Defense & Security

The Effect of China-Japan Conflict on Global Economy

Image Source : Shutterstock

Subscribe to our weekly newsletters for free

If you want to subscribe to World & New World Newsletter, please enter

your e-mail

Defense & Security

Image Source : Shutterstock

First Published in: Jan.19,2026

Jan.19, 2026

Relations between Japan and China entered a state of crisis on November 7th, 2025, after Japanese prime minister Sanae Takaichi said in the Japanese parliament that a Chinese attack on Taiwan potentially constituted an “existential crisis” under the Legislation for Peace and Security, allowing Japan to take military action in collective self-defense [1]. Following Takaichi’s remarks, the Chinese general consul in Osaka, Xue Jian, made threatening comments against Takaichi on X, triggering a diplomatic row between the two countries. Both sides protested the other’s remarks. In response to questions from the members of Japanese parliament, Takaichi refused to withdraw her remarks, claiming that they were consistent with the Japanese government’s existing position on the issue. Japan requested that China take “appropriate measures” against Xue. China refused the Japanese request and instead demanded Takaichi retract her statements. Then the Chinese government issued numerous retaliatory measures against Japan, including restricting travel and cultural exchanges, issuing a travel advisory, and cutting off seafood imports from the country. Moreover, On November 15th, the China Maritime Safety Administration announced that the People’s Liberation Army would conduct live-fire exercises in the central Yellow Sea from November 17th to 19th, and that navigation in this area would be prohibited during this period. The notice drew criticism from Taiwan, which accused China of saber-rattling in Japan for political gain [2]. On November 16th, the China Coast Guard announced that a formation of its ships carried out a patrol within the territorial waters of the Senkaku Islands, a territory disputed between Japan, China, and Taiwan. On December 2nd, Chinese and Japanese coastguard vessels engaged in a standoff over the islands. China said that it had implemented “necessary control measures” and driven a Japanese fishing boat away from the islands. On the other hand, Japan stated that it had intercepted and driven away two Chinese coastguard vessels, which approached the Japanese fishing boat. [3] From December 6th to 7th, Chinese Liaoning aircraft carrier transited through the Miyako Strait between the islands of Okinawa and Miyakojima and began takeoff and landing drills with Shenyang J-15 jets; aircraft took off from and landed on the aircraft carrier roughly 100 times in two days. [4] On December 7th, Japanese defense minister Shinjirō Koizumi accused China of two incidents on December 6th in which Shenyang J-15 jets from the Liaoning aircraft carrier at locking their fire-control radar at Japanese F-15 jets near the Miyako Strait. The Japanese government strongly protested to China. Takaichi also called the incident “extremely disappointing.” Japanese vice foreign minister Takehiro Funakoshi summoned Chinese ambassador Wu Jianghao over the incident. [5] In response, the PLA Navy spokesperson Wang Xuemeng accused Japan of a “slander and smear campaign,” saying that the Liaoning was carrying “routine carrier-based fighter jet flight training. [6]” In addition, he said that Japan Self-Defense Forces' aircraft had repeatedly approached and disrupted its fighter jet training. Japanese officials later said that their Chinese counterparts didn’t answer the hot line during the incident. Japanese defense minister Koizumi also said that while notified, Japan “did not receive sufficient information” regarding the military exercises, while Kihara said Japanese jets were far away from the Chinese jets while training. [7] The US criticized the radar targeting of Japanese aircraft and strengthened the US alliance with Japan. A US State Department spokesperson also said that “China’s actions do not contribute to regional peace and stability.” [8] The Liaoning aircraft carrier group traveled northeast from their position east of Kikai Island following the incident. A Chinese naval Type 054 frigate also sailed through the Miyako Strait on December 8th, while another traveled through the Osumi Strait. On December 9th, two Russian Tupolev Tu-95 bombers, four Chinese Shenyang J-16 fighter jets, and two Chinese Xi’an H-6 bombers flew through the Miyako Strait into the Pacific Ocean as part of joint military drills. On December 10th, two US B-52 bombers flew together with three Japanese F-15 jets and three F-35 jets. The Japanese defense ministry said that the US and Japan “reaffirmed their strong resolve to prevent any unilateral attempt to change the status quo by force.” [9] With this recent tension between China and Japan in the background, this paper explores the impacts of the China-Japan conflict on the global economy. This paper first explains major conflicts between China and Japan in the past and then examines the effects of the China-Japan conflict on the global economy.

The First Sino-Japanese War (July 25th, 1894 – April 17th, 1895) was a conflict between the Qing dynasty of China and the Empire of Japan primarily for influence over Korea. [10] After more than six months of unbroken successes by Japanese naval and land forces and the loss of the ports of Lüshunkou (Port Arthur) and Weihaiwei, the Qing government sued for peace in February 1895 and signed the unequal Treaty of Shimonoseki with Japan two months later, thereby ending the war. In the late 19th century, Korea remained one of the Qing tributary states, while Japan viewed Korea as a target of imperial expansion. In June 1894, the Qing government, at the request of the Korean emperor Gojong, sent 2,800 troops to aid in suppressing the Donghak Peasant Revolution. The Japanese government considered this a violation of the 1885 Convention of Tientsin and sent an expeditionary force of 8,000 troops to Korea. The Japanese force landed in Incheon. The Japanese army moved to Seoul, seized the Korean emperor, and set up a pro-Japanese government on July 23rd, 1894 in the occupation of Gyeongbokgung. The Qing government decided to withdraw its troops, but rejected recognition of the pro-Japanese government, which had granted the Imperial Japanese Army the right to expel the Qing’s Huai Army from Korea. However, approximately 3,000 Qing troops remained in Korea, and could be supplied only by sea; on July 25th, the Japanese Navy won the Battle of Pungdo over the Qing navy and sank the Qing’s steamer Kowshing, which was carrying 1,200 Qing reinforcements. Japan declared war against the Qing on August 1st. Following the Battle of Pyongyang on September 15th, Qing troops retreated to Manchuria, allowing the Japanese army to take over Korea. Two days later, the Qing’s Beiyang Fleet suffered a decisive defeat at the Battle of the Yalu River, with its surviving ships retreating to Port Arthur. In October 1894, the Japanese army invaded Manchuria, and captured Port Arthur on November 21st. Then Japan captured Weihaiwei on the Shandong Peninsula on February 12th, 1895. This gave the Japanese army control over the approaches to Beijing, and the Qing court began to negotiate with Japan in early March. The war concluded with the Treaty of Shimonoseki on April 17th, which required the Qing government to pay a massive indemnity and to cede the island of Taiwan to Japan. Japan gained a predominant position in the Korean peninsula. The war demonstrated the failure of the Qing dynasty’s attempts to modernize its military and fend off threats to its sovereignty, especially when compared with Japan’s successful Meiji Restoration. For the first time, regional hegemony in East Asia shifted from China to Japan; the prestige of the Qing dynasty, along with the classical tradition in China, suffered a major blow. [11] Inside China, the defeat was a catalyst for a series of political upheavals led by Sun Yat-sen and Kang Youwei, culminating in the 1911 Revolution and ultimate end of the Qing dynasty in China.

