NATO anniversary 2024 - 75 years of the defense alliance

by Christina Bellmann

한국어로 읽기

Читать на русском

Leer en español

Gap

In Deutsch lesen

اقرأ بالعربية

Lire en français

What is required of member states between now and the Alliance's anniversary summit in Washington D.C. from July 9 to 11

75 years after its founding, NATO is facing an unprecedented set of challenges. The global security landscape is changing rapidly - from the ongoing war in Ukraine to crucial elections on both sides of the Atlantic. The summit in Washington D.C. will not only be a celebration of the past, but also a crucial marker for the future direction of the Alliance.

NATO is in troubled waters ahead of its 75th birthday - on the one hand, it is not 'brain dead' but offers protection to new members - on the other hand, the challenges are enormous in view of the war in Ukraine.

In the third year of the war, the military situation in Ukraine is serious. The military is coming under increasing pressure and European partners are delivering too little and too slowly.

Western support must be stepped up in order to influence the outcome of the war - Russia's future behavior towards its neighbors also depends on this.

Elections will be held on both sides of the Atlantic in 2024 - the US presidential election in November will be particularly decisive for NATO.

Two thirds of NATO member states are well on the way to meeting the two percent national defense spending target - Germany in particular must ensure that this target is met in the long term.

Now it is up to the leadership of larger countries such as Germany, France and Poland to develop traction in European defense in order to present a future US president with a resilient burden-sharing balance sheet and not leave Ukraine - and the European security order - in the lurch.

Return to the core mission

In the 75th year of its existence, the North Atlantic Defense Alliance has returned to its core mission: deterrence and defense against a territorial aggressor. NATO defense planning will be reviewed for its resilience before the NATO summit in Washington D.C. from 9 to 11 July 2024. What challenges does the Alliance face in its anniversary year and what needs to happen between now and the NATO summit to make the summit a success?

The state of the Alliance ahead of the summit

NATO is in difficult waters ahead of its 75th anniversary. On the one hand, it has proven since the beginning of the Russian war of aggression that it is capable of acting and not brain-dead. The two new members, Finland and Sweden, have given up their decades of neutrality because their populations are convinced that they are better protected against Russian aggression within the 30 allies, despite the excellent condition of their military. On the other hand, the admission process has taken much longer than was to be expected given the high level of interoperability of both countries with NATO standards. It took a good twenty months since the application was submitted for both flags to fly on the flagpoles in front of NATO headquarters in Brussels - the internal blockade by Turkey and Hungary is an expression of the Alliance's challenge to maintain a united front against the Russian threat.

The Vilnius decision of 2023 to adhere to the previous two percent target for annual defense spending as a percentage of national gross domestic product (GDP) as a minimum figure in future and even to strive for additional spending beyond this is an enormous effort for the members of the alliance - and the biggest point of criticism from its sceptics. The implementation of this goal goes hand in hand with the further development of the defense posture, which was also decided in Vilnius. This includes new regional defense plans that provide for more combat-capable troops that can be deployed more quickly. The Washington summit will show how far the Alliance has come in this respect in a year - gaps between targets and actual capabilities would consequently have to be covered by investments that go beyond the two percent GDP contributions. There are also a number of other important events and factors that will influence the summit.

Ukraine's military situation

In the third year of the war, the military situation in Ukraine is serious. The fighting has largely turned into a war of position, with high casualties on both sides. The sluggish supply of support from the West means that the Ukrainians have to make do with significantly less than their defense needs. The European Union has failed to meet its promise to deliver one million 155-millimetre shells within a year (by March 2024), while the Russian war economy is producing supplies in multiple shifts. This imbalance is making itself painfully felt in the Ukrainian defense - due to the material deficit, nowhere near enough Russian positions can be eliminated and Russian attacks repelled, and Ukrainian personnel on the front line are depleted. President Volodymyr Zelensky is coming under increasing pressure to mobilize fresh forces for the front. As a result, the Ukrainian military is having to give up some of its terrain in order to conserve material and personnel and take up the most sustainable defensive position possible for the coming weeks and months until relief hopefully comes.

