Defense & Security

Connected Cars as Geopolitical Weapons: The National Security Battle Over Chinese EVs

Image Source : Shutterstock

Subscribe to our weekly newsletters for free

If you want to subscribe to World & New World Newsletter, please enter

your e-mail

Defense & Security

Image Source : Shutterstock

First Published in: Dec.22,2025

Dec.19, 2025

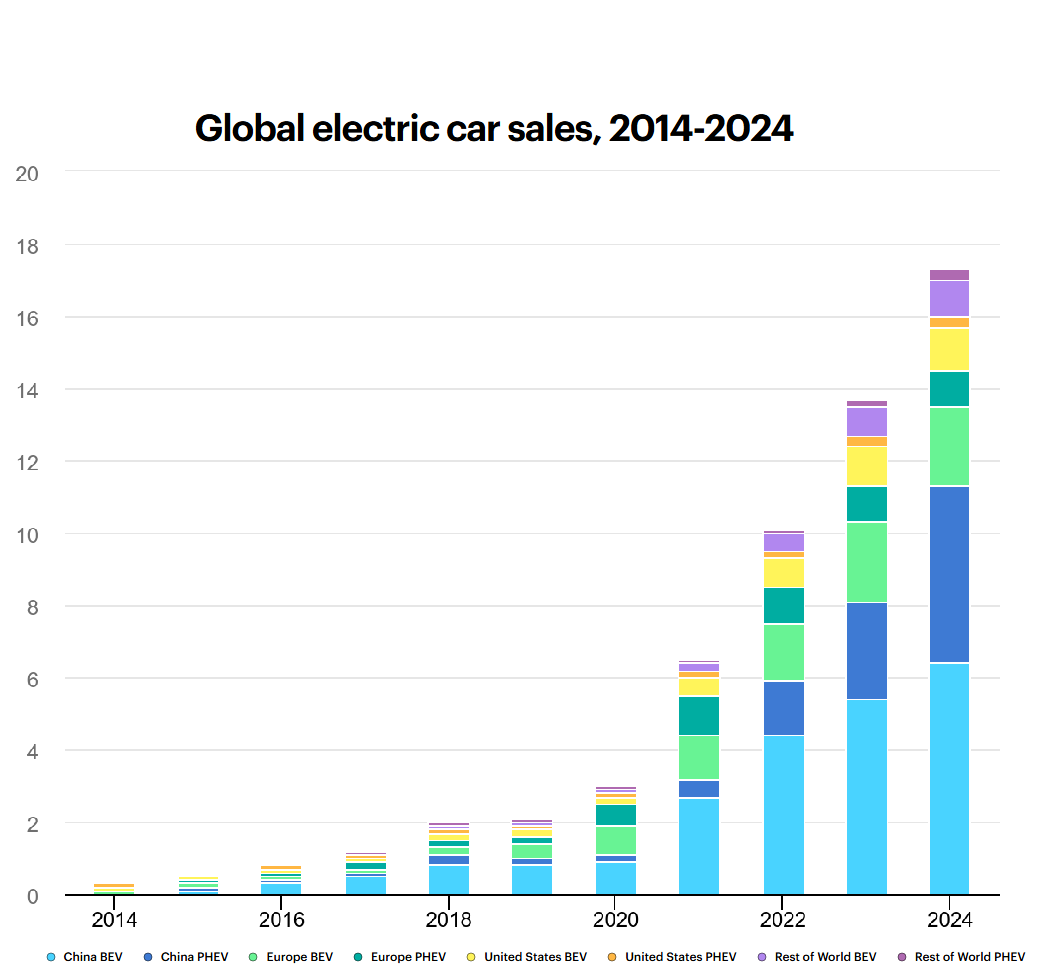

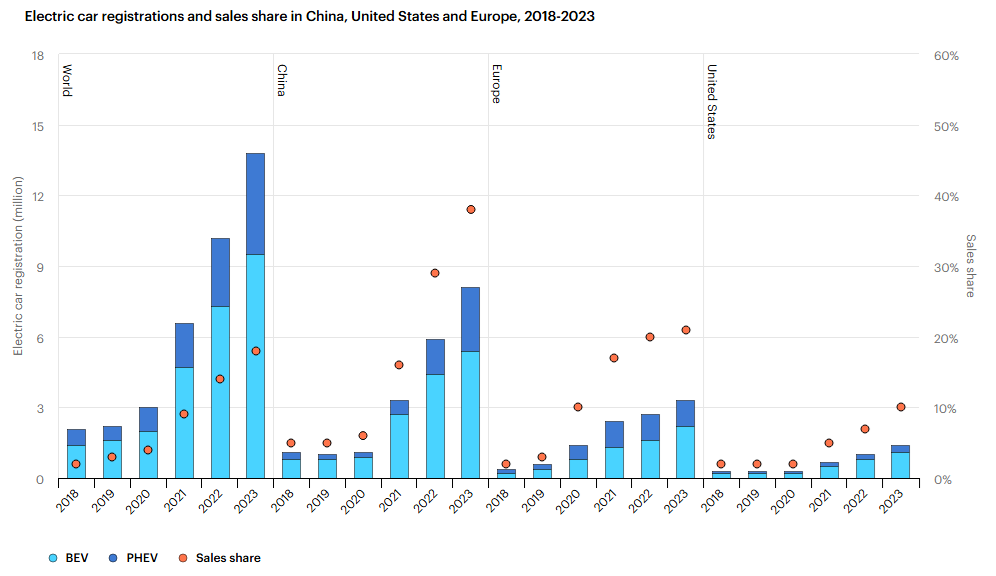

According to the IEA by 2024, more than 20% of new cars sold worldwide were electric, exceeding 17 million and positioning China as the leader in the market with more than 11 million sales. In comparison, the European and US markets also saw a growth in the sector, but not comparable to the Chinese counterpart.

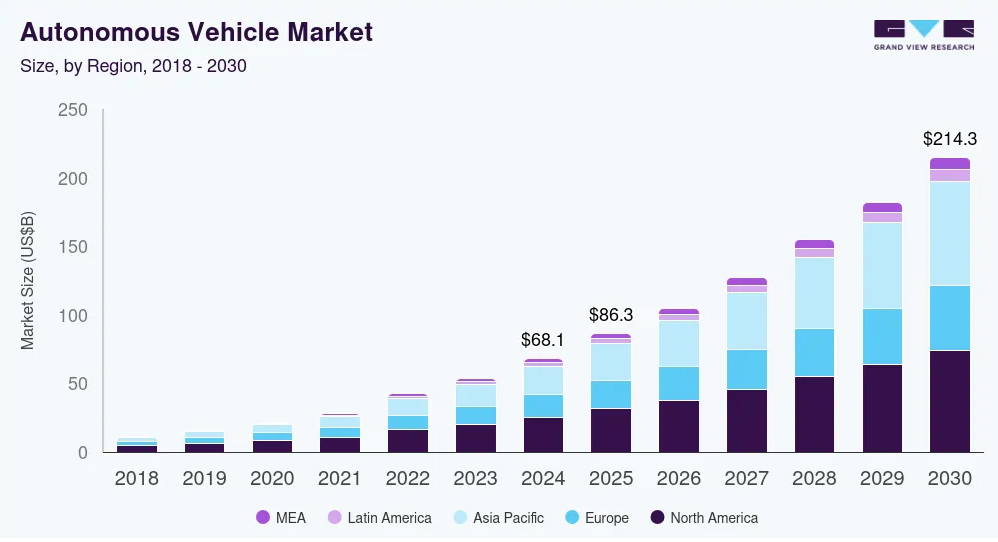

On the other hand, autonomous vehicles, whose market value size was estimated at USD 68.09 billion in 2024, are also trending worldwide, North America being the largest market in 2024 (market share of 37.1% and passenger vehicles leading the market with 69% of the global revenue), while the Asia Pacific region is the fastest-growing market.

Recently, despite the data and market share, discussions and analysis of the vehicle industry have moved into new concerns related to security risks, trade protectionism and unfair competition. Why? Because the vehicle industry has evolved and adopted new technologies, at the same time, concerns have shifted accordingly. These changes have relied on or prioritized human convenience and connectivity over everything else.

