European Union Strategic Autonomy. Necessary but potentially problematic?

by Krzysztof Śliwiński

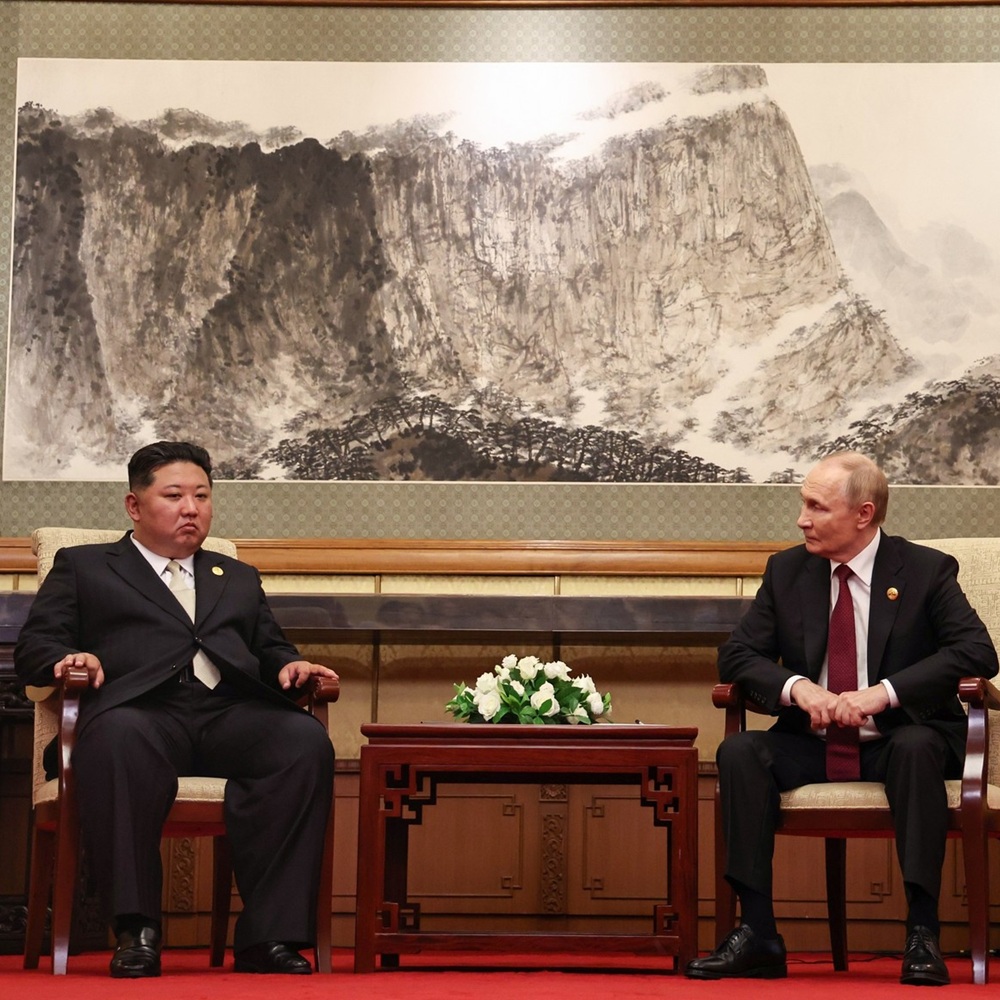

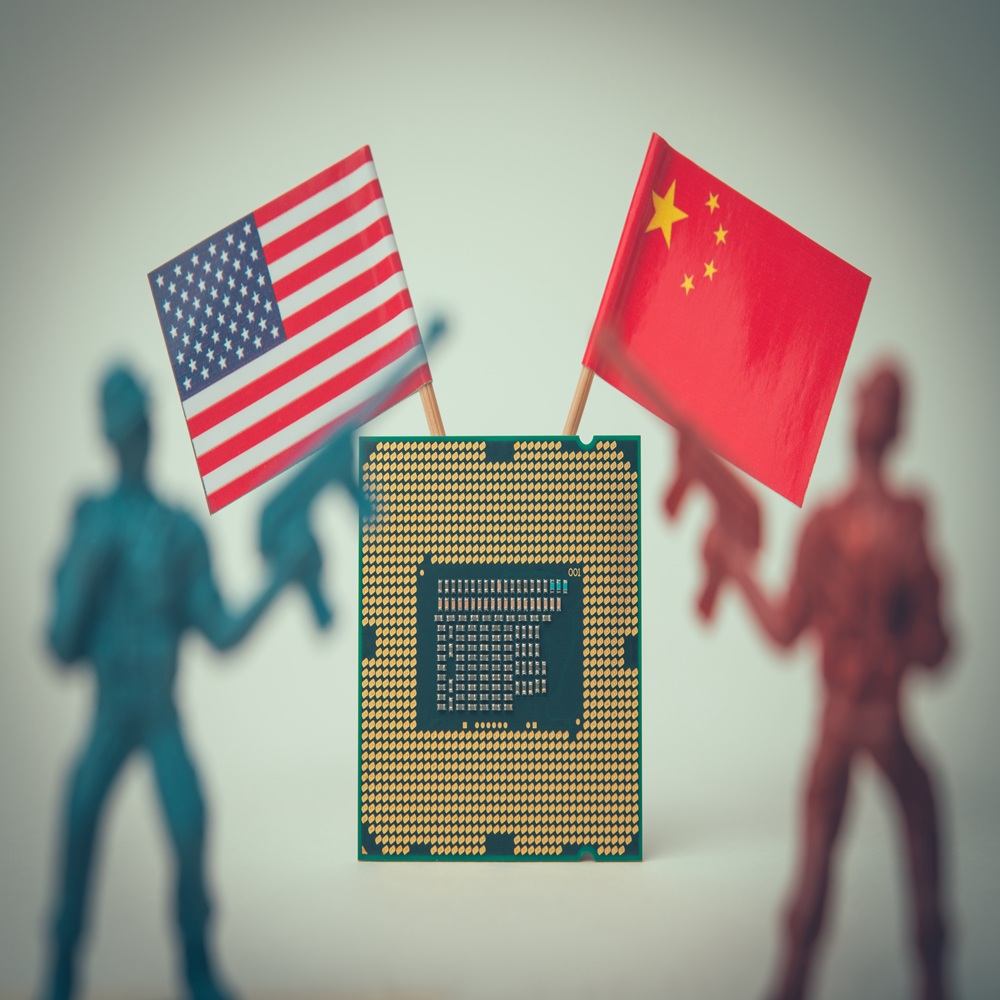

Abstract This paper examines the evolving concept of European Union Strategic Autonomy (EU-SA) within the context of contemporary geopolitical challenges, with a particular focus on EU-Russia and EU-China relations. EU-SA reflects the EU's aspiration to act independently in foreign policy, security, defence, and economic affairs, moving from a rule-taker to a rule-maker in global politics. The study outlines the historical development of EU-SA from 2013 to the present, highlighting key milestones such as the Strategic Compass and the impact of the Ukraine War, which accelerated efforts toward defence collaboration, energy independence, and economic resilience. It explores the transatlantic dynamics, noting growing uncertainties in the U.S. commitment to NATO and the resulting push for a more autonomous European defence posture. Additionally, it addresses the complex EU-China relationship, marked by both cooperation and competition, as well as the strained EU-Russia ties amid ongoing conflict. The paper concludes by questioning the economic feasibility and political risks of deeper EU strategic autonomy, especially regarding security centralisation and Germany's leadership role. Key Words: EU, Strategic Autonomy, Security, Geopolitics, U.S, China, Russia Introduction At the 2025 North Atlantic Treaty Organisation (NATO) Summit in The Hague, member states (Allies) committed to investing 5% of their Gross Domestic Product (GDP) annually in core defence requirements and defence- and security-related spending by 2035. They will allocate at least 3.5% of GDP annually, based on the agreed-upon definition of NATO defence expenditure, by 2035 to resource core defence requirements and meet the NATO Capability Targets. Allies agreed to submit annual plans that show a credible, incremental path to achieving this goal.[1] At the same time, Spain secured a special compromise, committing to meet core requirements with just 2.1% of GDP, making it the only exception to the broader 5% target. Previously, in 2014, NATO Heads of State and Government had agreed to commit 2% of their national GDP to defence spending, to help ensure the Alliance's continued military readiness. This decision was taken in response to Russia's illegal annexation of Crimea, and amid broader instability in the Middle East. The 2014 Defence Investment Pledge was built on an earlier commitment to meeting this 2% of GDP guideline, agreed in 2006 by NATO Defence Ministers. In light of the increase in defence spending, given that 23 out of 32 NATO Allies are EU member states, the idea of European Union strategic autonomy (EU-SA) comes to mind. This paper will explore the issue of EU-SA with a specific reference to EU-Russia and EU-China relations.[2] A Brief History of EU Strategic Autonomy European Union strategic autonomy is an evolving concept that reflects its ambition to act independently in strategically important policy areas, including foreign policy, security, defence, and economic relations. Strong strategic autonomy, according to Barbara Lippert, Nicolai von Ondarza and Volker Perthes, means being able to set, modify and enforce international rules, as opposed to (unwillingly) obeying rules set by others. The opposite of strategic autonomy is being a rule-taker, subject to strategic decisions made by others, such as the United States, China, or Russia.[3] The concept was first prominently discussed in the context of defence in 2013 and has since expanded to encompass a broader range of policy areas. Historically speaking, one can identify numerous phases during which EU-SA evolved. - 2013-2016: During this period, EU-SA focused on security and defence, with initiatives like the Permanent Structured Cooperation (PESCO) and the European Defence Fund, aiming to strengthen the EU's defence capabilities.