Africa’s delicate diplomacy in the South China Sea dispute

by Samir Bhattacharya

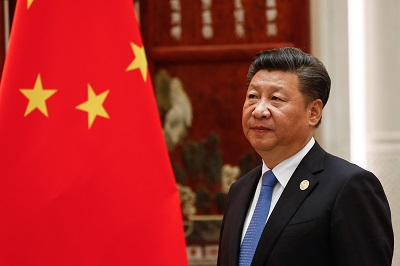

한국어로 읽기Leer en españolIn Deutsch lesen Gap اقرأ بالعربيةLire en françaisЧитать на русском The ongoing skirmishes in the South China Sea between China and regional states represent another severe threat to the world economy, directly affecting Africa. As China grows increasingly aggressive in its race for global hegemony and influence, and the United States (US) slowly plunges into the battle to prevent China’s rise, the world is watching the unfolding of this rivalry with unease. Although a few places have felt intense pressure from this alarming competition, the South China Sea (SCS) region is where a violent showdown looks increasingly probable. Unlike the war in Ukraine or Gaza, the US and China may start a direct war in the SCS. And amidst this multifaceted new Cold War 2.0, Africa remains cautious. The South China tinderbox On 23 April, another skirmish took place between China and the Philippines when two Filipino patrol boats approached the shallow turquoise waters of a disputed shoal around 194 km west of the Philippine Islands province of Palawan. The patrol boats were there for an underwater survey near the disputed shoal claimed by both China and the Philippines, thus prompting a Chinese response. A Chinese coast guard, via radio, instructed them to leave the area and threatened hostile measures. Following several radio exchanges, the Chinese coast guard damaged both the Philippine patrol boats by firing high-pressure water cannons at them. However, this was not the first time China’s assertion in this region has caused friction with other SCS neighbours, including Japan and South Korea. China has used an unconvincing U-shaped “nine-dash line” that crosses the exclusive economic zones, or EEZs, of Brunei, Indonesia, Malaysia, the Philippines, Taiwan, and Vietnam to demonstrate its claim in the region. Despite their low intrinsic value, the region lies along a vital trade and supply corridor that supports over US$3 trillion in yearly shipborne commerce. Oil, gas, and fishing sources abound in the area. Beijing has declined to acknowledge a 2016 decision from the Permanent Court of Arbitration that ruled Beijing’s broad claims invalid based on historical grounds. China and the Philippines have already fought many times over the Second Thomas Shoal and the Bashi Channel. China has become increasingly aggressive in the region in the last few years, putting regional stability at high risk. So far, these skirmishes will likely remain regional without the risk of any full-scale war. However, there are risks of casualties or even the vessel capsizing. Making of Cold War 2.0 over the SCS Washington’s response to the upcoming crisis is still modest. US President Biden raised concerns about China’s actions in the SCS , including efforts to impede the Philippines from resupplying its forces on the fiercely disputed Second Thomas Shoal. The US has repeatedly warned China that it’s obligated to defend the Philippines, its oldest treaty ally in Asia, if Filipino forces, ships or aircraft come under an armed attack. The US also conducted Balikatan drills (‘shoulder-to-shoulder’ in Tagalog) with the Philippines with more than 16,000 American and Philippines military personnel. Indeed, its resources are thinly stretched, and Beijing seems to be moving ahead. To deter China by stepping up regional defence diplomacy, Washington is exploring the possibility of a security alliance with Japan, Australia, and the Philippines, tentatively called SQUAD. This is in addition to two other existing groupings in the region, “Quad” and “AUKUS,” a defence pact among Australia, the United Kingdom and the US. While AUKUS is a defence pact, Quad is simply a dialogue platform. Africa’s tricky balancing act Even while the socioeconomic repercussions of the Russia-Ukraine war have not yet wholly subsided in Africa, the ongoing skirmishes in the SCS represent another severe threat to the world economy, directly affecting several African nations. Despite being geographically far, the conflict’s spillover effect would impact the continent’s food security in terms of both the availability and pricing of some food crops. In addition, the SCS region represents a crucial geographic sweet spot for Africa as a source of trade and investment, translating into growth and development for many African economies. The crisis can potentially fuel price rise, particularly for oil-importing countries. The prospect of a consequential price rise of essential commodities will have enormous ramifications for domestic stability in most African countries. Furthermore, many African economies heavily rely on trade, investment, and aid from South and Southeast Asia, the crisis will significantly hamper the development and growth of the continent. There are also strategic lessons for Africa to learn from the conflict. China’s principal interest in Africa consists of protecting its BRI investments and ensuring steady trade flow. Africa is also essential for China to fulfil its resource needs, maintaining industrial growth and energy security. Therefore, securing stability in countries where China has invested is in China’s interest, just like keeping a stable relationship with China is in the interest of those investment-starved countries. Further, since many investment projects in China are located in different African countries, these countries should be careful. China can become aggressively irredentist, even in Africa. Currently, China owns a naval base in Djibouti and a ballistic missile tracker Yuan Wang 5, off the coast of Durban. It has strong economic influence across the countries of Africa’s east coast thanks to its Belt Road Initiative (BRI). On the West Coast, China has many seaports financed or constructed by Chinese entities. If the national governments of these countries fail to pay, China would happily take control of these ports through lease as it did in Hambantota, Sri Lanka. In addition to Sri Lanka, other South Asian countries such as Pakistan, Nepal, Bangladesh, and Myanmar also faced dire consequences due to the failure of their BRI debt payment, leading to economic crises, and sometimes even political crises. Therefore, caution would be expected from these African governments. Conclusion China’s increasingly aggressive posture over the SCS raises concerns about the stability of the region. As the current uneasy détente between the US and China bears remarkable similarities to the Cold War, questions are raised regarding the possibilities of a new Cold War 2.0. Questions are also raised concerning the possible reactions from different African countries vis-á-vis Chinese aggression in the region. Undoubtedly, any serious conflict between China and the Philippines would be dangerous. These frequent skirmishes may not lead to a direct war between the US and China. Yet, the risk of vessel capsizing and casualties is high. Any such event would ultimately spark a crisis in Africa. So far, Africa is cautious and continues to balance its great power relationships. Undoubtedly, it is increasingly concerned with the aggressive posture of the Chinese in the region. On the other hand, it needs China for economic purposes. Therefore, Africa will continue to walk the tightrope where it would want US involvement in de-escalating the situation without ruffling any feathers with China. The views expressed above belong to the author(s).