China Prepares for a Long “Struggle”

by Tuvia Gering

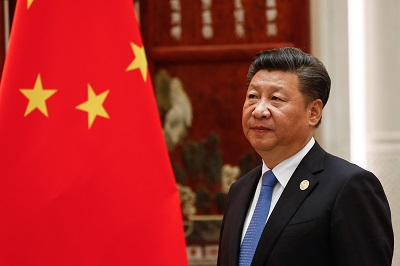

Chinese leader Xi Jinping was unanimously “reelected” for another five-year term at the Two Sessions, and the Chinese government approved significant changes in the party-state structure to counter the US-led West’s dominance and promote economic and technological self-sufficiency. At the same time, China is engaging in diplomatic activism in the Middle East and elsewhere, forcing Israel to reconsider regional dynamics and prepare for a protracted state of “struggle” between the two superpowers. In March 2023, Chinese leader Xi Jinping marked several highly successful events. Internally, he was “reelected” for a third term as President, and externally, he brokered a normalization agreement between Saudi Arabia and Iran – without any American involvement. These two developments coincided with the Two Sessions, China’s annual parliament meeting, where Xi passed far-reaching reforms aimed at increasing China’s economic and technological self-reliance in the face of Western adversaries. Judging by his remarks, it appears that under Xi China will continue its proactive foreign policy directed against the US-led global order. This in turn will test Israel’s ability to continue to maintain a balanced foreign policy vis-à-vis the two superpowers. Israel must now account for China’s growing influence in diplomatic and security theaters in the Middle East, as well as Beijing’s closer relations with Iran and Russia. To ensure its own security and economic interests, it must reconsider the regional dynamic while engaging in dialogue with the relevant actors. Finally, the escalation of tensions between the superpowers forces Jerusalem to prepare for extreme scenarios, most notably war in the Taiwan Strait. After a decade as president, Xi Jinping was unanimously reelected by the Chinese parliament for another five-year term. The vote – in which Xi was the sole candidate – was held as part of the annual Two Sessions, the Chinese legislature’s most important political gathering. The main event usually takes place over a seven-day period in March, when approximately 3,000 delegates from the National People’s Congress (NPC) – the legislative body – and some 2,000 delegates from the top political advisory body, the Chinese People’s Political Consultative Conference (CPPCC), convene in Beijing. In the course of the gathering, the Premier delivers a work report, while the delegates pass legislation, make amendments to the country’s constitution, and approve appointments in various state bodies. This year’s events were especially significant because they occurred immediately following the 20th Congress of the Chinese Communist Party (CCP), held in October 2022. At that gathering, which takes place every five years, Xi was also appointed to a third term as general secretary of the CCP and Chairman of the Central Military Commission. Since the 1980s, every five years, the CCP has introduced widespread reforms in the structure of the party-state. Previous reforms included changes to the balance of power between the Party and the state in ways that conformed to the incoming leadership's priorities and vision, as well as domestic and foreign developments. This year, the NPC approved significant changes in the party-state structure, continuing the trend in which the CCP under Xi has been "swallowing up" the government, with the lines between the two becoming increasingly blurred. These changes reflect Xi's belief that only a strong and centralized party can deal with domestic and foreign challenges, particularly the United States, China's main strategic rival. Indeed, during a heavily-publicized meeting at the start of the Two Sessions between Xi and representatives of the Chinese business sector, the Chinese leader stunned the audience by launching a direct attack against Washington, which he blamed for "the unprecedented severe challenges" that China is facing, and for trying to "contain, blockade, and suppress" China. What made his remarks particularly noteworthy was that despite rising tensions between the superpowers in recent years, Xi avoided explicitly naming and shaming the United States, instead allowing Chinese diplomats to spar with Western hawks. As a matter of fact, an examination of Xi’s writings reveals that even early in his political life, he saw the West, and the United States in particular, through a Cold War prism. However, it was the trade war waged by the Trump administration, which later escalated into a comprehensive technological and geopolitical war, that reinforced for him the need for economic and technological independence. The Biden administration went even further in its efforts to prevent China from gaining access to critical technology, and unlike its predecessor, has been successful in securing allies’ support. The Chinese countermeasures can be found in its most recent reforms, which included increasing the powers of the Ministry of Science and Technology (MoST) through the establishment of a new decision making body, the Central Science and Technology Commission, which is likely to be headed by Xi himself. Some of the ministry's specialized functions were transferred to relevant government ministries as part of the restructuring. The changes will allow the ministry to focus on macro-management of competition in innovation and to foster local development of basic research, core technologies, and a solution to the problem of the "bottleneck" imposed by the West, such as restrictions on China's import of microchips and airplane engines. In addition, a new institution, the National Data Bureau, will be tasked with managing digital resources, under the auspices of the Chinese government’s top macroeconomic management agency, the National Development and Reform Commission (NDRC). This year's reforms likewise highlighted China's financial sector, with the establishment of the new National Financial Regulatory Administration (NFRA) and expanded powers for the China Securities Regulatory Commission (CSRC). It was also decided to cut 5 percent of the central government and party workforce. Beyond the economic rivalry with the United States, the ramifications of the war in Ukraine, and COVID-19 restrictions, Beijing faces a host of internal challenges: a skyrocketing debt-to-GDP ratio (at the end of 2022, it stood at 273 percent), a declining population, a real estate bubble, natural resource pollution, a slowdown in imports and exports, high savings levels among households, and income inequality. If the rivalry with the United States intensifies – for example, if China were to invade Taiwan – Beijing would have to anticipate the imposition of additional sanctions, similar to those that Russia has been struggling with for the past year. Yet until such time as the situation vis-à-vis the United States reaches a critical stage, if at all, and against the backdrop of increasing concern in the