[4] - 2017-2019: During this period, the EU-SA shifted its focus to defending European interests in a hostile geopolitical environment, influenced by events such as Brexit, the Trump presidency, and China's growing assertiveness.- 2020: The COVID-19 pandemic highlighted economic vulnerabilities, prompting a focus on mitigating dependence on foreign supply chains, particularly in critical sectors like health and technology.- Since 2021: The scope widened to virtually all EU policy areas, including digital, energy, and values, with terminology evolving to include "open strategic autonomy," "strategic sovereignty," "capacity to act," and "resilience".- 2022: The Ukraine War and Accelerated Implementation. Russia's invasion of Ukraine catalysed concrete actions toward EU-SA, notably in defence, energy independence, and economic resilience. The European Council's Versailles Declaration (March 2022) expressed strong political will to increase EU-SA, calling for collaborative investments in defence, phasing out dependency on Russian energy, and reducing reliance on critical raw materials, semiconductors, health, digital technologies, and food imports.[5] - The Strategic Compass for security and defence policy (endorsed March 2022) outlines a roadmap to 2030, emphasising strengthened EU defence capacities. Among others, it includes: o Establishment of a strong EU Rapid Deployment Capacity of up to 5000 troops for different types of crises.o Ready to deploy 200 fully equipped Common Security and Defence Policy (CSDP) mission experts within 30 days, including in complex environments.[6]o Conducting regular live exercises on land and at sea.o Enhanced military mobility.o Reinforcement of the EU's civilian and military CSDP missions and operations by promoting a rapid and more flexible decision-making process, acting more robustly and ensuring greater financial solidarity.o Making full use of the European Peace Facility to support partners.[7] According to the EU itself, the EU-SA is not a zero-sum game, but rather a sliding scale between complete autonomy and full dependency, with different results for different policy areas. What is more, when compared to the famous Maslow's hierarchy of needs (European Parliament briefing's language), the EU is not only perceived as an economic power, but it is also seen as a normative power. Therefore, the EU is recognised for its core values of democracy, human rights and the rule of law. Ultimately, Maslow's “self-actualisation” could mean the achievement of an EU in which citizens recognise their European identity and which has realised its full autonomous policy potential.[8] As if this is not enough, the same source introduces the concept of the 360° strategic autonomy wheel, which reportedly illustrates policy areas in which the EU aims for greater strategic autonomy, as well as the connections between them. Mutual influence between policy areas can happen across the wheel, but is particularly strong in adjacent areas. Military action, for example, can cause migration, health is linked to food quality, energy policy influences the climate, and misinformation undermines democracy. The wheel can help to understand links, set priorities and view potential conflicts. More autonomy in the digital green economy will, for example, require vast quantities of “rare earth” materials, making the EU more (instead of less) dependent on imports. Reductions in energy consumption achieved through the digitalisation of the economy (for example, by reducing transport) will be partly offset by the increase in energy consumption by electronic devices and data centres. Global Context The significance of EU-SA lies in ensuring the EU's political survival and global influence in a multipolar world where its relative power is diminishing. The EU's long-term economic outlook is bleak: its share of global GDP, now at 17% (at current prices), could nearly halve by 2050. According to the World Economic Forum, this economic backsliding not only threatens Europe's ability to fund its social model but also risks weighing on the bloc's global influence, leaving it even more dependent on the U.S. and China.