The Second Sino-Japanese WarThe Second Sino-Japanese War was fought between the Empire of Japan and the Republic of China and between 1937 and 1945, after a period of war localized to Manchuria that started in 1931. [12] It was the largest war in Asia in the 20th century. [13] On September 18th, 1931, the Japanese staged the Mukden incident, a false flag event fabricated to justify their invasion of Manchuria and establishment of the puppet state of Manchukuo. This is sometimes marked as the beginning of the war between the Empire of Japan and the Republic of China. From 1931 to 1937, China and Japan engaged in skirmishes, including Shanghai, as well as in Northern China. The military forces of Nationalist and Chinese Communist Party, led by Chiang Kai-shek and Mao Zedong respectively, had fought each other in the Chinese Civil War since 1927. In late 1933, Chiang Kai-shek encircled the Chinese Communists in an attempt to finally destroy them, forcing the Communists into the Long March. The Communists lost almost 90% of their men. Although a Japanese invasion became imminent, Chiang still refused to form a united front with the Communists before he was placed under house arrest by his subordinates who forced him to form the Second United Front in late 1936 in order to resist the Japanese invasion together. [14] The full-scale war started on July 7th, 1937 with the Marco Polo Bridge incident near Beijing, which prompted a full-scale Japanese invasion of the rest of China. The Japanese army captured the capital of Nanjing in 1937 and perpetrated the Nanjing Massacre. After failing to stop the Japanese capture of Wuhan (China’s de facto capital at that time) in 1938, the Nationalist government relocated to Chongqing in the Chinese interior. After the Sino-Soviet Non-Aggression Pact, Soviet aid bolstered the National Revolutionary Army and Air Force. By 1939, after Chinese victories at Changsha and with Japan’s lines of communications stretched deep into the interior, the war reached a stalemate. The Japanese forces could not defeat the Communist forces in Shaanxi, who waged a campaign of sabotage and guerrilla warfare. In November 1939, Nationalist forces carried out a large-scale winter offensive, and in August 1940, Communist forces launched the Hundred Regiments Offensive in central China. In April 1941, Soviet aid was halted with the Soviet–Japanese Neutrality Pact. [15] In December 1941, Japan launched a surprise attack on Pearl Harbor in Hawaii and declared war on the US. The US increased its aid to China under the Lend-Lease Act, becoming its main financial and military supporter. With Burma cut off, the US Air Forces airlifted material over the Himalayas. In 1944, Japan launched Operation Ichi-Go, the invasion of Henan and Changsha. In 1945, the Chinese Expeditionary Force resumed its advance in Burma and completed the Ledo Road linking India to China. China launched large counter-offensives in South China, repulsed a failed Japanese invasion of West Hunan, and recaptured Japanese occupied regions of Guangxi. [16] Japan surrendered on September 2nd, 1945, after the atomic bombings of Hiroshima and Nagasaki by the US, Soviet declaration of war against Japan and subsequent invasions of Manchukuo and Korea. The war resulted in the deaths of approximately 20 million Chinese. China was recognized as one of the Big Four Allied powers in World War II and one of the “Four Policemen,” which formed the foundation of the UN. [17] It regained all lost territories and became one of the five permanent members of the UN Security Council. The Chinese Civil War resumed in 1946, ending with a communist victory and the Proclamation of the People’s Republic of China in 1949. The government of the Republic of China relocated to Taiwan.

Senkaku Islands Dispute September 2010 Senkaku Boat CollisionThe Senkaku boat collision incident occurred on the morning of September 7th, 2010, when a Chinese trawler (Minjinyu 5179) collided with Japanese Coast Guard patrol boats near the Senkaku Islands. The Senkaku Islands are a group of five uninhabited islands and three islets located in the East China Sea, which are under the administrative control of Japan, but also claimed by China and Taiwan. The Senkaku Islands have both economic and military value. There are rich fishing grounds in the exclusive economic zone (EEZ) surrounding the Senkaku islands, as well as significant oil and gas deposits. The islands are also of great geostrategic value, facilitating control over the East China Sea. [18] The Senkaku Islands are claimed by Japan, the People’s Republic of China and the Republic of China (Taiwan). [19] In 2008 a sports fishing boat from Taiwan, Lien Ho, was rammed and sunk by Japanese Coast Guard patrol ships which led to an official apology and monetary compensation of NT$10 million paid by Japan. Multiple events involving Japanese Coast Guard and fishing boats from nearby Chinese provinces and Taiwan have occurred since 1972. From 2005 to the 2010 incident, however, bilateral relations between Japan and China had been positive. [20] According to the Japanese Coast Guard, the patrol boat Mizuki of the 11th Regional Coast Guard Headquarters encountered Minjinyu 5179 at around 10:15 (JST) on September 7th, 2010. Mizuki ordered Minjinyu 5179 to stop for inspection since Minjinyu 5179 was traveling 12 km (7.5 mi) north-west of the Senkaku Islands, which is outside the agreed area for Chinese fishing, and within disputed Japanese territorial waters. Minjinyu 5179 refused to follow the order and attempted to flee from the scene. During the chase and interception, Minjinyu 5179 collided with Japanese Coast Guard patrol vessels. On September 8th, 2010, Japanese Coast Guard boarded the Chinese trawler and arrested its captain for obstruction of performance of public duty and illegal fishing. [21] The trawler, the captain, and 14 crew members were transported to Ishigaki Island of Japan for detention. A Japanese investigator told the press that he smelled alcohol on the arrested captain but apparently no alcohol test results were ever released. The collision and Japan’s subsequent detention of the captain, Zhan Qixiong resulted in a major diplomatic dispute between Japan and China. When China’s repeated demands for the release of the captain were refused and his detention extended for ten more days, the Chinese government canceled official meetings of the ministerial level and above. [22] In response to the arrest, the Chinese government made a series of diplomatic protests, demanding the immediate release of the trawler and all its crew. China summoned Uichiro Niwa, the Japanese ambassador to China in Beijing, six times, each time with an official of higher diplomatic rank, on one occasion after midnight. Moreover, China initiated a series of escalatory measures, including rhetorical threats, encouraging popular protests across China, the arrest of four Japanese citizens in China for allegedly photographing military targets and the implementation of an unofficial embargo on Rare Earth Elements (REE). These measures were implemented with various degrees of ambiguity and designed to exploit a number of Japanese vulnerabilities – including the Japanese government’s weakened domestic position and the Japanese economy’s high dependency on Chinese REE exports. [23] In the short-term, China attempted to force Japan to release the detained trawler captain immediately. In the long-term, however, China tried to demonstrate its ability to use a strong economic instrument which could be used as deterrent, and as coercive measure. The detained Chinese crew members were released without charge and were allowed to return home. In China, the overall event is perceived as a diplomatic victory, while the Japanese government’s “weak-kneed” handling of the issue was criticized in Japan, in particular by former Prime Minister Shinzo Abe. [24] One hundred Japanese conservative lawmakers signed a letter criticizing the release of the Chinese captain, and Japanese citizens took to the street to protest both China’s behavior and the “weakness” of the Japanese government. Video footage proving the deliberate nature of the boat ramming was only shown to Japanese lawmakers in a closed screening, but not released to the wider public, likely out of fear of further diplomatic clashes with China. The footage was eventually leaked online and led to increased criticism of the Japanese government for keeping details of the incident from the public. The crisis was resolved by the end of November 2010 when diplomatic dialogue between Japan and China was fully restored, and a significant de-escalation of measures took place.