A simple answer is no, but there are elements that can change the answer into a yes in the future. Vehicles are evolving into connected machines, with software-driven platforms, sensors, cameras, connectivity modules and AI systems. Thus, the vehicle industry is entering a new era where data is key, and whoever controls it, is likely to control the market itself. As mentioned before, vehicle-related security risks have sparked discussions in recent years. Nowadays, practically any vehicle sold has a certain degree of connectivity, naturally this leads to a continuous and massive collection of information (sensitive or not), including for example: real-time location, driving patterns, biometric data, audio recordings, images from the Advanced Driver-Assistance Systems (ADAS) and more. For common people this might pass unnoticed but for governments, the fact of collecting and storing data or having the possibility to do so has become a critical point and a threat to their national security. After all, fear is real, and the more connected a vehicle is, the higher the chances that it can become a surveillance device, for example. The speculations can grow as much as our/their imagination leaves them, but after all, security risks and fear related to them exist. In line with the security risks, the possibility of software backdoors hidden in operating systems or telematic units is another possibility. Naturally, if exploited this possibility, these vulnerabilities could allow a remote shutdown of vehicles or fleets, manipulation of navigation systems or even data extraction could occur. In simple terms, this could open the door to cyberattacks, including the potential loss of control of a vehicle. Once again, the possibility of these ideas has reshaped and changed the paradigm of connected vehicles