[9] Moreover, the COVID-19 pandemic highlighted the conflictual nature of economic interdependence, as reliance on foreign supply chains for critical goods exposed vulnerabilities. Soft power has become an instrument of hard power, necessitating autonomy in trade, finance, and investment. The U.S.'s strategic pivot to Asia, the exclusion of Europe in conflicts like Nagorno-Karabakh, Libya, and Syria (termed Astanisation[10], which favours Russia and Turkey), the sidelining of the EU in EU-Russia negotiations regarding the war in Ukraine, and China's state-led economic model have all pushed the EU towards the sidelines. Transatlantic divide Security is a critical dimension, with significant uncertainty surrounding the U.S. commitment to NATO under the Trump administration. Reports indicate Trump has questioned NATO's Article 5 guarantees, with actions like withdrawing military personnel from a Ukraine aid hub in Poland on April 8, 2025, and proposing to stand down 10,000 light infantry troops in Poland, Romania, and the Baltic states by 2025.[11] This has led to fears of a "NATO-minus" scenario, where the EU must fill security gaps without full U.S. backing. In response, the EU is pushing for greater strategic autonomy in defence. Initiatives like ReArm EU are mentioned, with calls for the EU to develop a stand-alone, integrated military capacity to stabilise the global economy. As Jean-Pierre Maulny, Deputy Director of the French Institute for International and Strategic Affairs (IRIS), adequately observes "The risk is now clear: a form of bilateral agreement between the United States and Russia, benefiting the interests of both countries, could leave Ukraine severely weakened and an easy prey for Moscow, thereby weakening other European countries consequently. As a consolation prize, we will have to ensure Europe's conventional security, as U.S. Secretary of Defence Pete Hegseth announced to Europeans at the opening of the NATO ministerial meeting held in Brussels on 12–13 February 2025. This situation will place Europeans in a terrible dilemma: Either they do not wish to provide security guarantees to Ukraine and risk completely discrediting themselves in the eyes of powers such as the United States, Russia, and China, as Europeans will have demonstrated that they are unable to defend the continent, while also creating a significant long-term risk to Europe's security. Alternatively, they could provide security guarantees to Ukraine, accepting the financial burden that would impact the European Union's long-term competitiveness. In light of this situation, some advocate for the establishment of a European pillar within NATO. If one considers that the United States is negotiating peace in Europe without and against the Europeans, and that they no longer wish to defend Europe with conventional military means (will they respect the NATO Defence Planning Process?), Europeans should take on Europe's security fully. This would mean taking control of NATO. It will also be easier to make NATO and the European Union work together with a more Europeanised organisation".[12] Economically, there are several issues that contemporary demand addresses, but the most pressing is, of course, the Tariffs. The U.S. and European Union are running out of time to strike a deal on trade tariffs. Negotiations have been slow since both the U.S. and EU temporarily cut duties on each other until July 9. If an agreement is not achieved by then, full reciprocal import tariffs of 50% on EU goods, and the bloc's wide-spanning countermeasures are set to come into effect.