September 2012 Japanese Government’s Island PurchaseThe Senkaku Islands dispute in September 2012 was a major flare-up between Japan and China, triggered by Japan‘s purchase (from private owners) and nationalization of three of the uninhabited islands, which China claims as its territory. In April 2012, the governor of Tokyo, Shintaro Ishihara, a right-wing nationalist, announced a plan for his municipal government to purchase three of the islands (Uotsuri, Minamikojima, and Kitakojima) from their private owner and build on them in order to assert Japanese sovereignty. In August 2012, Chinese activists from Hong Kong briefly landed on the islands, triggering a visit by Japanese activists in response. In September 2012, the Japanese government completed the purchase of the three islands from a private Japanese owner. This action triggered massive anti-Japanese protests across China, disruptions to Japanese businesses, boycotts of Japanese products, and increased patrols by Chinese vessels near the islands, thereby escalating tensions between China and Japan over sovereignty. This action also impacted trade between the two countries and tested the US-Japan security alliance. Consequences of the conflict were as follows: First, the dispute intensified nationalist feelings in both China and Japan, with demonstrations occurring in more than 100 Chinese cities, coinciding with the anniversary of the Mukden Incident. The Japanese embassy in Beijing was attacked. Major Japanese companies temporarily shut their factories and offices in China. Two more Japanese activists landed briefly on the islands. Secondly, Chinese Boycotts and business disruptions hit Japanese companies like Panasonic, Honda, and Canon, with significant drops in Japanese car sales and exports to China. Third, in response to Japan’s purchase of the three islands, China sent patrol boats to the area, challenging Japan’s administration and marking a new, more confrontational status quo. Later six Chinese ships sailed into the waters around the islands, staying for a short period of time to assert China’s territorial claim. Chinese maritime surveillance vessels made 12 forays into the waters close to the Islands after Japan bought the three islands in September 2012. Japan increased the number of coastguard vessels patrolling the island from three to thirty. Moreover, in December 2012, a Chinese maritime surveillance plane flied over the islands for the first time. Japan responded by scrambling eight F-15 fighter jets. The incident demonstrated that the dangers of an armed clash existed not only at sea, but also in the air. The dispute wasn’t resolved; instead, it marked a significant escalation, with Japan solidifying its de facto administrative control and China increasing its assertive presence. Fourth, since 2012, China has maintained a daily presence with its coast guard vessels near the islands, thereby creating the situations of confrontation with the Japanese navy.

It is hard to predict what effects China-Japan conflicts will have on global economy, as well as the economy of both countries. Cambridge Centre for Risk Studies at University of Cambridge carried out research on this issue in June 2014 after Japanese government purchased three of the uninhabited Senkaku islands and then the conflict between China and Japan took place in September 2012. Cambridge Centre for Risk Studies categorizes China-Japan Conflict as a magnitude 3 conflict.

Table 1: Magnitude scale of conflict (source: Cambridge Centre for Risk Studies)

Cambridge Centre for Risk Studies provided three scenario for the China-Japan Conflict (S1, S2, and X1). Standard Scenario S1 consists of 9 months of conflict before stalemate occurs and intervention enables peace to be concluded. Scenario Variant S2 is similar to the standard scenario, but the conflict period lasts for 2 years, with trade disruption continuing for a further 3 years. An important aspect of the macroeconomic consequences is the duration of the disruption to international trade. Phase 4 in the scenario is prolonged, with double the economic losses and around 250,000 people dead. Scenario Variant X1 (Extreme 1) is the most severe variant considered in the impact analysis. Conventional weapons are still preferred but the conflict lasts more than 5 years, thereby causing over 3 times the losses and nearly 500,000 deaths. Such a variant plunges the whole world into a three-year recession after 90% of export trade is lost. According to Cambridge Centre for Risk Studies, the China-Japan Conflict evolves through Phase 1 through 7.

Phase 1: escalating tensionsDiplomatic posturing, Naval maneuvers, and large-scale war-games have defined recent tensions between Japan and China. Amid military modernization, increased Chinese nationalism, the legacy of conflict (Sino-Japanese wars) and an extreme thirst for natural resources, Japan and China have continued to clash over the Senkaku Islands. As Japan imports 90% of its energy, it is eager to maintain an open and free flow of maritime trade, but despite bilateral trade reaching US$ 345 billion, China has pursued a more assertive position, fueled by nationalism and a rise in anti-Japanese sentiment. [25] Since Japan’s nationalization of three of the disputed Senkaku islands in 2012, China has increased the frequency and scale of incursions. For example, Chinese aircraft have entered the disputed airspace, and Chinese frigates have engaged Japanese destroyers. Tensions have reached their highest level since the end of World War II in 1945. In a show of self-determination, Japan’s Diet (parliament) passed new laws that repealed limitations of the Constitution on use of military force to settle international disputes. There is a growing concern that the situation in the East China Sea will soon escalate beyond the disputes in the South China Sea, where the Chinese navy attacked commercial Vietnamese vessels over proximity to the Spratly Islands. [26] A Japanese fishing vessel is fired upon after straying into Chinese waters. Although the crew of the damaged boat are returned safely, angry diplomatic exchanges begin from the highest levels of both Japanese and Chinese governments. Japan acknowledges the error of the fishing boat and promises immediate action to prevent further incidents. [27] Although tight-lipped at first, details emerge that the Japanese government deployed naval engineers to install radar equipment on the disputed Senkaku islands to ‘help ships and boats navigate the area safely.’ The Chinese government and state-run media react angrily to the news, stating that the objective of ‘preventing marine accidents’ is a ‘thinly veiled attempt to disguise a notorious, unlawful and dangerous attempt to claim Japan’s sovereignty over the Senkaku islands.’

