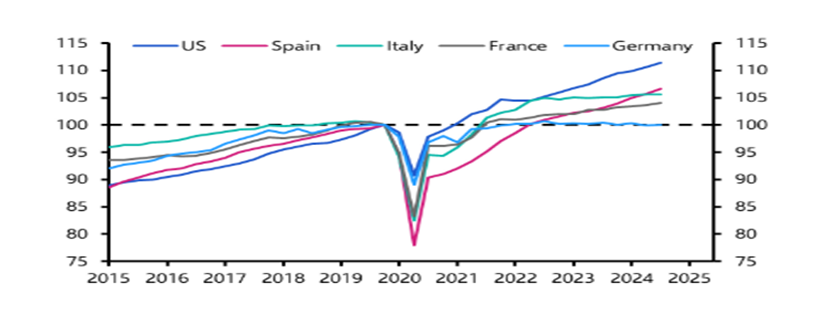

Europe may be a great place to live with free health care, generous welfare, and great cities. However, when we compare the economy of three major economies, the US, Europe, and China, it is obvious that the European economy is in big trouble. Europe is being squeezed by the US and China. As Figure 3 shows, economic growth has been anemic across Europe. Germany has been its worst performer in recent years. The German economy is the same size today as it was in the fourth quarter of 2019. In other words, it has had five years of lost growth. But the rest of Europe has not fared much better. The French economy is only 4.1% larger than it was in the final quarter of 2019, while Italy’s economy is 5.6% bigger. (See Figure 3.) And while Spain’s GDP has increased by 6.6% since then, this has been helped greatly by an influx of immigration that meant that GDP per capita has increased by only 2.9% over the same period. By contrast, the US economy has grown by 11.4%.

Figure 3: Real GDP (Q4 2019 = 100) (Source: LSEG, Capital Economics)

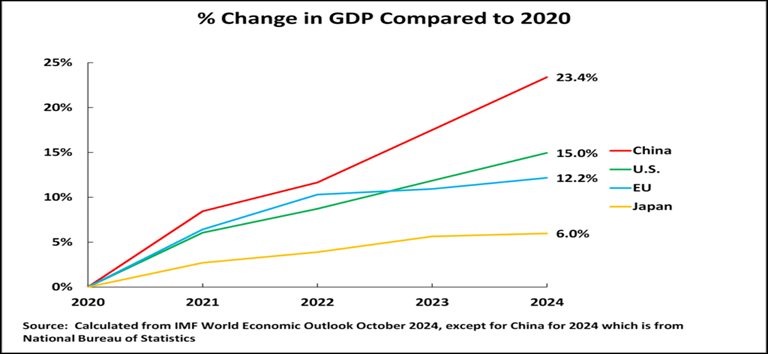

As Figure 4 shows, over the period 2020-2024, the EU’s total GDP growth was 12.2% compared to 23.4% for China, 15% for the US.

Figure 4: Growth, EU, US, China, and Japan, 2020-2024

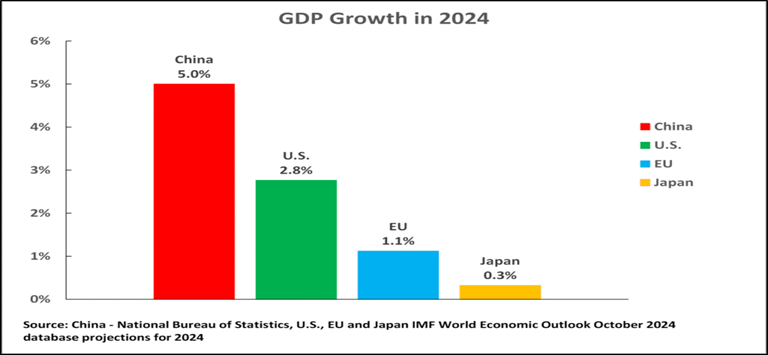

As Figure 5 shows, the EU grew only 1.1% in 2024 compared to 2.8% for the US and 5.0% for China.

Figure 5: GDP growth, EU, US, China, and Japan, 2024

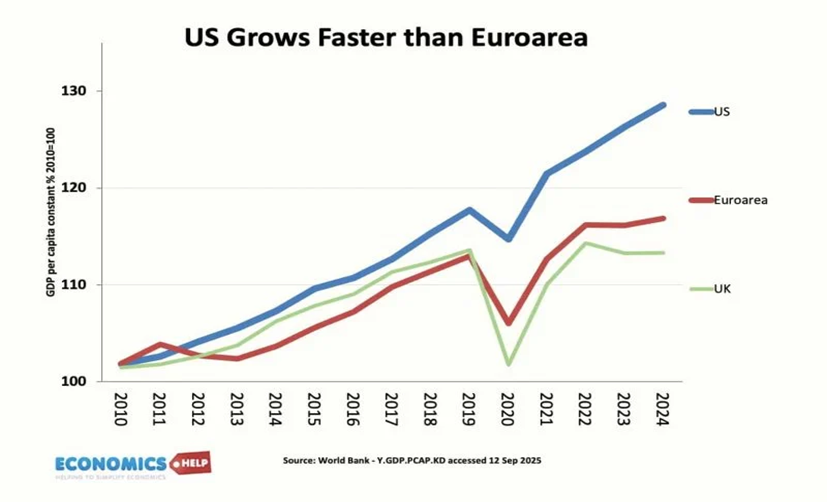

Moreover, when we compare the economies of two Western rivals, the US and Europe, it is obvious that the EU has grown slower than the US, as Figure 6 shows.