[13] According to Almut Möller, Director for European and Global Affairs and head of the Europe in the World programme (European Policy Centre), "for the first time in decades, Europeans can no longer rely on a benign partner on the other side of the Atlantic, leaving them dangerously exposed and acutely vulnerable, including on the very foundations of liberal democracy. Until recently, the U.S. dominated a world order that provided a favourable environment for the EU to extend its membership, further develop, and leverage its strengths, particularly as a trading power, without having to worry much about geopolitics. Suddenly, liberal Europe looks very lonely, and is struggling to keep up with a world of change".[14] Other problems arguably include digital regulation and data protection, antitrust policy and digital taxation, fiscal policy and social protection, geopolitical rivalries, China's rise, and competition and trade policy. EU–China conundrum Both the EU and the U.S. are concerned about China's growing economic and technological influence, but they have differing approaches to addressing this challenge. The EU has sought to maintain a balance between cooperation and competition with China, while the U.S. has adopted a more confrontational approach.[15] These differences have led to tensions in areas such as trade policy and technology regulation. For example, the EU has been critical of the U.S.'s unilateral approach to addressing China's trade practices, while the U.S. has accused the EU of being too lenient towards China. These disagreements have made it difficult to achieve a coordinated transatlantic response to China's rise.[16] According to German experts, the balance of power between China and the EU and its member states is developing increasingly asymmetrically to Europe's disadvantage. Only in trade policy – and partially in investment – can the EU maintain its position in a manner respected by China.[17] Europe holds significant importance for China across various dimensions: economically, as its top supplier and second-largest export destination; technologically, as a source of advanced technology; institutionally, as a model to emulate; politically, to advance its objectives concerning other nations, particularly the United States; and selectively, as a collaborator in areas like global health and regional stabilisation. Unlike Russia and the United States, China perceives a vital interest in the EU's continued existence and unity within a multipolar world; yet, it employs a "divide and rule" strategy. China selectively rewards or penalises individual EU countries based on their political and economic significance and their compliance with China's expectations on key issues. These issues include arms sales to Taiwan, meetings with the Tibetan Dalai Lama, and positions on the Uighurs, human rights in China, and the South China Sea. China engages with Europe on multiple levels — political, economic, technological, cultural, and academic — using various political channels (such as strategic partnerships with the EU and individual EU member states), dialogue formats (like the 16+1 format with sixteen Central and Eastern European countries), and high-level bilateral intergovernmental consultations with Germany, France, and the United Kingdom. China's hopes that the European Union would emerge as an independent and comprehensive player in global politics, serving as a counterbalance to the United States, have diminished. However, China would be supportive of any European efforts towards achieving strategic autonomy, provided it does not translate into a confrontational approach towards China itself. In