Phase 2: provocation and posturingStocks tied to Japanese businesses suffer heavy losses on Chinese stock markets as tensions between Japan and China increased amid uncertainty over the Chinese response. Although expected to call for a UN Security Council meeting, the Chinese government bypass diplomatic protocols and issue a public condemnation and ultimatum, demanding that Japan remove immediately the radar and personnel within 72 hours. Failure to do so, the statement from the Chinese government continues, is considered “an unacceptable act of aggression against Chinese sovereignty.” Despite international calls for calm action and volatility in global stock markets, Japan refuses to remove the radar equipment, reiterating their “honest and responsible intent to protect all in the East China Sea.” After 24 hours, China orders an immediate cessation of all trade import agreements with Japan. China also issues a travel advisory, warning all Chinese citizens to leave Japan immediately. The US and several EU countries urge calm. The Dow Jones and FTSE100 are among many global markets that suffer heavy losses on fear of war and the implications for long-term economic growth. The world waits anxiously for the deadline. Rumors of negotiations excite the press and prop up the markets but the sudden and conspicuously coordinated departure of all non-essential personnel from the Chinese embassies and consulates in Japan creates widespread pessimism. Many international operations decide to withdraw executives from their offices in key cities in the region.

Phase 3: military incidentsSeventy-two hours after the ultimatum, a Chinese People’s Liberation Army Navy (PLAN) Lanzhou-class destroyer launches a C-602 cruise missile against the radar installation on the disputed islands. The missile destroys the radar along with a naval transportation unit, killing 18 members of Japan’s Maritime Self-Defense Force (JMSDF). The Western countries condemn the Chinese missile attack with UK, US, and France calling an urgent meeting of the UN Security Council. Japanese citizens are outraged. The Japanese government publicly promises retaliation against China. The US government urges restraint on Japan and warns that any proactive Japanese actions to provoke China could compromise US ability to support them in future actions. Stock markets plunge as fear of war sets in, with commodity prices, in particular oil, increasing significantly. The following evening two Japanese Mitsubishi F2 fighter planes from Tsuiki Air Base in Fukuoka, armed with ASM-2 anti-ship missiles, destroy the Chinese ship responsible for the missile attack on Senkaku Islands. China state news agencies report 37 Chinese sailors killed in the attack, with the destroyer afloat in open water but damaged beyond repair. Protestors in China take to the streets, criticizing Japan’s attacks. Japanese citizens are jubilant, with nationalistic media coverage. The wider international community condemns the retaliation act. China instigates a full blockade of Japanese vessels traveling through the Taiwan Strait and South China Sea, while promising safe passage for all non-Japan bound ships; China closes its airspace to airplanes coming to or from Japan. Japan reacts similarly, restricting movement of Chinese ships and airplanes. To prevent any attempt on the part of Japan’s Maritime Self-Defense Force to access the islands, Chinese PLAN enacts a familiar mine warfare strategy to block access. The ‘Elfreida’, a commercial US$200m Ultra Large Container Vessel traveling from Busan in South Korea to Singapore, is lost at sea along with nearly 15,000 TEUs (twenty-foot equivalent units) of cargo. Although the cause is not confirmed, speculation mounts that the ship struck a Chinese mine that had drifted into open water. Japan is quick to label it as another Chinese act of recklessness, while China blames a Japanese submarine attack for the disaster. Amid the high level of tension, another civilian disaster occurs as a commercial aircraft carrying 400 passengers disappears. A 747-400 heading from Beijing to Sydney disappears from the radar over the East China Sea. Accident investigators cannot determine whether it was destroyed in an act of war. Aside from the human cost, insurance claims are expected of up to a billion dollars. The US, Australia, and India create a total blockade of the East China Sea. Ships traveling from Japan are forced to travel south of the Philippines, thereby increasing journey times by over 30%. South Korea’s trade routes with Asia and Europe are also severely affected, however, as it is summer, trade with Europe suffer less, as they can use Arctic-shipping lanes and actually reduce shipping times by almost one week. China’s imports and exports are hit hardest. Their cross-Pacific journeys are rendered almost impossible, severely hampering trade and diplomatic relations with the US. [28] Chinese citizens take to the streets in protest. Although protests are generally anti-Western, they focus on anti-Japanese protests. Japanese businesses are ransacked and burned, and Japanese commercially branded products destroyed on the street. A Japanese factory in Shanghai is stormed by an angry mob, killing Japanese managers. Dozens more Japanese workers are taken hostage by Chinese protestors.

Phase 4: all-out conflictJapan’s Special Forces mount a clandestine operation to rescue the Shanghai hostages, bringing commandoes ashore and into the factory compound in central Shanghai, undetected by Chinese defense forces. The clandestine operation successfully extracts the Japanese hostages, and the Japanese Special Forces escape before the Chinese army react, but several Chinese protestors are killed. China responds with a subtle but devastating act. A cyber attack shuts down Japan’s Futtsu Power station, near Tokyo, the second largest gas power station in the world and key provider of energy to the Keihin and Keiyo Industrial Zones (the largest industrial region in Japan). The attack cripples Japan’s industrial sector and denies power to military bases in the region. Power shortages restrict industries to three-day weeks as Japan starves for energy. At the same time, Washington D.C. suffers a mysterious but temporary power outage. Despite China denying responsibility for computerized hacking of the US power grid, military commentators interpret it as ‘virtual shot across the bow’, to warn the US away from military intervention in the China-Japan conflict. Trading is suspended on global stock markets as fear of a world war triggers sharp falls. Panic strikes Japan as people begin to evacuate the major cities in Japan. Many foreign nationals have already left but those who remain struggle to find ways to exit Japan. A full diplomatic effort is launched to remove citizens from both China and Japan. Foreign governments provide a constant stream of flights to India, Singapore and Australia as fear of escalation spreads. After a short period of relative calm, Japan carries out a pre-dawn air strike against mainland China. Ship-launched cruise missiles and aircraft-launched air-to-ground missiles target the military bases and radar stations around Shanghai, Beijing, and the Hong Kong - Guanghzou region. It is the start of a major period of offensive action by Japanese military forces, which continues for nearly three months of nightly bombing. As the anti-aircraft defenses around the cities in China are degraded, air raids are launched targeting the major industrial and commercial centers, in a concerted action of strategic bombing to reduce the economic power of China and change the strategic balance of military power and global influence in the region after the conflict. Assembly plants, office buildings, factories, ports, trucking and rail facilities are destroyed in concerted waves, night after night. Chinese air defense is fierce, and Japanese aircraft suffer heavy losses. Despite the night timing of the attacks, and air raid warnings, tens of thousands of Chinese workers are reported killed in the first few weeks. The death toll mounts over the coming months. China’s retaliation is swift; carrying out similar airstrikes against industrial and commercial sites in Japan’s Sendai region, and commencing an intensive bombing campaign of Japan’s power plants, liquid petroleum gas plants and shipping terminals. Japan’s already restricted energy supply is further damaged, and China’s strategy is now to cripple Japan’s economic infrastructure and to place pressure on the Japanese government to back down. China launches waves of missile attacks against industrial sites in the Tokyo-Yokohama region. In addition to tens of thousands of casualties, Japan’s industrial capacity suffers severe damage.