Figure 6: US grow faster than EU countries, 2010-2024 (source: World Bank)

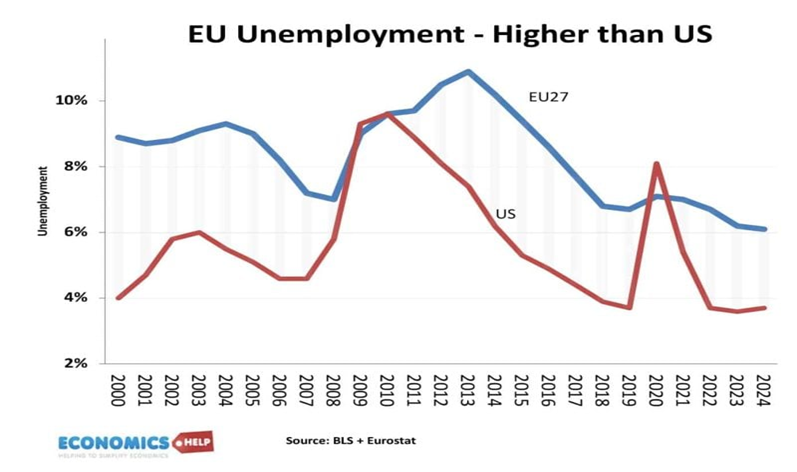

As Figure 7 shows, Europe’s unemployment has been higher than the US.

Figure 7: EU unemployment is higher than US, 2000-2024

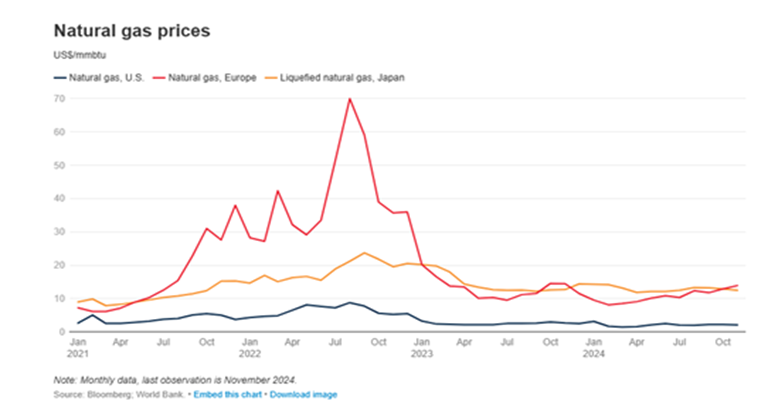

As Figure 8 shows, Europe’s LNG price has been higher than US price during the 2020-2024, and higher than Asian price immediately after Russia invaded Ukraine, thereby burdening the European economy.

Figure 8: LNG price, EU, US, Asia, January 2000-January 2024

Furthermore, when it comes to new engines of growth – big tech, AI, electric cars, Europe has slipped behind both the US and China. Europe is being squeezed by cheaper imports in China and better tech in America.

III. Causes of the Failure of European Economy

Why has the European economy failed? According to Neil Shearing, a chief economist of Capital Economics, Europe’s under-performance has been due in part to the effects of the energy crisis following Russia’s invasion of Ukraine as Figure 9 shows Europe’s skyrocketing gas prices. [2]

Figure 9: Natural gas prices, Europe, US, Japan, January 2021- end 2024

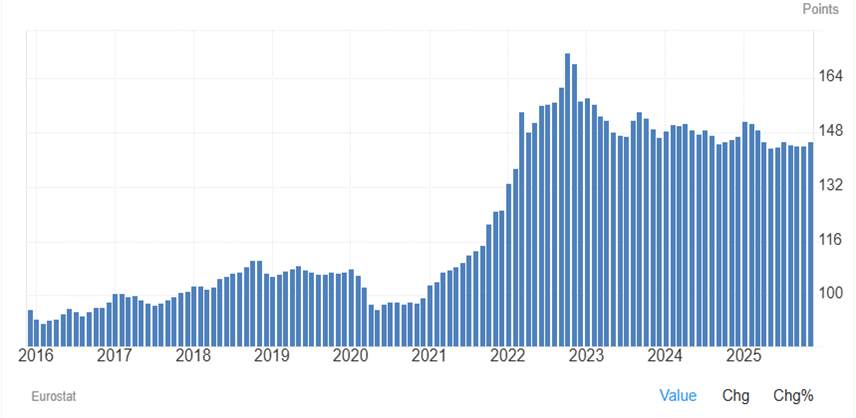

In addition, as Figure 10 shows, energy prices in the Euro area reached an all time high of 171.75 points in October of 2022 following the Ukraine war. It decreased to 145.49 points in November 2025, but it is still too high.