comes.1

The Czech initiative to procure half a million rounds in 155 millimeter caliber and 300,000 rounds in 122 millimeter caliber on the world market for Ukraine by June 2024 is urgently needed - but it does not change the fact that Europe and the West are delivering too little and too late, despite the efforts that have been made so far and must continue to be made.2 Even if the US and Europe were to produce at full speed, it would only be half of what Russia produces and receives in support from its allies. Western support therefore urgently needs to be ramped up, as it is of crucial importance for the outcome of the war - and for Russia's future behavior in its neighborhood.

Upcoming elections

A series of landmark elections will take place on both sides of the Atlantic in the run-up to the summit. The US presidential elections in November 2024 will be of the greatest importance for the future direction of NATO. To date, the USA has been the largest single supporter of Ukraine in the military field; in addition, the USA has decisive weight in the coordination of concrete support from NATO countries - the German Chancellor has repeatedly oriented himself towards US arms deliveries when it comes to the question of German support or even made this a condition for his own commitments.3

While the Democrats in the US Congress continue to support aid packages to Ukraine, the Republican Party is dominated by voices around presidential candidate Donald Trump calling for this "European war" to be left to the Europeans and for domestic challenges to be addressed instead.4 This has led to a months-long blockade of further aid amounting to 60 billion US dollars in the US House of Representatives, which is led by a wafer-thin majority of Republicans. Ukraine urgently needs these supplies to avert shortages in ammunition and air defense. At the time of publication of this Monitor, a release of the funds is not in sight. In terms of foreign policy, there is a bipartisan consensus that the real danger for the USA lies in a systemic conflict with China. Among Republican supporters, impatience with the continuation of the war is increasing, while approval for further support for Ukraine is decreasing. The mood among the general population is similar: between April 2022 and September 2023, the view that the US is doing "too much" for Ukraine increased (from 14% to 41%).5

On the European side, the most important milestone for further support for Ukraine is the election of the new European Parliament from 6 to 9 June 2024. Since the outbreak of the war, approval ratings in the EU for support for Ukraine have been remarkably stable.6 Even in the face of a sometimes difficult economic environment in the 20 eurozone states, approval ratings for the continuation of aid to Ukraine have only fallen slightly in a few EU states - starting from a high level.

While the broad center of the EP groups (EPP, S&D and Renew) are united in their support for Ukraine and the transatlantic alliance, the foreign and security policy positioning of the far-right parties of the ECR and ID groups and the non-attached groups is not always clear. According to Nicolai von Ondarza and Max Becker from the German Institute for International and Security Affairs (SWP), while the ECR parliamentary group "largely plays a constructive and compatible role" in foreign and security policy, including with regard to NATO and Ukraine, parts of the ID parliamentary group such as the French Rassemblement National (RN) or the German AfD either voted against resolutions critical of Russia in parliament or abstained.7 According to Olaf Wientzek from the Konrad Adenauer Foundation, both the ECR and ID can expect significant seat gains in the upcoming EP elections.8 In terms of numbers, the ID and ECR groups are competing with Renew to be the third strongest force behind the EPP and S&D - according to current estimates, they all have between 80 and 90 seats. It would be conceivable for the currently non-attached Hungarian Fidesz (currently 13 MEPs) to join both the ECR and ID. In view of the increasing co-decision role of parliament - including for further Ukraine support packages - it is important for the EU how these parties and party alliances position themselves in terms of foreign and security policy.9 In fact, parties in the ID faction represent Russian propaganda within Europe in order to exert influence through disinformation, subversion and mobilization and thus undermine the social consensus with regard to Ukraine and NATO.10 This may also become apparent in individual elections, such as in the eastern German states in September 2024.

Economic pressure - prioritizing defence?