Phase 5: stalemateThe hostilities between Japan and China provokes global condemnation and the international community suffers economically from the fallout of the war, but for some period of time nobody can prevent the conflict from continuing. China’s membership of the UN Security Council is suspended. The UN Security Council calls for an immediate ceasefire and de-militarization of the area, but is unable to get agreement to mandate trading sanctions against the belligerent nations. Shipping of gas and oil supplies to both Japan and China are severely curtailed and energy reserves in both countries are reported running low, but critically so in Japan. The US declares that it is not prepared to let the Japanese citizens run out of fuel, and soon will provide Japan with the gas and oil supplies it needs. Japan agrees to suspend military attacks against China. A US shipping convoy of oil tankers heads for Japan, and the US demands that China withdraws its naval blockade around Japan to let it pass. Aircraft carriers and supporting ships from the US Pacific fleet move into tactical positions around the South China Sea. The implication is clear. The US can not allow Japan to lose the conflict and now prepare to intervene militarily if necessary. Russia protests against the US action and hints that it will make its gas and oil available to China in reciprocation, but after diplomatic pressure Russia finally aligns with the international consensus to end the China-Japan conflict. The rest of the ‘democratic security diamond’- i.e. Australia and India, as well as the UK, France, Germany, and regional actors, Vietnam and the Philippines – shows public solidarity around the initiative to end the war. For weeks the US navy and Chinese navy face off at sea, circling and withdrawing, but no shots are fired. There are no further attacks on the Japanese mainland and there is a period of stalemate between the two countries.

Phase 6: negotiated peaceThe US, along with Russia as a partner, calls for an immediate ceasefire, the removal of the weapons on the disputed islands, and the opportunity for both China and Japan to address the UN on the issue of each country’s Exclusive Economic Zone (EEZ). The Chinese premier and the Japanese prime minister finally meet at peace talks in Singapore. After three days of negotiations, a peace treaty is signed, thereby guaranteeing the free flow of trade through the South and East China Sea and gestures towards the reconstruction of each other’s infrastructure. Global markets respond positively.

Phase 7: aftermathChina agrees to the conditions that any further attack would void all agreements, and that Pacific and South China Sea shipping lanes will be opened as soon as possible so that trade with the US and Canada can begin again. Japan also agrees to the ceasefire and to the US and Russia’s role in negotiating trade relations with China and restoring most of the US$ 345 billion agreement. The free flow of shipping routes returns within 3 months, causing an increase in global stock markets as some normality returned. It requires a large presence and deployment of US Naval forces, at significant cost to their economy. Commodity prices began to drop within hours of the agreement. Ownership of the Senkaku islands remains disputed, but after 9 months of conflict, 100,000 deaths, and billions of dollars in losses, neither side has the political will, energy supplies, the public support, or the money to continue the conflict.

2. Examination of the Effects of China-Japan Conflict on Global EconomyTo model the effects of a China-Japan conflict, Cambridge Centre for Risk Studies at University of Cambridge selected a number of key indicators. Shocks were chosen based on historical precedents that would be expected to occur during a China-Japan conflict. While the conflict may last for only a few months, most of the shocks applied in the model persist and generally last for a period of one year before returning to baseline over the next several years. Several of the variables were shocked for a longer period to represent the ongoing macroeconomic effects created by conflict. The effects of conflict. on some variables were very long lasting and have very high macroeconomic inertia in the system, thereby taking several years to return to pre-disaster levels. Such an example is the effect of conflict on global trade. The modeling by Cambridge Centre for Risk Studies was carried out in 2014, but the Cambridge Centre is interested in generic results for whenever a conflict might break out in future years.

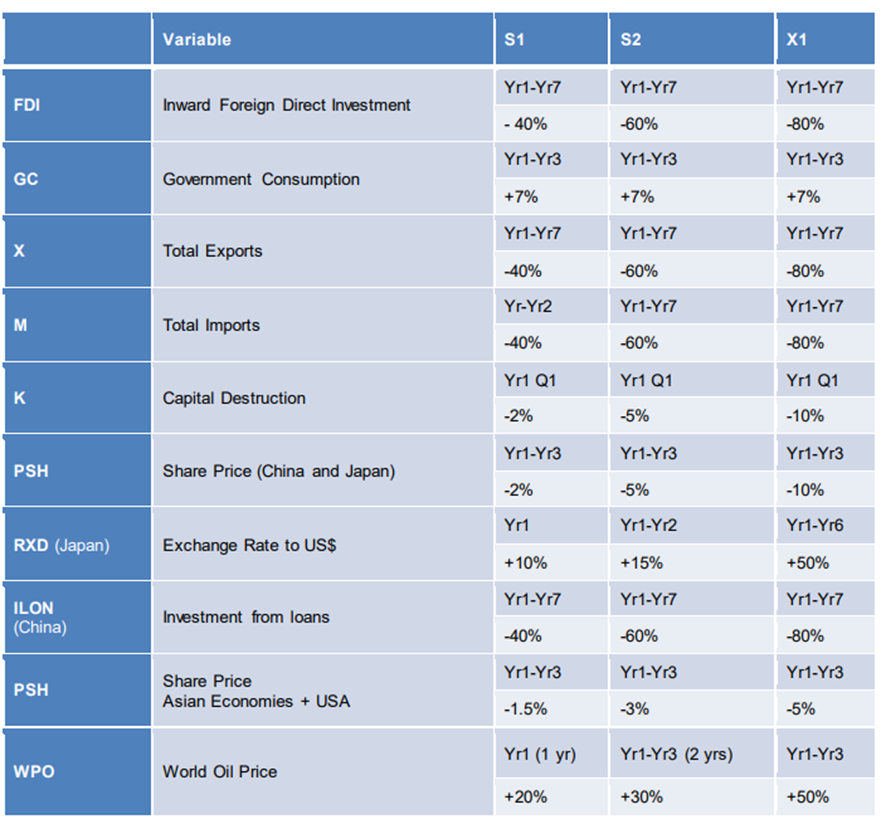

Variable descriptionsThe three independent scenarios (S1, S2, and X1) have been modeled using the Oxford Economics Global Economic Model. Following are the variables in the model to which the shocks were applied. Table 2 provides an overview of the input (parameter) variables applied.