Figure 10: Energy price, Euro zone (source: Eurostat)

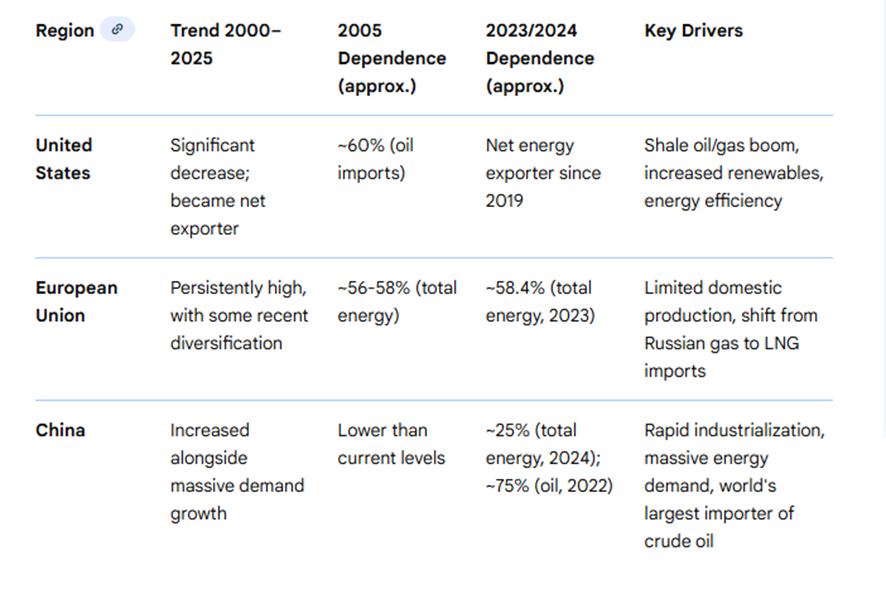

As Table 1 shows, dependence on energy imports has shown divergent trends since 2000: The US has dramatically reduced its reliance on energy imports and become a net exporter, while the European Union has maintained a high level of energy dependence, and China’s dependence has generally increased along with its enormous economic growth.

The US has undergone a remarkable transformation. Around 2005, US crude oil imports reached a peak at about 60% of their consumption. Thanks to the shale revolution and growing renewable energy use, US domestic production soared, and the US became a net energy exporter in 2019. By 2024, US energy imports made up only 17% of its energy demand.

China’s rapid economic growth has driven a massive increase in energy demand. As a result, its dependence on energy imports has increased significantly since 2000. China is the world’s largest importer of crude oil. While China is also the leading investor in renewable energy, which meets a portion of its growing energy demand, the absolute need for fossil fuel imports to power its industrial sector remains high. In 2024, energy imports met around 25% of their total energy demand.

Table 1: Dependence on Energy Imports, 2000–2025

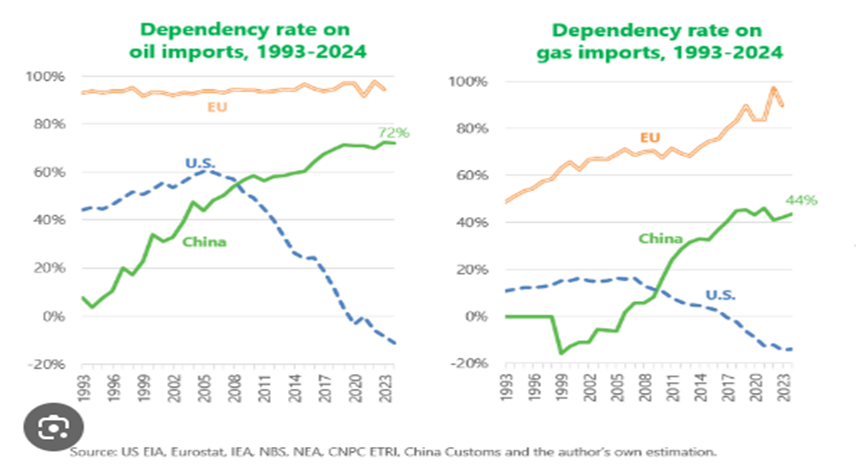

As Figure 11 shows, the EU consistently shows high dependence on energy imports over the last three decades during the 1993-2024 period. The EU’s dependence on oil and gas imports have been much higher than the US and China. EU’s dependence on oil imports was over 90%, while EU’s gas import dependence reached over 90% in 2023 following the Ukraine war. While the EU has made progress in renewable energy, it remains heavily reliant on oil and gas imports, and has recently shifted its import sources from Russia to other partners such as the US and Norway.