contrast, Europe's political priorities—such as ensuring peace and stability in East Asia, China's role in global stability, development, environmental issues, climate change, and non-proliferation, as well as improving human rights in China — are often considered secondary and are not actively pursued by all EU member states. Europe lacks a unified and assertive foreign policy stance regarding the geopolitical rivalry between the United States and China for dominance in the Asia-Pacific region. There is also an absence of a clear position on China's authoritarian vision of order. Even in trade and investment disputes, Europe struggles to establish a unified approach to resolving these issues. The EU member states are too diverse in terms of size, profiles, and interests in their dealings with China: Economically, there is a divide between countries that are appealing industrial and technological partners for China and those that compete for favour in Beijing. Some nations have a clear interest in global governance. Additionally, the United Kingdom and France maintain their respective military presences in the Asia region. In this context, ReArm EU and its financial instrument SAFE (analysed here https://worldnewworld.com/page/content.php?no=5384 ) have the potential to provide the EU with meaningful strategic autonomy and invite genuine geopolitical actorness. EU–Russia conundrum Since Donald Trump took office as the U.S. president, the coordination of transatlantic policies regarding Russia has largely disintegrated. The White House's openness to a comprehensive "deal" with Russian President Vladimir Putin contrasts with Congress's attempts to limit Trump's foreign policy options with Russia, resulting in the marginalisation of coordination with European allies. This situation is further complicated by Washington's increasing reliance on extraterritorial sanctions, a trend that began before Trump's presidency. Consequently, according to European foreign and security experts, Europe must achieve greater strategic autonomy in its dealings with Russia. However, this relationship is particularly strained by significant conflicts of interest. Russia's invasion of Ukraine significantly disrupted the previously peaceful and liberal democratic relations among European nations. Putin's "special military operation" compelled the EU to introduce seventeen (so far) escalating economic sanction packages aimed at undermining the Russian economy and ultimately limiting Russia's capacity to continue the war. In a gesture of solidarity with Ukraine, the EU has also allocated billions of euros to both EU member states and Ukraine to avert a humanitarian disaster and ensure the provision of essential needs for Ukrainians fleeing the conflict.[18] After three and a half years from the outset of the war, Russia continues to pose a complex challenge that the EU and European nations cannot address independently in the foreseeable future. If the U.S. security guarantee weakens before Europe can bolster its own capabilities, the EU could face new vulnerabilities that Russia might exploit along its external borders, such as in the Baltic states, and elsewhere. Currently, the EU and its member states lack sufficient means to deter Russia from pursuing its interests aggressively and recklessly in the shared neighbourhood.[19] Critics, on the other hand, argue that calls for EU strategic autonomy, particularly the creation of a European Army and a significant increase in military spending, are a double-edged sword. First, the primary official rationale is that the EU must prepare itself for a possible attack on EU member states by Russia. The legacy media are full of European leaders claiming that Russia will sooner or later attack Europe.