Table 2: Input (parameter) variables in macroeconomic modeling

Inward foreign direct investment is investment in business and capital. China has significant inflows of foreign direct investment and is therefore much more affected by a conflict shock to this variable than Japan. A 40% reduction of inward foreign direct investment represents a loss of approximately US$ 100 billion per year to the Chinese economy at its peak in year 2. In Japan, this represents a loss of about US$ 2.1 billion per year at its peak in year 2. Government consumption increases during the conflict to pay for military, ammunition and additional resources required for conflict. China spent 2% (US$ 166 billion) of GDP on defense in 2014, while Japan spent 1% (US$ 59.3 billion) of GDP on defense. In each of the three scenarios, government spending increased 7% in the first year and then returned to baseline levels by the end of the second year. This represents an increase in government spending of US$ 86 billion per year for China and US$ 70 billion per year for Japan. Exports and imports account for a significant share of GDP for both Japan and China. In China, exports account for 26% of GDP and in Japan, exports account for 18%. One of the largest economic effects that will occur as a result of this conflict will result from exports and imports being prevented to entering the East China Sea. Exports and imports are both shocked simultaneously and equally in each scenario. The peak of the shock to exports and imports occurs at the outbreak of conflict but takes a further six years to recover to pre-conflict levels. Capital destruction is defined as capital that can no longer be used as a productive resource and is an expected but unfortunate consequence of conflict. A declining capital base therefore has very serious consequences for economic growth and output. The level of capital destruction increases in each of the three scenarios from 2% of the capital stock in S1, 5% in S2 and 10% in X1. Share (stock) prices capture the market valuation of firms within an economy and incorporate the assets into a firm’s books and the expected value of future revenue and profit. Share prices therefore capture the level of confidence that the market has in the future profitability of a firm. Any firm that operates in a country that is in conflict will face increasing risks to its normal business operation and long-term strategic objectives. Increased uncertainty about future growth will have significant downward pressure on the market valuation of firms that operate in these areas. Share prices have been shocked 2% in S1, 5% in S2 and 10% in S3 compared to the baseline. Share prices are also expected to decline in other parts of the world as future global expectations are amended downward. These effects are modeled directly on neighboring Asian countries and the US stock market. In all three scenarios, however, share prices return to baseline by the end of second year after the conflict began. Capital flight occurs when assets and money rapidly move out of a country or region. Capital flight is most likely to occur when investment and business outlooks are uncertain, and investments are placed at risk. In Japan, capital flight is modeled as a devaluation of its exchange rate benchmarked against the US dollar. A 10% devaluation of the Japanese currency takes place in S1, 15% in S2 and 50% in X1. Modeling capital flight from China is more problematic. China has strict controls on capital, and the Yuan does not float on international currency markets. As a result, the exchange rate in China is fixed at present levels across all scenarios. Capital flight from China is therefore indirectly captured through a decline in investment funded by loans. This is represented by a shock of 40% in S1, 60% in S2 and 80% in X1 with recovery back to baseline projections taking six years. World oil prices typically rise during conflict due to increased demand for energy and heightened uncertainty around supply. This is modeled as a 20% increase in S1, 30% increase in S2 and 50% increase X1. The rise in oil prices lasts for 12 months during the conflict and then is allowed to return to base during the second year.

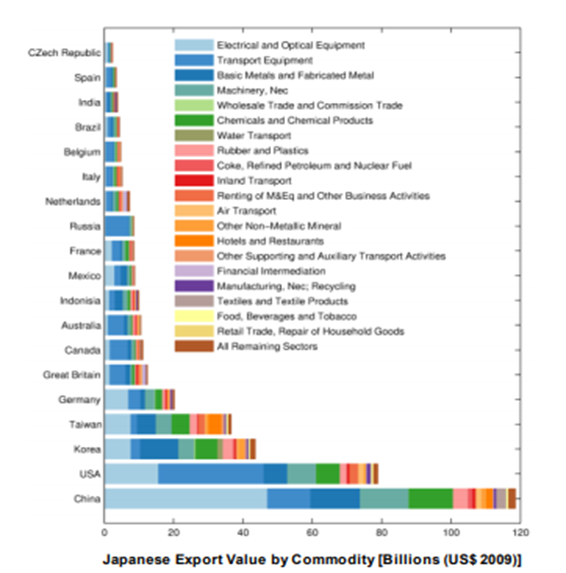

Impact of China-Japan conflict on exports and importsA shock on exports and imports to Japan and China represents one of the most significant effects that will affect global economic output. Figures 1 and 2 show the international exports from Japan and China which are halted by the conflict. The biggest recipient of exports from Japan and China, apart from each other, is the US.

Figure 1: China exports by value and type to different countries

Figure 2: Japan exports by value and type to different countries.

As a result of the conflict, total exports in China for the year 2 drop by 80% in the X1 scenario or approximately US$ 1.5 trillion. And for Japan exports decline by US$ 726 billion. Behind Japan and China, exports from the US are the most adversely affected international market dropping in traded value by over US$ 450 billion in the X1 scenario. Globally, the aggregate value of total exports declines by over US$ 6 trillion. A similar picture can be described for imports. Imports to the US reach a minimum in year 2 with a drop of US$ 165 billion, while the value of aggregate global imports drops by almost $4 trillion across all markets and sectors.

Impact of China-Japan conflict on energy pricesBrent crude spot price spikes at US$ 120 per barrel in scenario X1 and roughly US$ 110pb in each of the other two scenarios. This occurs despite downward pressure on global aggregate demand due to a decline in aggregate output, a substantial shock to global trade and a significant drop in market confidence. The biggest impact on global oil prices occurs 12 months after the conflict began with a steep decline in oil prices as the world recovers from the shock of conflict. There is then a period of two years of persistent decline in oil prices until the end of year 3. Global oil prices does not fully recover to pre-conflict levels by the end of the model period in year 7.

Impact of China-Japan conflict on commodity pricesA similar pattern will occur in the price of most other natural resources and commodities. Prices of raw commodities will initially rise as Japan and China increase demand for raw materials and resources in preparation for conflict. Coal, iron ore, natural gas and other rare earth metals will all spike in price as the threat of conflict looms. Once a long and protracted conflict between Japan and China looks unlikely and the international community is successful in getting the peace treaty signed, the price of natural resources will then decline rapidly as aggregate demand drops. By this point, the signs of a global recession are imminent. Aggregate demand is down, and trade between Japan and China has ceased. And market confidence will be at an all-time low. China, which was once the world’s largest exporter, struggles to attract foreign direct investment and cannot find sufficient buyers for its manufactured goods. This leads to lower demand for raw materials, which in turn leads to persistently low prices for raw commodities and resources for the next several years.