This high dependence on energy imports and energy crisis in Europe following the Ukraine war led to a deterioration in the region’s terms of trade that manifested itself in a large squeeze in real incomes and loss of competitiveness of energy-intensive industries, thereby lowering economic growth in Europe.

Figure 11: Dependence on energy imports, EU, US, and China, 1993-2024

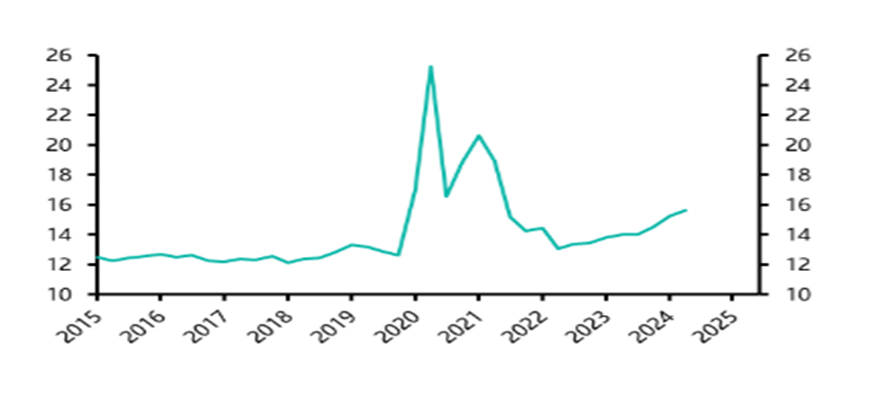

In addition, European households have also become more reluctant to spend, thereby leading Europe to lower growth. The household saving rate in Europe is now three percentage points higher than it was before the Covid-19 pandemic in 2019, while the savings rate in the US is now lower than it was in 2019. (See Figure 12.) The tendency of Europeans to spend less leads to lower growth in Europe.

Figure 12: Euro-zone household savings rate (% of disposable income)

However, the weakness of the European economy is fundamentally structural. There are several elements to this. The first key issue related to low growth in Europe is regulation in Europe that stifles competition and innovation.

The EU has become increasingly protectionist, mainly through regulation. While convenient, this strategy proves counterproductive. It eliminates the incentives for creativity and efficiency. The Digital Services Act and increasingly narrow interpretations of the General Data Protection Regulation (GDPR) were intended to rein in US tech giants, but have instead held Europe back in these same sectors. The AI Act and supply chain laws are similarly damaging. It is perhaps no surprise that the major disruptive and innovative firms of the past two decades have come from the US and China rather than from the Euro-zone countries.

Robot taxis are a good example. One in three taxi rides in California is already in a robot taxi. The growth has been exponential and they are set to overtake ordinary taxis. The market opportunity is huge; they will be cheaper than paying a driver. In Texas, Tesla charges just a dollar a mile. They are safer too – 90% fewer accidents. And that means cheaper car insurance. They will save income, decrease emissions and reduce the need to buy an expensive car. It’s not just America; 2,000 self-driving cars have already been transporting millions across the big cities in China. But, for Europeans, the idea of a self-driving car, is still the stuff of science fiction. Or more accurately, something blocked by the European love of regulation, risk-aversion, and a powerful car lobby still stuck in the combustion engine era. [3]

Another example is the tech industry. Europe is hampered by fragmented and excessive regulation. A US start-up can launch a product under a single regulatory framework and immediately access a market of more than 330 million consumers. The EU has a population of about 450 million but remains divided among 27 national regulatory regimes. An IMF analysis shows that internal market barriers in the EU act like a tariff of around 44% for goods and 110% for services – far higher than the tariff levels that the US imposes on most imports. [4]

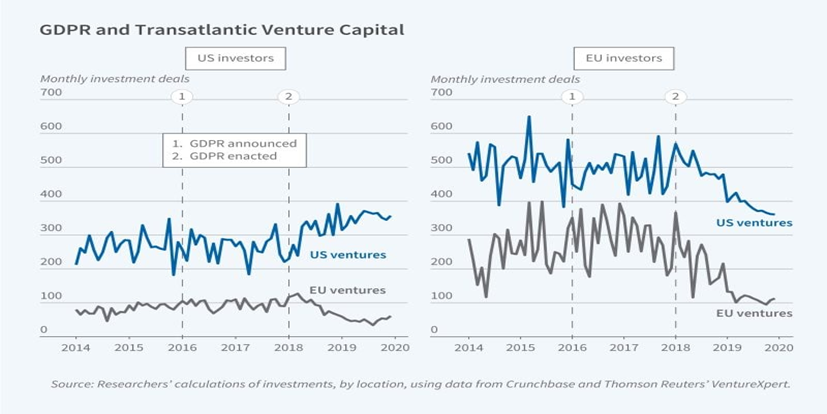

True, Europe has some successes such as Revolut, Klarna and Spotify, but these are dwarfed by the US giants of Meta, Google, Microsoft and Apple. Today, approximately half of the world’s 50 largest technology firms are American, while only four are European companies. [5] Over the past five decades, 241 US firms have grown from start-ups into massive unicorn companies. The EU’s response has been to seek to regulate the murky world of big tech surveillance, but in a way, the sledgehammer of GDPR regulation has done more to increase costs for local European business and tech startups as Figure 13 shows. While California alone has produced a quarter of the world’s tech unicorns, Germany-a similarly sized economy-has produced just 2% of high-value start-ups. Without urgent reform, Europe risks being sidelined in the global technological race.