Global inflation averaged 6.2% in 2023. Current forecasts assume falling inflation rates in the Euro-Atlantic region over the course of 2024 to 2026.11 At the same time, however, global economic growth of 3.1% (2024) and an expected 3.2% (2025) compared to the previous year is well below the projections for the post-pandemic recovery.12 The combination of higher consumer prices and slower economic recovery continues to pose the risk of declining approval for strong support within the populations of the European Ukraine-supporting states. Protests in the face of announcements of cuts in various policy areas have demonstrated this in Germany and Europe over the past year. This does not make it easy to prioritize defence spending from a national perspective for the coming years. In the case of Germany, the defense budget is competing with all other departments in the budget negotiations for 2025, which are calling for an increase in social spending and investments in view of the current burdens on the population.13

At the same time, inflation does not stop at military procurement. As early as 2022, Germany therefore had to cancel a number of planned procurement projects due to increased costs.14 The cost increase also affects the maintenance of existing equipment and personnel. Even if Germany nominally reaches the two percent target in 2024, the increases in national defense spending within the Alliance will actually be lower when adjusted for inflation.

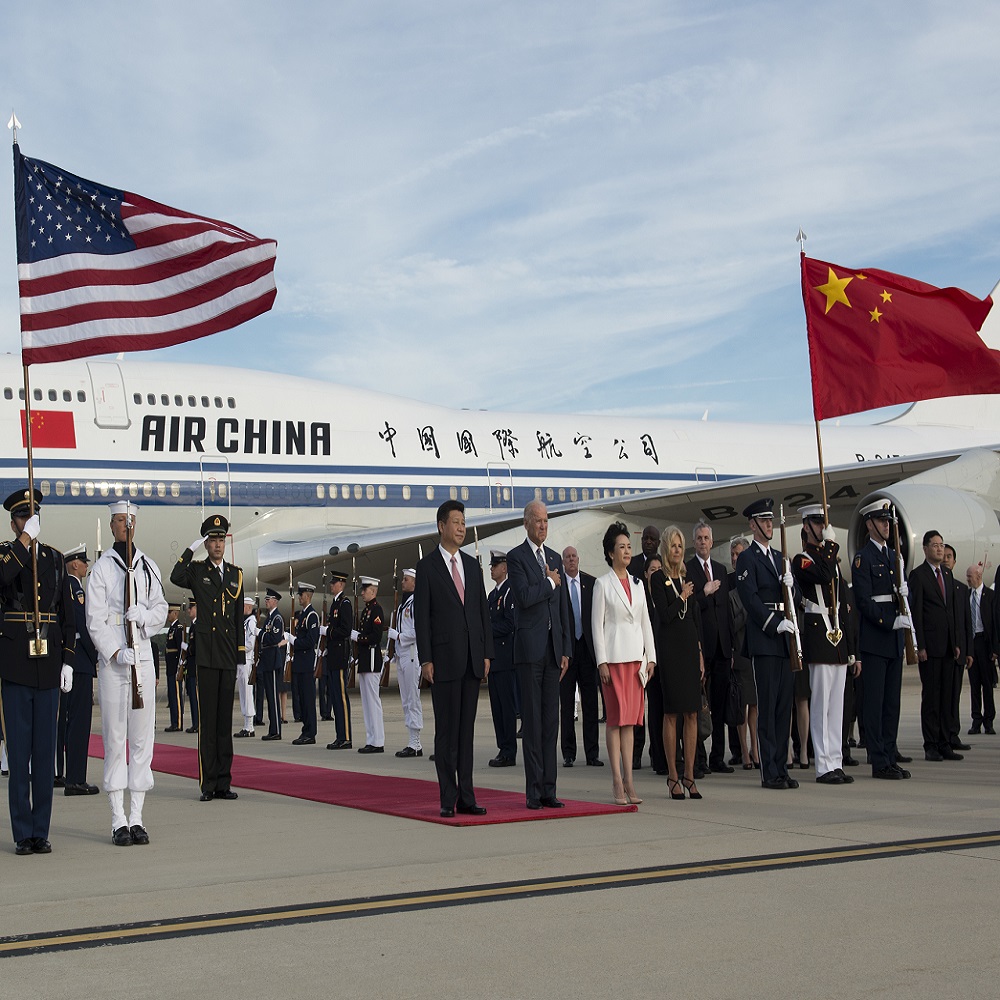

Systemic threat from China

The increasing systemic confrontation with China is not only identified in the US national security strategy; for the first time, China was classified as a concrete threat by NATO in its Strategic Concept of 2022. China is threatening to annex the democratically governed island of Taiwan to its territory, possibly by military means.15 This would have enormous global escalation potential and far-reaching effects on important international sea routes. Concerns about free trade routes are leading to a convergence of threat perceptions on both sides of the Atlantic. As a result, many European partners are rethinking their relations with China - as is Germany in its China strategy.

China's global ambition to restructure the existing multilateral order according to its own ideas does not only affect Taiwan's independence. China's supremacy in key technical and industrial sectors as well as critical infrastructure, rare raw materials and supply chains would lead to a deepening of existing dependencies. Because the USA sees China as a systemic threat to international order, freedom and prosperity, it has been refocusing its efforts since President Obama took office. European NATO partners are therefore expected to invest in Europe's security themselves. Only greater burden-sharing by the Europeans would enable the USA to focus its attention more strongly on the Indo-Pacific.

Challenges in new dimensions