Impact of China-Japan conflict on employmentA drop in global aggregate demand leads to a rapid increase in unemployment caused primarily by a drop in exports and a loss in the value of share price. In both Japan and China, there is a rapid increase in unemployment as the economy adjusts in the post-conflict period between year 2 and year 7. Unemployment in Japan skyrockets after the end of the conflict and reaches a peak at 14% in year 5, 10% higher than baseline. In China, the effects of unemployment are much more acute, reaching a peak unemployment rate of 9% during the first year, 5% above baseline. Similarly, unemployment in the rest of the world is also adversely affected. Unemployment in the US reached 9.4% in year 3, 2 years after the conflict has started, 3.8% above baseline projections.

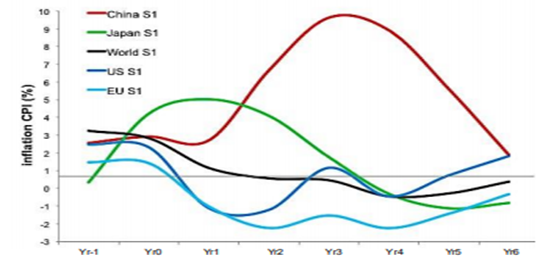

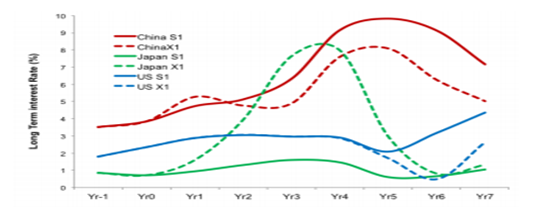

Impact of China-Japan conflict on inflationHistorically, one of the most devastating macroeconomic consequences in post-conflict periods is high and runaway inflation. Figure 3 shows the effects of the conflict on inflation in different countries in the scenario S1.

In the conflict scenario, both Japan and China experience inflationary pressure and a rise in consumer prices precipitated by a combination of import inflation and cost-push inflation. Cost push inflation occurs because important resources and goods are diverted away from the real economy and used for the war effort. Manufacturing plants that once made goods for general consumption are now used to produce weapons required for conflict – this drives up the price of normal goods in the economy as there are limited supplies of alternatives. Import inflation will occur because the import of goods from international markets are blocked from coming through the South and East China Seas, with a limited supply of local substitutes, prices for these goods will also rise. In China, prices are down in line with a drop in aggregate demand, a direct result of a reduction in foreign direct investment. In the most extreme scenario X1, there is a short period of deflation in the Chinese economy, peaking at -1.5%, which is followed by increasing inflationary pressure after the conflict ends. Inflation reaches a peak at 9.6% in year 4 in the S1 scenario before declining to pre-conflict levels by year 7. In Japan, where FDI is quite small, inflationary pressure accompanies the start of the conflict. Scenario S1 peaks at 5% inflation in year 2 before going into deflation in year 6. In scenario X1, inflation reaches 20% in year 2 before plunging to negative levels (deflation) from year 5 onwards. The global economy experiences a similar pattern of inflation. During the conflict, inflation increases and reaches peaks in scenarios S2 and X1 before starting a long decline. Average global consumer prices then go down for 4 to 5 years before returning to positive growth rates from year 6.

Impact of China-Japan conflict on government balance and reservesThe scenario results in a significant decrease (compared to baseline) in foreign reserves for both Japan and China. In the X1 scenario, Japan and China will decrease their foreign reserve holdings by US$ 2.2 trillion and US$ 430 billion respectively when compared to baseline by year 7. In a similar way, gross government debt as a percentage of GDP will also increase. In China, the debt to GDP ratio approaches 45% in scenario X1 and a little over 30% in scenario S1 by year 7. In Japan, the debt to GDP ratio increases from 212% in year 0 to around 277% in year 7.

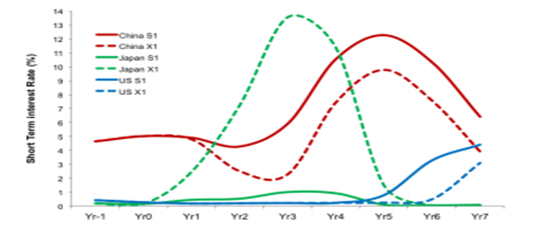

Impact of China-Japan conflict on interest ratesInterest rates are often used exogenously as a policy instrument to affect economic activity. Lowering interest rates gives the economy a boost and encourages borrowing, while raising interest rates has the effect of slowing down an economy that is overheating. In the scenario, interest rates are allowed to adjust endogenously (not through policy intervention) to reflect economic pressures that occur in the economy. For example, interest rates adjust to inflationary expectations and demand. When inflation is expected to go up in the future, borrowers need to compensate lenders for the expected drop in the value of money.

Inflation in both Japan and China increases over the scenario period, contributing to a rise in the interest rates in both nations. Interest rates also increase because of increased risk. During and after the conflict both Japan and China experience increased exposure to risk, which places upward pressure on interest rates.

Exchange rates represent the relative value of a nation’s currency and are closely correlated with a nation’s interest rates. In the scenario, Japanese exchange rates are free to adjust on currency markets, reflecting relative value of the Japanese Yen, while China controls its currency on international markets, depressing the value of the Yuan to favor its own exports. This different policy approaches to currency will result in different impacts on interest rates in both countries. In China, where exchange rates are fixed during the modeling period, short-term interest rates experience the highest increase in scenario S1, reaching a peak at a little over 12%. Because the Yuan is fixed and not allowed to devalue, the major forces acting on interest rates are dominated by inflation and the money supply. In Japan, where exchange rates are allowed to fluctuate on international markets, high interest rates are caused by an increase on the risk premium of US denominated debt and the lagged effects of the exchange rates affecting investment and consumption. In Japan, therefore, the highest interest rates will occur in scenario X1.

As Figures 4 and 5 show, short-term interest rates increase over the medium term before steadily declining. In China, a small decline in short-term interest rates for a period of 18 to 24 months after the conflict began is caused by the drop in foreign direct investment and increase in capital flight. Short-term interest rates then start to rise above baseline projections two to three years after the conflict started due to rising inflation and an increase on the risk premium of US denominated debt. By contrast, Japan experiences an immediate increase in short- term interest rates caused by rising inflation and increased risk premiums. Interest rates in the rest of the world are represented by the US in Figure 5. Historically, UK and US interest rates behave very similarly. Short-term interest rates are shown to decrease and plateau at a little over 0% for four years after the conflict before rising again. In a similar way, long-term interest rates drop to a low of 0.5% and 1.5% in the UK and US respectively in year 6 before rising once again.