Figure 13: GDPR regulation and EU & US Venture capital

There is an old saying: the US invents, China imitates, and Europe regulates. Harsh, but an element of truth. Though the big change is that China no longer imitates, but produces goods much cheaper than in Europe. But Europe is still stuck in a regulatory mind-set.

The result is that productivity growth in Europe - which is the key determinant of economic growth over the long run - is substantially lower, averaging 0.3% a year over the past decade compared to 1.6% a year in the US.

The second issue is Europe’s insufficient investment in new technologies (computers, artificial intelligence (AI), software, etc.) and the low level of spending on research and development (R&D). When we compare OECD countries, we see that these two components have a strong influence on productivity differences between countries. The econometric estimate leads to the following effects: a 1- point increase in the rate of investment in new technologies leads to a 0.8 point increase per year in productivity gains. In a similar way, a 1-point increase in GDP for research and development (R&D) expenditure leads to a 0.9 point increase per year in productivity gains. [6]

The fear is that Europe will be drawn into a vicious circle

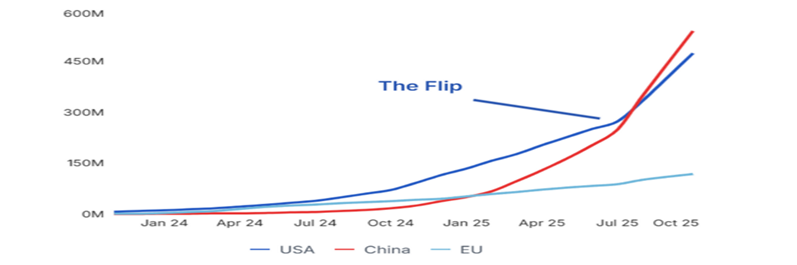

By 2022, investment in new technologies represented 5% of GDP in the US and 2.8% of GDP in the Euro zone. The EU’s efforts in advanced technologies, such as AI and cloud computing, far from match those of the US. The main instrument available to the EU, the European Innovation Council, had a budget of 256 million euros in 2024, while the US allocated more than 6 billion dollars for this purpose. The situation is repeated when looking at venture capital investment. In 2023, they invested about $8 billion in venture capital in AI in the EU, compared to $68 billion in the US and $15 billion in China. The few companies that create generative AI models in Europe, such as Aleph Alpha and Mistral, need large investments to avoid losing the race to US firms. However, European markets do not meet this need, pushing European firms to look outside for funding. [7] As a result, for example, the EU has been losing the open model contest as Figure 14 shows.

Figure 14: Cumulative downloads, 2023-25 (source: ATOM project, Hugging Face)

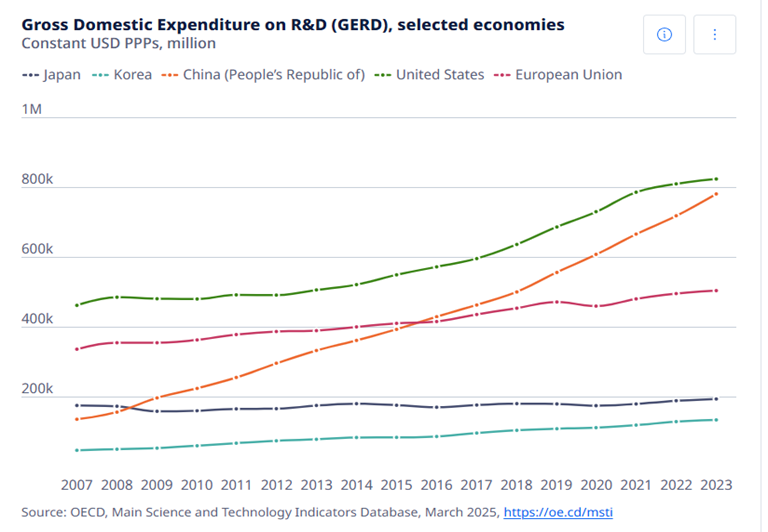

Moreover, the EU falls behind the US and China in terms of R&D spending. R&D spending in 2022 amounted to 3.5% of GDP in the US and 2.3% of GDP in the Euro zone. What’s more, from 2007 on, as Figure 15 shows, R&D spending in the US and China increased significantly compared to that of the Euro zone. The lag in technological investment and R&D explains a large part of Europe’s lag behind the US in terms of labor productivity and GDP. [8]

Figure 15: Gross domestic spending on R&D, 2007-2023

The third issue related to lower growth in Europe is the size of welfare states in Europe.