[20] Yet, this claim is not substantiated with much evidence. The proponents of the European army completely disregard numerous doubts surrounding the 2013/2014 "Euromaidan" and the role of the CIA in the events.[21] Second, according to the Office of the High Commissioner for Human Rights (OHCHR) 's estimations, the total number of conflict-related casualties in Ukraine from April 14, 2014, to December 31, 2021, stood at 51,000 – 54,000. These numbers are broken down as follows: 14,200 - 14,400 killed (at least 3,404 civilians, estimated 4,400 Ukrainian forces, and estimated 6,500 members of armed groups), and 37,000 - 39,000 injured (7,000 – 9,000 civilians, 13,800 – 14,200 Ukrainian forces and 15,800 - 16,200 members of armed groups).[22] In short, the situation was chaotic, with many casualties among civilians. Third, it was allegedly Europeans who torpedoed a first chance of peace negotiations as early as April 2014 in Istanbul.[23] Fourth, many European leaders seem to be utterly oblivious to the fact that the prolongation of the war adds to the destruction of Ukraine and Ukrainian society, deaths and emigration. Last but not least, given the fact that it is Germany that calls for both the European Army and the federalisation of Europe (with some assistance from France), one should be extra careful given the role of Germans during the WWII and the fact that neither has there been any official peace treaty with Germany nor have they recompensated countries such as Poland. Conclusion Strategic autonomy may be a necessity for Europe, given the dynamics of transatlantic relationships. The questions, however, that have to be pondered (and it does not seem that anyone in the legacy media or mainstream academia is ready to ask them) are numerous. Who will pay for that? Can Europeans afford such expenses under the current economic circumstances, and even worse economic prospects? Is the centralisation of security and military a Pandora's box? Should Europeans allow Germany (of all EU member states) to take special responsibility for this project? Isn't the pro-war rhetoric of Western political leaders making relations with Russia even more tense and dangerous, in other words, leading to escalation? History has solemnly proven that when left to their own devices, the Europeans inevitably create disastrous conflicts that have lasting consequences for generations. The American pivot to Asia and the consequent withdrawal from Europe may therefore have tragic ramifications for the European continent. References[1] Defence expenditures and NATO’s 5% commitment. (2025, June 27). North Atlantic Treaty Organization. https://www.nato.int/cps/en/natohq/topics_49198.htm[2] NATO and the EU have 23 members in common: Belgium, Bulgaria, Croatia, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Italy, Latvia, Lithuania, Luxembourg, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden. See more at: https://www.consilium.europa.eu/en/policies/eu-nato-cooperation/#0[3] Lippert, B., von Ondarza, N., & Perthes, V. (2019, March). European Strategic Autonomy. Actors, Issues, Conflicts of Interests. Stiftung Wissenschaft Un Politic. Deutches Institut für Politik Und Sicherheit. https://www.swp-berlin.org/ doi:10.18449/2019RP04/#hd-d14204e263[4] Damen, M. (2022, July). EU strategic autonomy 2013-2023: From concept to capacity (EU Strategic Autonomy Monitor). European Parliamentary Research Service. https://www.eprs.ep.parl.union.eu[5] Informal meeting of the Heads of State or Government Versailles Declaration. (2022, March 10–11). Stiftung Wissenschaft Un Politic. Deutches Institut Fur Politik Und Sicherheit. https://www.consilium.europa.eu/media/54773/20220311-versailles-declaration-en.pdf[6] See more at: https://www.eeas.europa.eu/eeas/csdp-structure-instruments-and-agencies_en[7] See more at: https://fpi.ec.europa.eu/what-we-do/european-peace-facility_en[8] Damen, M. (2022, July). EU strategic autonomy 