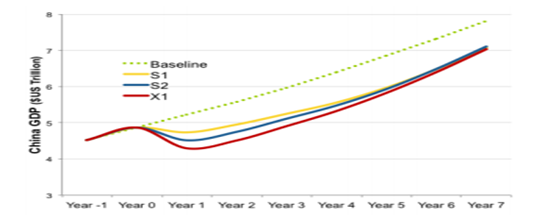

Impact of China-Japan conflict on productivity and growthIn all scenarios, both Japan and China go into recession in the first year of the conflict, year 1. In China, the recession lasts approximately 12 months, with negative growth reaching a peak at -10% in scenario X1 (see Figure 6).

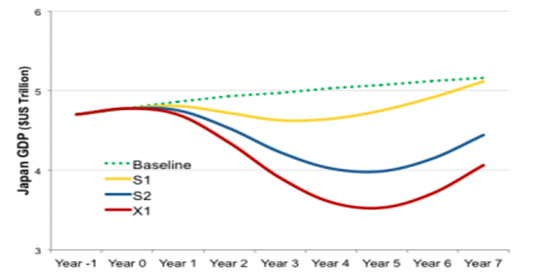

In Japan, the recession is much more protracted, lasting five years in scenario X1 (see Figure 7).

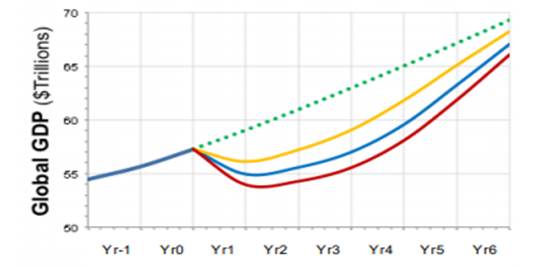

Globally, the recession lasts 1.5 years in scenario S2 and 2 years in scenario X1 with negative growth peaking at -2%. The conflict is shown to have a significant effect in terms of lost output (see Figure 8).

Table 3 shows the cost of the conflict compared to baseline over a five-year period between the start of year 1 and the end of year 5 for different regional economies. It is notable that the global economic consequences of the conflict are almost as significant in the US and the EU as they are in Japan and China.

Table 3: Lost output over 5 years from China-Japan Conflict scenario, ‘GDP@Risk’, US$ Trillions.

This paper examined the effects of China-Japan conflict on global economy through three scenarios. The conflict had negative effects on all aspects of global economy, including exports & imports and GDP. As the China-Japan conflict prolongs, the negative economic impacts of the conflict became bigger. Therefore, the negative economic impacts were largest in the scenario of X1.

[1] See Wikipedia, 2025 China-Japan diplomatic crisis. [2] Su, Yung-yao; Chin, Jonathan (16 November 2025). "Taipei slams Beijing for Yellow Sea live-fire drill". Taipei Times. [3] Wei, Alcott (2 December 2025). "Chinese and Japanese coastguard ships confront each other near disputed islands". South China Morning Post. [4] Kobara, Junnosuke (9 December 2025). "Japan says China didn't answer hotline during radar incident". Nikkei Asia. [5] Wang, Orange (8 December 2025). "Mid-air military stand-off triggers duelling protests in China-Japan row latest". South China Morning Post. [6] Hernández, Javier C. (7 December 2025). "Japan Says China Aimed Military Radar at Its Fighter Jets". The New York Times. [7] Murakami, Sakura; Gale, Alastair (10 December 2025). "Japan and China Remain at Odds Over Radar Use as US Weighs In". Bloomberg News. [8] Psaledakis, Daphne; Geddie, John (10 December 2025). "US backs Japan in dispute with China over radar incident". Reuters. [9] Kaneko, Kaori; Kelly, Tim (11 December 2025). "US bombers join Japanese jets in show of force after China-Russia drills, Tokyo says". Reuters. [10] Kim, Samuel S. (2006). The Two Koreas and the Great Powers. Cambridge University Press. p. 2. [11] The Defeat That Changed China's History -- Beijing Review". [12] China's War with Japan". Faculty of History, University of Oxford. Retrieved 13 July 2024. [13] Bix, Herbert P. (1992). "The Showa Emperor's 'Monologue' and the Problem of War Responsibility". Journal of Japanese Studies. 18 (2): 295–363. [14] Hotta, E. (25 December 2007). Pan-Asianism and Japan's War 1931–1945. Palgrave Macmillan. [15] See Wikipedia, the Second Sino-Japanese War [16] See Wikipedia, the Second Sino-Japanese War [17] Frank, Richard (2020). Tower of Skulls: A History of the Asia-Pacific War: July 1937-May 1942. W. W. Norton & Company. [18] Lee, Seokwoo et al. (2002). Territorial disputes among Japan, Taiwan and China concerning the Senkaku Islands. [19] Lee, Seokwoo et al. (2002). Territorial disputes among Japan, Taiwan and China concerning the Senkaku Islands. [20] Unryu Suganuma (2000). Sovereign Rights and Territorial Space in Sino-Japanese Relations. University of Hawaii Press. [21] "High-seas collisions trigger Japan-China spat". Agence France-Presse. 7 September 2010. [22] Zhao, Suisheng (2023). The dragon roars back : transformational leaders and dynamics of Chinese foreign policy. Stanford, California: Stanford University Press. [23] Zhao, Suisheng (2023). The dragon roars back : transformational leaders and dynamics of Chinese foreign policy. Stanford, California: Stanford University Press [24] Lee, Seokwoo et al. (2002). Territorial disputes among Japan, Taiwan and China concerning the Senkaku Islands. [25] Storey, Ian. “Japan’s Growing Angst ov er the South China Sea ”, ISEA’S Perspective, In stitute of Southeast Asian Stu ies, Singapore. [26] Kyodo News International; March 3, 2014; ‘Japan eyes revising current laws to enable collective self-defense’. [27] Senkaku air intrusion prompts radar upgrade”, December 15, 20102, Japan Times, http://www.japantimes.co.jp/news/2012/12/15/national/senkaku-air-intrusionprompts- radar-upgrade/#.Ugz9oxapBYI [28] Lim Jae-Un, Korea gains permanent observer s tatus on Arctic Council, May 21 2013, http://www.korea.net/NewsFocus/Policies/view?articleId=108026 [29] Ministry of Foreign Affairs, Japan (http://webjapan.org/factsheet/en/pdf/02RegionsofJap.p df)

First published in :

World & New World Journal

Unlock articles by signing up or logging in.

Become a member for unrestricted reading!