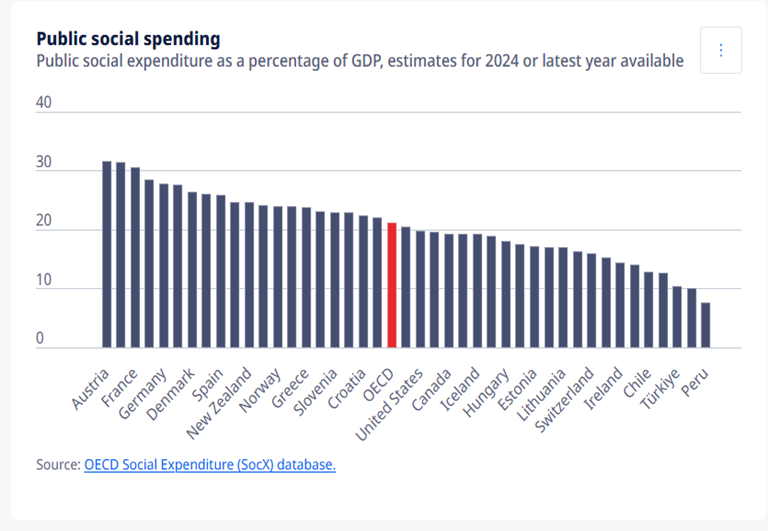

The size of welfare states differs markedly across OECD countries. European countries have the largest welfare states in the OECD and among the highest in the World. As Figure 16 shows, European welfare states are significantly larger than in the US, with EU countries allocating approximately 27% of GDP to social benefits in 2024, compared to roughly 19.8% in the US. Some European countries like Austria, Finland, and France spend over 30% of GDP on social benefits in 2024. While the US spends 7% of GDP on public provision of pensions, it is 16% in Italy and it is 13% in France.

Figure 16: Public social spending as a % of GDP in 2024, EU countries & US

Big welfare states have a complex, debated impact on economic growth, with evidence showing they can both impede growth through higher taxes and reduced work incentives, or foster it by boosting education, stability, and innovation. However, there has recently been a groundswell of opinion among economists that the scale of the welfare state is one of the elements responsible for slower economic growth and that a retrenchment in the welfare state is necessary if growth will be revived in Europe. The welfare state is indicted with the charge of becoming a barrier to economic growth in Europe through higher taxes and reduced work incentives.

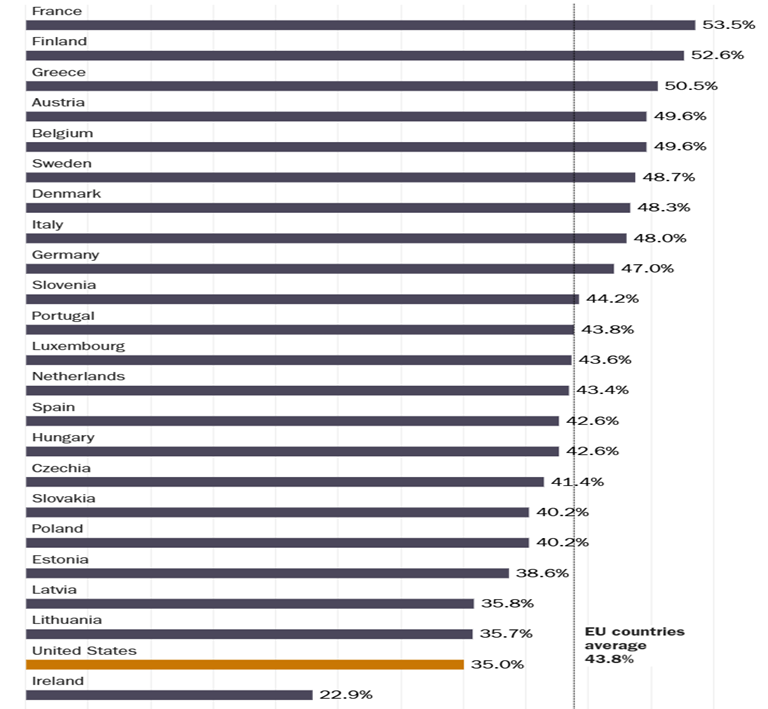

As Figure 17 shows, the tax burden is higher in the EU than in the US for most taxpayers. The overall tax-to-GDP ratio for the EU averages approximately 44%. By contrast, the US ranks as one of the lowest among developed countries, with a tax-to-GDP ratio 35% in 2022 approximately 9% lower than the EU average.