As governments start recognizing these security threats associated with connected vehicles, many have begun implementing several regulations to protect their national security. For instance, the UK, Israel, the USA and the EU are among the most active actors. One of the branches of the economic war between the US and China is exactly the mobility industry, the fierce competition between both nations has tightened the nationalist policies of President Trump, in fact the US has rapidly adopted a national-security lens for automotive imports. There have been discussions in Congress and even the Commerce Department has proposed rules allowing Washington to prohibit connected car technologies linked to foreign adversaries. In addition, there is huge pressure over the United States-Mexico-Canada Agreement (USMCA), specifically in the encouragement to revise the vehicles entering the US and the promotion of US vehicle-manufacturing companies. For those reasons, the US had imposed tariffs on Chinese-made vehicles (from 25% up to 100% on 2024 during Biden’s administration and later a 35.5% extra tariff on Chinese-made EVs) and had set several rules in line with the USMCA, to limit or protect the American market from Chinese vehicles, as it argued that China is taking advantage of the USMCA by using Mexico or Canada as the entry points to the American market, avoiding tariffs and minimizing costs. According to experts, this Chinese circumvention of US tariffs can occur in three main ways. First through transshipment – products enter Canada or Mexico and then they are shipped to the USA. The second way is by incorporating the Chinese products into the North American supply chains. And the third way is through direct Chinese investments in manufacturing facilities in Mexico or Canada. At the same time, across the Atlantic the EU has also been working on tightening regulations through the Cyber Resilience Act, as well as strengthening the General Safety Regulations, both focusing on the application of rigorous standards to vehicle cybersecurity, data governance, and supply-chain transparency. Also in Europe, recently, a British newspaper reported that military and intelligence chiefs had been ordered not to discuss official business while riding in EVs, and cars with Chinese components had been banned from sensitive military sites. In addition, the former head of the intelligence service MI6 claimed that Chinese-made technology, including cars, could be controlled and programmed remotely. Consequently, the UK has begun evaluating supply chains for hidden dependencies in infotainment systems, telematics, and semiconductors. In the same line, Israel has adopted rigid measures, the Israeli army has begun withdrawing Chinese-made vehicles from officers, citing espionage concerns. Other measures implemented include auditing imported vehicles to ensure no remote-access pathways existence, plus the encouragement of local automakers and tech firms to develop secure telematics modules to minimize foreign reliance.

To understand the role of China in the EVs and connected vehicles is important to highlight the low labor costs in China, coupled with government subsidies and a well-structured and established supply chain, these three factors gave the Chinese firms huge advantages over their competitors. However, those are not the only factors involved in the equation, the promotion of EVs over internal combustion vehicles and the adoption and development of technologies that turn “simple” vehicles into connected vehicles are important to mention too. All these factors have been well capitalized by Chinese firms, in consequence, China has become the world’s largest EV exporter and somehow a threat for the West. As mentioned throughout the article, the security risks have sparked discussions and concerns, and it is fair, as Chinese-made vehicles have become competitive and technologically well-connected, much, that nowadays are in conditions to fight for the global automotive market. Therefore, there is a clear sense of concern among Western governments, especially in conditions of a politicized world that we live in nowadays. Naturally Beijing argues that bans and investigations on their Chinese-made vehicles are forms of economic protectionism and rejects any claims related to espionage, data leaks or misuse. While, it has also responded by tightening its own domestic rules: foreign vehicles are prohibited from accessing sensitive regions, including areas near government buildings and military facilities.

Automakers from Korea, Japan or the European and American are being directly benefited from the rising Chinese scrutiny of connected cars, meaning that new export and investment opportunities could be achieved by them. If these countries can materialize transparent software supply chains, strong cybersecurity frameworks, and local data-storage compliance, their advantage would increase. Specifically Korean and Japanese firms – which are proven reliable players with a strong presence worldwide and strengths in battery technology and infotainment systems –, can position themselves as trusted suppliers in those markets that are worried about Chinese-made vehicles and their possible espionage or security risks. On the other hand, however, there are big challenges ahead. If each country or region decides to have proper regulations, major hurdles will appear. For example; compliance costs will rise as automakers must meet different cybersecurity rules across regions; the technology surrounding software auditing, and the transparency of the supply chains itself will require significant investments; the supply chain and design of vehicles will be affected and in consequence production cost will increase; and, if there are different digital standards or rules, it is likely that there could be some limitations in the global interoperability.