In addition to the geopolitical challenges outlined above, NATO designated space in 2019 as an additional battlefield to the existing fields - land, air, sea and cyberspace - due to its increased importance.16 In recent decades, China has rapidly expanded its presence in space in both the civilian and military sectors.17 The war in Ukraine has once again underlined the importance of satellite-based intelligence and the significance of connected weapons for combat.

In addition, the effects of man-made climate change, which also have an impact on security in the Euro-Atlantic alliance area, have recently become increasingly apparent. At the 2021 NATO summit in Brussels, the Alliance set itself the goal of becoming a leading international organization in understanding and adapting to the effects of climate change on security.18 To this end, it adopted the "Climate Change and Security Action Plan".

The NATO countries' homework

A successful NATO summit in the anniversary year 2024 would send an important signal of the unity and defense capability of the Euro-Atlantic alliance in the face of Russia's breach of international law in a time of systemic competition. NATO member states are confronted with a complex threat situation ahead of the next summit in Washington D.C.. These give rise to various requirements:

More NATO members must reach the two percent target

In financial terms, the Washington summit will probably be considered a success if a substantial number of member states reach the two percent target. In 2023, this was the case for eleven countries (Poland, USA, Greece, Estonia, Lithuania, Finland, Romania, Hungary, Latvia, UK, Slovakia).19 In February 2024, NATO Secretary General Jens Stoltenberg announced on the sidelines of a meeting of the Ukraine Contact Group in Brussels that 18 countries would reach the target by the summit.20 Germany, the Netherlands, Czech Republic, Bulgaria, Denmark, Albania and North Macedonia are the countries that have recently reached the target.21 The newest NATO member, Sweden, increases the number to.19

Achieving the two percent target for defense spending is not an end in itself. The discussion within NATO as to whether one should deviate from the numerical contribution target and instead assess the actual capabilities contributed by the individual member states is not a new one. Amounts of money to measure collective defense remain the simplest way to approximate burden-sharing within NATO - and until all countries have achieved this, it will remain the relevant metric in the political discussion.

From NATO's perspective, the gap between the desired capabilities listed in the defense plans and the troop contingents registered by the member states has widened steadily of late. In reality, there is no way around increased defense spending in order to adequately equip the required personnel, who would have to be subordinate to the NATO Supreme Allied Commander (SACEUR) in an emergency - from a military perspective, the demand is therefore increasingly being made that two percent should be the minimum target. In order to achieve all the required capabilities, larger contributions are needed from all nations.