Figure 17: Tax burden, EU and US, 2022 (source: OECD Government at a glance, 2023)

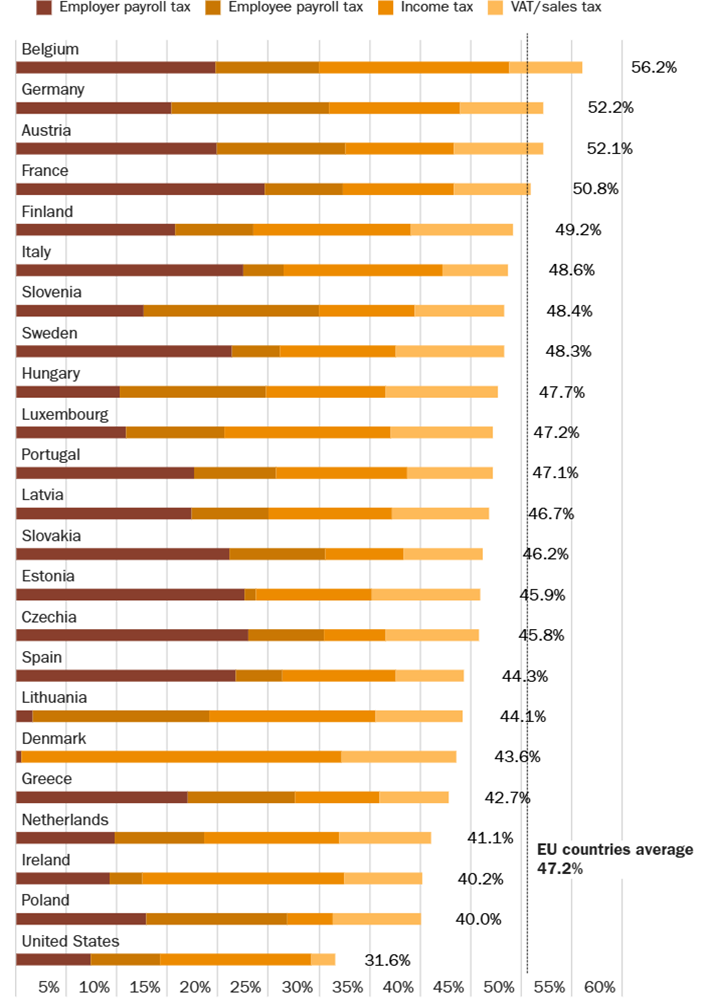

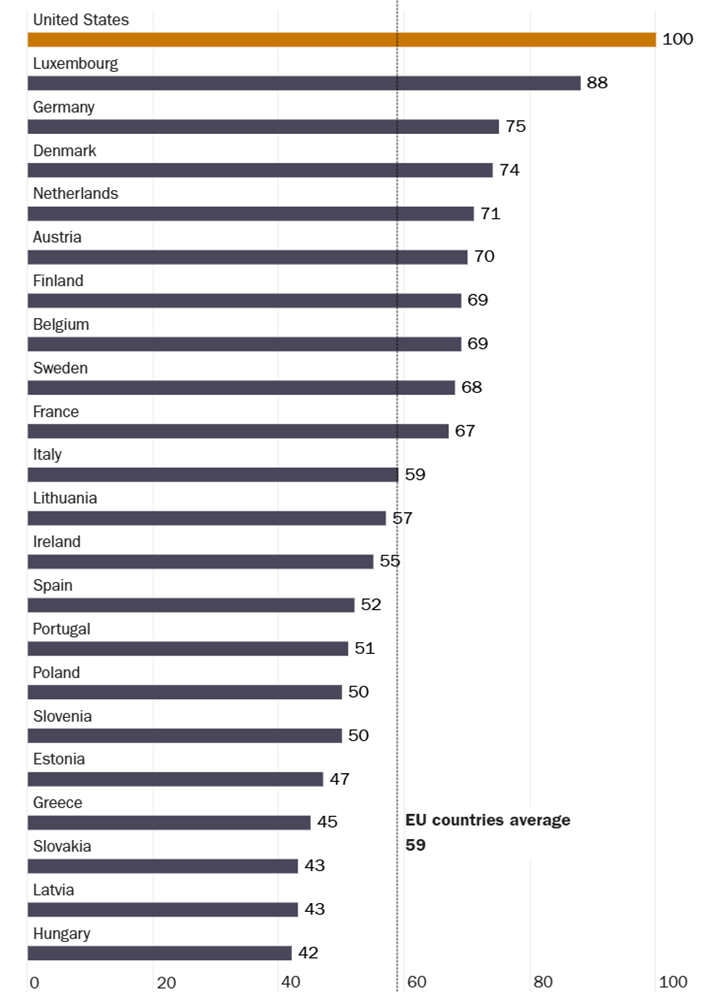

Figure 18 shows the total tax wedge for average single workers in each member country of EU. Belgium, Germany, Austria, and France confiscate more than half of their workers’ pre-tax compensation. Compared to the EU member countries, workers in the US face the lowest average tax wedge. This distorts work incentives for Europeans and renders everyone in Europe poorer. [9] High taxes and less work incentives make EU citizens spend less than US citizens, thereby lowering economic growth in Europe as Figure 19 shows.