While the rapid growth of EVs worldwide can be considered a good sign for sustainability goals – as they displaced over 1 million barrels per day of oil consumption in 2024 –. Recently there have appeared certain concerns related to security risks – proven or not – trade protectionism and unfair competition. On top of that, the transformation of cars into fully connected digital platforms has created a new paradigm, in which certain nations – mostly western nations – have started to be worried and rethinking their mobility through the lens of national security. In consequence, governments have tightened rules related to data, cybersecurity and foreign software dependencies. This new vision is already changing and transforming the vehicle industry, while the most affected, being the Chinese firms – due the natural competition and geopolitical reasons – there are other global automakers that, if they take the chance, could become key players – as far as they prioritize transparency in supply chains, security and technological trust. The new paradigm has shifted what used to be an ordinary, everyday product into a critical national infrastructure that must be subject to regulation. Finally, this paradigm also highlights the importance of data sovereignty and how important it has become and will be in the future.

Carey, N. (2025, December 2). China floods the world with gasoline cars it can't sell at home. Retrieved from Reuters: https://www.reuters.com/investigations/china-floods-world-with-gasoline-cars-it-cant-sell-home-2025-12-02/ European Commision. (2025, March 5). Industrial Action Plan for the European automotive sector . Retrieved from European Commision: https://transport.ec.europa.eu/document/download/89b3143e-09b6-4ae6-a826-932b90ed0816_en Financial Post. (2025, December 11). Why China's EVs are dangerous to Canada: CVMA. Retrieved from YouTube: https://www.youtube.com/watch?v=WV7bn29lpOQ Grand View Research. (2025). Autonomous Vehicle Market (2025 - 2030). Retrieved from Grand View Research: https://www.grandviewresearch.com/industry-analysis/autonomous-vehicles-market IEA. (2025). Trends in electric car markets. Retrieved from IEA: https://www.iea.org/reports/global-ev-outlook-2025/trends-in-electric-car-markets-2 Introvigne, M. (2024, February 6). Should Chinese Electric Cars Be Banned in the West? Retrieved from Bitter Winter: https://bitterwinter.org/should-chinese-electric-cars-be-banned-in-the-west/?gad_source=1&gad_campaignid=11726773838&gbraid=0AAAAAC6C3PdZ9Jx_edcTzlW0hHoO8yN2D&gclid=CjwKCAiA3L_JBhAlEiwAlcWO59TNJrosoZkG7MwAid0bRuGKs5KY0P7csiXimfUzLlbYshtFMafkdxoCqvQQAvD_Bw Leggett, T. (2025, June 10). China's electric cars are becoming slicker and cheaper - but is there a deeper cost? Retrieved from BBC: https://www.bbc.com/news/articles/cy8d4v69jw6o Meltzer, J. P., & Barron Esper, M. (2025, September 23). Is China circumventing US tariffs via Mexico and Canada? Retrieved from https://www.brookings.edu/articles/is-china-circumventing-us-tariffs-via-mexico-and-canada/#:~:text=Chinese%20intermediate%20goods%20used%20in,to%20the%20production%20of%20new: https://www.brookings.edu/articles/is-china-circumventing-us-tariffs-via-mexico-and-canada/#:~:text=Chinese%20intermediate%20goods%20used%20in,to%20the%20production%20of%20new Navarrete, F. (2024, May 21). Aranceles de EU a autos chinos ponen en aprietos a México. Retrieved from El Financiero: https://www.elfinanciero.com.mx/empresas/2024/05/21/aranceles-de-eu-a-autos-chinos-ponen-en-aprietos-a-mexico/ Oertel, J. (2024, January 25). European Council on Foreign Relations. Retrieved from https://ecfr.eu/article/security-recall-the-risk-of-chinese-electric-vehicles-in-europe/: https://ecfr.eu/article/security-recall-the-risk-of-chinese-electric-vehicles-in-europe/ Radio biafra. (2025). Fearing data leaks, Israel bans Chinese-made cars for army officers. Retrieved from Radio biafra: https://radiobiafra.co/ Schuman, M. (2025, November). China’s EV Market Is Imploding. Retrieved from The Atlantic: https://www.theatlantic.com/international/2025/11/china-electric-cars-market/684887/ Zhang, Z. (2025, December 4). China’s EV dominance sparks EU retaliation. Retrieved from East Asia Forum: https://eastasiaforum.org/2025/12/04/chinas-ev-dominance-sparks-eu-retaliation/

First published in :

World & New World Journal

Unlock articles by signing up or logging in.

Become a member for unrestricted reading!