2013-2023: From concept to capacity (EU Strategic Autonomy Monitor). European Parliamentary Research Service. https://www.eprs.ep.parl.union.eu[9] Open but Secure: Europe’s Path to Strategic Interdependence. INSIGHT REPORT. (2025). World Economic Forum. https://reports.weforum.org/docs/WEF_Open_but_Secure_Europe%E2%80%99s_Path_to_Strategic_Interdependence_2025.pdf[10] In reference to the Astana format on Syria) which leads to the exclusion of Europe from the settlement of regional conflicts in favour of Russia and Turkey. See more: https://www.eeas.europa.eu/eeas/why-european-strategic-autonomy-matters_en[11] Tilles, D. (2025, April 8). US to withdraw military from Ukraine aid hub in Poland. Notes from Poland. https://notesfrompoland.com/2025/04/08/us-to-withdraw-military-from-ukraine-aid-hub-in-poland/[12] Maulny, J.-P. (2025, February 13). United States – Europe: Our Paths Are Splitting. The French Institute for International and Strategic Affairs (IRIS). https://www.iris-france.org/en/united-states-europe-our-paths-are-splitting/[13] Kiderlin, S. (2025, June 18). These are the sticking points holding up a U.S.-EU trade deal. CNBC. https://www.cnbc.com/2025/06/18/these-are-the-sticking-points-holding-up-a-us-eu-trade-deal.html#:~:text=The%20EU%20and%20US%20flags,Poland%20on%20March%206%2C%202025.&text=Afp%20%7C%20Getty%20Images-,The%20U.S.%20and%20European%20Union%20are%20running%20out%20of%20time,($1.93%20trillion)%20in%202024?[14] Möller, A. (2025, February 26). Europe in the World in 2025: Navigating a perilous world with realism and ambition. European Policy Centre. https://www.epc.eu/publication/Europe-in-the-World-in-2025-Navigating-a-perilous-world-with-realism-625da4/#:~:text=2025%20will%20be%20a%20year,with%20a%20world%20of%20change[15] Bradford, A. (2023). When Rights, Markets, and Security Collide (pp. 221–254). Oxford University Press. https://doi.org/10.1093/oso/9780197649268.003.0007[16] Portanskiy, A. (2023). UE - US: new barriers to trade. Современная Европа. https://doi.org/10.31857/s020170832304006x[17] Lippert, B., von Ondarza, N., & Perthes, V. (2019, March). European Strategic Autonomy. Actors, Issues, Conflicts of Interests. Stiftung Wissenschaft Un Politic. Deutches Institut für Politik Und Sicherheit. https://www.swp-berlin.org/ doi:10.18449/2019RP04/#hd-d14204e263 [18] Klüver, L. (2025, April 18). Putin’s War on Ukraine: What can the EU actually do? European Careers Association. https://ecamaastricht.org/blueandyellow-knowyourunion/putins-war-on-ukraine-what-can-the-eu-actually-do#:~:text=Similarly%2C%20the%20Strategic%20Compass%2C%20the%20most%20recent,its%20interests%20and%20promote%20its%20values%20internationally.[19] Lippert, B., von Ondarza, N., & Perthes, V. (2019, March). European Strategic Autonomy. Actors, Issues, Conflicts of Interests. Stiftung Wissenschaft Un Politic. Deutches Institut für Politik Und Sicherheit. https://www.swp-berlin.org/ doi:10.18449/2019RP04/#hd-d14204e263 [20] ochecová, K. (2025, February 11). Russia could start a major war in Europe within 5 years, Danish intelligence warns. Politico. https://www.politico.eu/article/russia-war-threat-europe-within-5-years-danish-intelligence-ddis-warns/[21] Katchanovski, I. (2024). The Maidan Massacre in Ukraine The Mass Killing that Changed the World. Palgrave Macmillan. https://doi.org/https://doi.org/10.1007/978-3-031-67121-0[22] Office of the United Nations High Commissioner for Human Rights. (2022, January 27). Conflict-related civilian casualties in Ukraine: December 2021 update. United Nations Human Rights Monitoring Mission in Ukraine. https://ohchr.org[23] Johnson, J. (2022, May 6). Boris Johnson Pressured Zelenskyy to Ditch Peace Talks With Russia: Ukrainian Paper. Common Dreams. https://www.commondreams.org/news/2022/05/06/boris-johnson-pressured-zelenskyy-ditch-peace-talks-russia-ukrainian-paper