Due to the threat situation and political pressure, it seems possible that 21 countries, i.e. two thirds of the member states, will meet the two percent target by the NATO summit in Washington. In addition to the 19 countries mentioned above, these are France22 and Montenegro.23 Turkey wants to achieve the target by 2025,24 although this commitment is uncertain in view of the poor economic situation. Italy wants to spend two percent within the next two years25, while Norway should reach the target by 2026 according to Prime Minister Jonas Gahr Stoere26. Slovenia has set 2027 as the target date for meeting the commitments27, while Portugal, Spain and Belgium have set 2030 as the target date. Canada (1.38%), Croatia (1.79%) and Luxembourg (0.72%) have not provided any information.

Reduce bureaucracy, speed up procurement

In material terms, the main aim is to convert the increased defense spending into "material on the farm" in a timely manner. To achieve this, the planning and procurement processes in many European countries need to be accelerated, made less bureaucratic and at the same time better coordinated. The common European defense will require massive improvements in the coming years. Some announcements have already been made during the pre-election campaign for the European Parliament; here, too, what counts is how the announcements are implemented after the election. Progress must also be made in the area of research and development in order to invest scarce resources in state-of-the-art systems. The question of joint development versus off-the-shelf procurement of available equipment will also have to be decided in many cases. A rethink in European procurement is essential for this. This is primarily the responsibility of the European nation states: long-term contracts with the arms industry must be concluded urgently, cooperation initiated and loans granted for production.

Strengthening EU-NATO cooperation and NATO partnership policy

NATO's Strategic Concept and the EU's Strategic Compass show a strong convergence in threat analysis. The EU has effective starting points and tools, particularly for cross-cutting challenges such as combating climate change, the threat of hybrid attacks and the protection of critical infrastructure. With the European Peace Facility and other instruments, a concrete institutional framework has been created to strengthen the European pillar in NATO and contribute to fairer burden-sharing on both sides of the Atlantic. The EU and NATO should further intensify the exchange on common challenges and utilize the strengths of the respective forum.

In addition to the partnership with the EU, the member states should continue to promote NATO's partnership policy. 2024 marks the 25th anniversary of NATO's eastward enlargement and the 30th anniversary of NATO's Partnership for Peace program. In view of a global confrontation with Russia and an increasingly aggressive China, it is worth taking a look at the instruments that were devised during the Cold War with a view to 'like-minded' partners outside the Alliance. NATO's partnership policy - adapted to the new circumstances - is an ideal instrument for forging close ties with democratic nations in the Indo-Pacific that share NATO's interests and values.28

Investing in interoperability

NATO must continue to act as a "guardian of standards" in favor of military interoperability. This year's major exercises as part of "Steadfast Defender 2024" and "Quadriga 2024" will show, among other things, which weaknesses still exist in the various dimensions of interoperability in practical tests. In addition, care must be taken to ensure that military innovations from pioneers within NATO do not leave the Alliance's other allies behind in technical terms. This does not mean that technological progress is slowed down in a race to the bottom; instead, member states with lower expenditure on research and development must be enabled to catch up more quickly - especially in areas such as space technology and the use of artificial intelligence in warfare, it is becoming increasingly important to avoid the technological gap between the members of the alliance.

What does this mean for Germany?

The Federal Chancellor's announcement on February 27, 2022 that the establishment of the 100 billion euro special fund heralded a turning point in Germany's security policy was seen everywhere in Germany and within the Alliance as the right decision in view of Russia's aggression. In his speech, Olaf Scholz emphasized that Germany was not seeking this expenditure to please allies. The special fund serves national security. However, the acute threat to European security remains and although the NATO target will be reached in 2024, the future of Germany's defense budget is anything but certain. However, investment in the Bundeswehr's defense capabilities is essential to contribute to credible deterrence. The foundation for securing sustainable defense spending in Germany's medium-term financial planning must be laid now, otherwise two percent - depending on the spending status of the special fund - may already be unattainable in 2026, when the regular federal budget is once again used as the basis for calculating the NATO target. As the budget for 2025 will not yet have been decided at the NATO summit in July 2024, the Chancellor will need to make a credible commitment to the allies that Germany will not fall behind.