international business community about the direction China is heading under Xi, Beijing is attempting to project to the world “business as usual.” At the conclusion of the Two Sessions, the incoming prime minister, Li Qiang, appeared to be smiling as he told foreign reporters that the United States and China must cooperate, because “there are no winners in a conflict.” He also promised that he would ensure a competitive, market-oriented, and fair environment that would protect the rights of Chinese and foreign businesses. However, here too the Party’s “invisible hand” was evident when he added that “the role of the new government is to execute and implement the important decisions and plans laid out by the CPC Central Committee.” The new appointments of other senior positions reflected the same ambivalence that Li expressed in his remarks. On the one hand, the Congress decided to extend the terms of 24 of the 26 ministers and national commissions, among them the head of the China’s central bank, Yi Gang, and Finance Minister Liu Kun, even though they had reached retirement age. One of the two new appointees, on the other hand, is Minister of National Defense Li Shangfu, who has been sanctioned by the US since 2018 for purchasing Russian weapons. Unlike his predecessors, who had battle experience, Li is an aerospace engineer in training. He was the former director of the People's Liberation Army's (PLA) space and cyber programs, as well as the deputy commander of the PLA's Strategic Support Force, which was in charge of China's space, cyber, and electronic warfare capabilities. Aside from the obvious defiance toward the US, his appointment demonstrates the importance that China places on modernizing China's military technology, given the ever-increasing restrictions imposed on technological imports to China. Self-sufficiency should not be confused with isolationism. The agreement brokered by Beijing between Saudi Arabia and Iran on March 10 – while the Two Sessions were in session – was the clearest indication that China intends to maintain its active foreign policy. Granted, China pushed through an open door, given the conflicting parties’ inherent need for an agreement to focus on their economies, and only time will tell whether the agreement will hold; nonetheless, this was the first time that Beijing has led any kind of mediation effort, let alone successfully, and the United States was not even in the room. In doing so, China has demonstrated that it can use its dominant economic and commercial position to advance diplomatic and security objectives, ostensibly as an "alternative" to the United States. China’s global ambitions are not limited to the Middle East. The Belt and Road Initiative (BRI), as stated in the government's work report, will celebrate its tenth anniversary in October. What began as a central-southeast Asian initiative has evolved into a global network of "silk roads" emanating from China and extending into space, with hundreds of massive infrastructure projects worth over $1 trillion in 146 countries. The BRI has had to deal with a number of implementation and funding challenges over the years, so it has been scaled back. At the same time, Chinese officials emphasize that it will remain a focal point of Beijing's foreign policy, with the emphasis shifting to smaller but more strategic projects such as bolstering global supply chains and cooperating in the digital domain, as well as healthcare, public policy, renewable energy, and people-to-people and diplomatic ties. Xi has unveiled other ambitious projects in recent years, most notably the Global Development Initiative (GDI), which is tasked with promoting the United Nations' goals for sustainable development, and the Global Security Initiative (GSI). At the conclusion of the Two Sessions, Xi announced the Global Civilization Initiative (GCI), the details of which remain unknown. As with the BRI, any success story that can be classified as development or security will be attributed to them, even if it occurred years before these initiatives. This is what happened with the Saudi-Iranian agreement or the Chinese peace initiative to end the Ukrainian war, both of which Beijing hailed as shining examples of the GSI in action. In practice, these initiatives reflect Beijing's desire to reshape the global order to reflect its interests and values, while undermining the United States-led West's dominance in its spheres of influence. For example, Xi described the GCI as "a new form of human civilization" that "shatters the myth that modernization is equal to Westernization. The bottom line is that the Two Sessions and the extension of Xi’s term of office indicate that China will continue to push itself to the forefront of the international stage. The next five years will be defined by a stronger push for self-sufficiency, financial stability, and technological advancement. At the same time, China will not close itself off to the rest of the world. On the contrary, China will not back down from "a struggle" against what Xi refers to as the West's and the United States' "attempts to blackmail, contain, and blockade" it. This spirit was evident during the first press conference given by China's new foreign minister, Qin Gang, who warned that "if the United States does not hit the brakes, but continues to speed down the wrong path...there will surely be conflict and confrontation." While Western doors are closing in on China, Beijing will continue to see Israel as a backdoor for securing core technologies that will help it achieve self-reliance, rendering Israel obsolete in the long run. This is evident in the recent influx of Chinese commercial delegations to Israel, following Beijing's lifting of travel restrictions. Simultaneously, the US-Israel Strategic High-Level Dialogue on Technology, launched during President Joe Biden's July visit to Jerusalem, will examine Israeli-Chinese cooperation, particularly in the less regulated hi-tech sector and academia. The agreement reached between Saudi Arabia and Iran, as well as Xi's recent visit to Russia, during which the parties agreed to "increase contacts over security issues in the Persian Gulf," indicates that China's diplomatic activism in the Middle East will only grow. The evolving situation in which China and the US both play key roles in regional geopolitics – against the backdrop of increased competition between the two countries and the war in Ukraine – forces Israel to reconsider regional dynamics. In order to prevent Iran from acquiring military nuclear power in peaceful means, Jerusalem must deepen its dialogue with Washington, Beijing, Moscow, and its Arab partners in the Negev Forum on regional security and economic interests. Finally, if a conflict between China and the United States is truly "inevitable," Israel must prepare for the worst-case scenario, in which two superpowers go to war in the Taiwan Strait, and consider the implications for its relations with Beijing.