Figure 18: EU workers pay more taxes than US workers, 2022 (source: OECD Government at a glance, 2023)

Figure 19: Americans spend 70% more on EU citizens (Average individual consumption per capita, 2020; United States indexed to 100). (source: National Accounts of OECD countries)

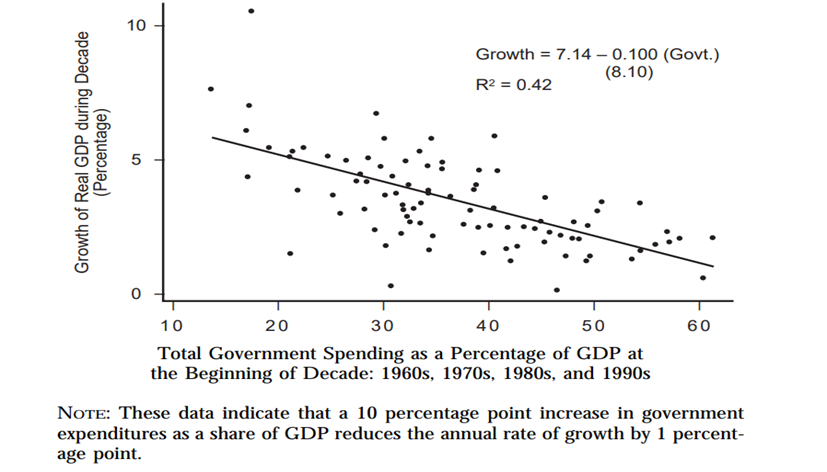

In fact, Gwartney, Holcombe and Lawson (1998) showed empirically that as the size of general government spending has almost doubled on average in OECD countries from 1960 to 1996, their real GDP growth rates have dropped by almost two thirds on average (see Figure 20). According to them, the worst economic performers were some Southern European countries that increased the size of the government the most.

Figure 20: Big government spending reduces growth.

At the height of the Euro-zone crisis in 2012, German Chancellor Angela Merkel tried to make the case that Europe’s welfare states were too large, as Europe accounted for 7% of the global population, for a quarter of global GDP and for 50% of global social spending. The situation has not improved since then. On September 9, 2024, Draghi presented his report “The Future of European Competitiveness,” a 400-page document, to deal with Europe’s sluggish economy, but he kept untouched Europe’s over-sized welfare state, while he strongly called for reforms and investments to reinforce productivity growth. [10]

The fourth issue is the Euro. The Euro has been a mixed blessing for Europe. It lowers transaction costs but highlights an unbalanced EU economy. Germany runs a large current account surplus, fringe economies like Portugal and Greece running deficits. But there is no scope for Germany to appreciate, weaker countries to devalue. One size fits all. But, this can have disastrous effects. The Euro Debt Crisis of 2012, led to high bond yields and a response of austerity, which contributed to weak growth in the last decade. Mario Draghi’s intervention reduced bond yields, but the European Central Bank has been criticized for a deflationary bias, and it has certainly struggled since the Covid-19 era, with growth in Europe much less.

IV. Conclusion

This paper showed that the European economy is in big trouble with lower growth. This paper explained that Europe’s economic under-performance & sluggish economy can be attributed to energy crisis and high saving, as well as over-regulation, large size of welfare state & high taxation, and lack of innovation & low investment in new technology and R&D.

Referencias

[1] https://www.telegraph.co.uk/business/2025/12/14/rising-fear–europe-really-is-doomed-and -taking-britain-down/ [2] https://www.capitaleconomics.com/blog/its-not-just-france-europe–faces-ongoing-decline- without-fundamental-reform-its-core [3] https://www.capitaleconomics.com/blog/its-not-just-france-europe–faces-ongoing-decline- without-fundamental-reform-its-core [4] https://www.project-syndicate.org/commentary/europe-most-serious-problem-not-immigra tion-but-technological-backwardness-by-nouriel-roubini-2025-12 [5] https://www.project-syndicate.org/commentary/europe-most-serious-problem-not-immigra tion-but-technological-backwardness-by-nouriel-roubini-2025-12 [6] https://www.polytechnique-insights.com/en/columns/economy/economy-why-europe-is-falllling-behind-the-usa/ [7] https://www.polytechnique-insights.com/en/columns/economy/economy-why-europe-is-fall ing-behind-the-usa/ [8] https://www.polytechnique-insights.com/en/columns/economy/economy-why-europe-is-fall ing-behind-the-usa/ [9] https://mises.org/mises-wire/europes-economy-slows-its-welfare-state-grows [10] https://www.csis.org/analysis/draghi-report-strategy-reform-european-economic-model

First published in :

World & New World Journal

World & New World Journal Policy Team