The Bundeswehr will also have to stretch itself enormously in order to achieve the troop levels announced for the new defense plans. The number of servicewomen and men is currently stagnating at just under 182,000. 29 In order to be able to provide the brigade in Lithuania in addition to the nationally required forces and to meet the division commitment for 2026, the Bundeswehr must come significantly closer to the target figure of 203,300 active servicewomen and men by 2027.30 The questions of how many of the 182,000 soldiers available on paper are also willing to become part of the brigade in Lithuania and how many of the total number are actually deployable in an emergency have not even been asked at this point.

What counts now - political leadership

The security situation in Europe is serious and NATO has no shortage of challenges in its 75th year of existence. It is in good shape to meet these challenges and has welcomed two strong nations into its ranks, Finland and Sweden. However, it is now important not to let up in the efforts that have been agreed. A united external stance is key here, as the current NATO Secretary General Jens Stoltenberg never tires of emphasizing. His successor will have to continue this. Even more important, however, are actual, concrete and substantial actions - the English expression "put one's money where one's mouth is" must be the leitmotif of all European NATO nations in view of the US elections at the end of the year, regardless of the outcome.

Ultimately, political leadership is what counts within the alliance in virtually all the areas mentioned - and it matters now. Many smaller countries in Europe look to the larger member states such as Germany, France and Poland for leadership. This applies both in terms of sustainable compliance with the two percent target and when it comes to political agreement and cooperation in the field of armaments. Here, the larger states have a role model and leadership function that can develop traction and pressure on the Alliance as a whole. This political leadership will be more important than ever for the European representatives in NATO in 2024. At the moment, however, it seems questionable whether the current leadership vacuum can be filled before the NATO summit. Germany, France and Poland have not yet been able to develop a jointly coordinated stance that could have a positive effect. It is therefore also questionable whether the NATO summit will be able to send important signals beyond the minimum objectives. The US presidential election hangs over everything like a sword of Damocles - the erratic leadership style of another US President Donald Trump could be difficult to reconcile with the strategic goals of the alliance.

Imprint

This publication of the Konrad-Adenauer-Stiftung e. V. is for information purposes only. It may not be used by political parties or election campaigners or helpers for the purpose of election advertising. This applies to federal, state and local elections as well as elections to the European Parliament.

Publisher: Konrad-Adenauer-Stiftung e. V., 2024, Berlin Design: yellow too, Pasiek Horntrich GbR Produced with the financial support of the Federal Republic of Germany.

References

1 Reisner, Markus: So ernst ist die Lage an der Front. In: Streitkräfte und Strategien Podcast, NDR Info, 12.03.2024, online unter: https://ogy.de/0ne7

2 Zachová, Aneta: Tschechische Initiative: Munition für Ukraine könnte im Juni eintreffen. Euractiv, 13.03.2024, online unter https://ogy.de/gofh

3 Besonders eindrücklich bleibt das Beispiel der Lieferung schwerer Waffen in Erinnerung: so rang sich Bundeskanzler Scholz zur Freigabe der Lieferung Leopard-Panzer deutscher Fertigung erst nach amerikanischer Zusage von Abrams-Panzern von militärisch zweifelhaftem Mehrwert durch.

4 Dress, Brad: Ramaswamy isolates himself on Ukraine with proposed Putin pact. In: The Hill, 01.09.2023, online unter: https://ogy.de/c9ow

5 Hutzler, Alexandra: How initial US support for aiding Ukraine has come to a standstill 2 years later. ABC News, 24.02.2024, online unter https://ogy.de/h0z6

6 Grand, Camille u.a.: European public opinion remains supportive of Ukraine. Bruegel, 05.06.2023, online unter https://ogy.de/ipbu

7 von Ondarza, Nicolai und Becker, Max: Geostrategie von rechts außen: Wie sich EU-Gegner und Rechtsaußenparteien außen- und sicherheitspolitisch positionieren. SWP-aktuell, 01.03.2024, online unter: https://ogy.de/a62v

8 Wientzek, Dr. Olaf: EVP-Parteienbarometer Februar 2024 - Die Lage der Europäischen Volkspartei in der EU. Konrad-Adenauer-Stiftung, 06.03.2024, online unter https://ogy.de/fv9b

9 s. Footnote 7

10 Klein, Margarete: Putins „Wiederwahl“: Wie der Kriegsverlauf die innenpolitische Stabilität Russlands bestimmt. In: SWP-Podcast, 06.03.2024, online unter: https://ogy.de/7i5s

11 Potrafke, Prof. Dr. Niklas: Economic Experts Survey: Wirtschaftsexperten erwarten Rückgang der Inflation weltweit (3. Quartal 2023). ifo-Institut, 19. Oktober 2023, online unter: https://ogy.de/wunq

12 Umersbach, Bruno: Wachstum des weltweiten realen Bruttoinlandsprodukts (BIP) von 1980 bis 2024. Statista, 07.02.2024, online unter: https://ogy.de/5ohz

13 Petersen, Volker: Ampel droht Zerreißprobe: Vier Gründe, warum der Haushalt 2025 so gefährlich ist. N-tv, 07.03.2024, online unter: https://ogy.de/9fcl

14 Specht, Frank u.a.: Regierung kürzt mehrere Rüstungsprojekte. Handelsblatt, 24.10.2022, online unter: https://ogy.de/71z3

15 Vgl. Wurzel, Steffen u.a.: Worum es im Konflikt um Taiwan geht. Deutschlandfunk, 12.04.2023, online unter https://ogy.de/ddc1

16 Vogel, Dominic: Bundeswehr und Weltraum - Das Weltraumoperationszentrum als Einstieg in multidimensionale Operationen. Stiftung Wissenschaft und Politik, 01.10.2020, online unter: https://ogy.de/c7m1

17 Rose, Frank A.: Managing China‘s rise in outer space. Brookings, letzter Zugriff am 18.09.2023, online unter https://ogy.de/374g

18 Vgl. Kertysova, Katarina: Implementing NATO’s Climate Security Agenda: Challenges Ahead. In: NATO Review, 10.08.2023, online unter: https://ogy.de/ho94

19 Vgl. Statista: Defense expenditures of NATO countries as a percentage of gross domestic product in 2023. Abgerufen am 18.09.2023 online unter https://ogy.de/wtsb

20 Neuhann, Florian: Ukraine-Kontaktgruppe in Brüssel: Eine Krisensitzung - und ein Tabubruch? ZDF heute, 14.02.2024, online unter https://ogy.de/rezf

21 Mendelson, Ben: Diese Nato-Länder halten 2024 das Zwei-Prozent-Ziel ein. Handelsblatt, 15.02.2024, online unter https://ogy.de/quiu

22 Kayali, Laura: France will reach NATO defense spending target in 2024. Politico, 15.02.2024, online unter https://ogy.de/7vdd

23 https://icds.ee/en/defence-spending-who-is-doing-what/

24 Vgl. Daily Sabah: Türkiye’s defense spending expected to constitute 2% of GDP by 2025. 21.10.2022, online unter https://ogy.de/xtbr

25 Vgl. Decode39: Defence spending: Rome’s path towards the 2% target. 20.07.2023, online unter https://ogy.de/c0g3

26 Waldwyn, Karl: Norwegian defence chief sounds alarm and raises sights. In: Military Balance Blog, International Institute for Strategic Studies, 23.06.2023, online unter https://ogy.de/8b4a

27 Vgl. Army Technology: Russian threat driving Slovenia’s defence budget increase. 02.08.2022, online unter https://ogy.de/c5y7

28 Vgl. Kamp, Dr. Karl-Heinz: Allianz der Interessen. In: IP, Ausgabe September/Oktober

29 Vgl. Bundeswehr. Stand: 31.07.2023, abgerufen am 19.09.2023, online unter: https://ogy.de/m69j

30 Bundeswehr: Ambitioniertes Ziel: 203.000 Soldatinnen und Soldaten bis 2027. Online unter https://ogy.de/3pzs