How to better equip the U.S. DFC to compete with China

by Andrew Herscowitz

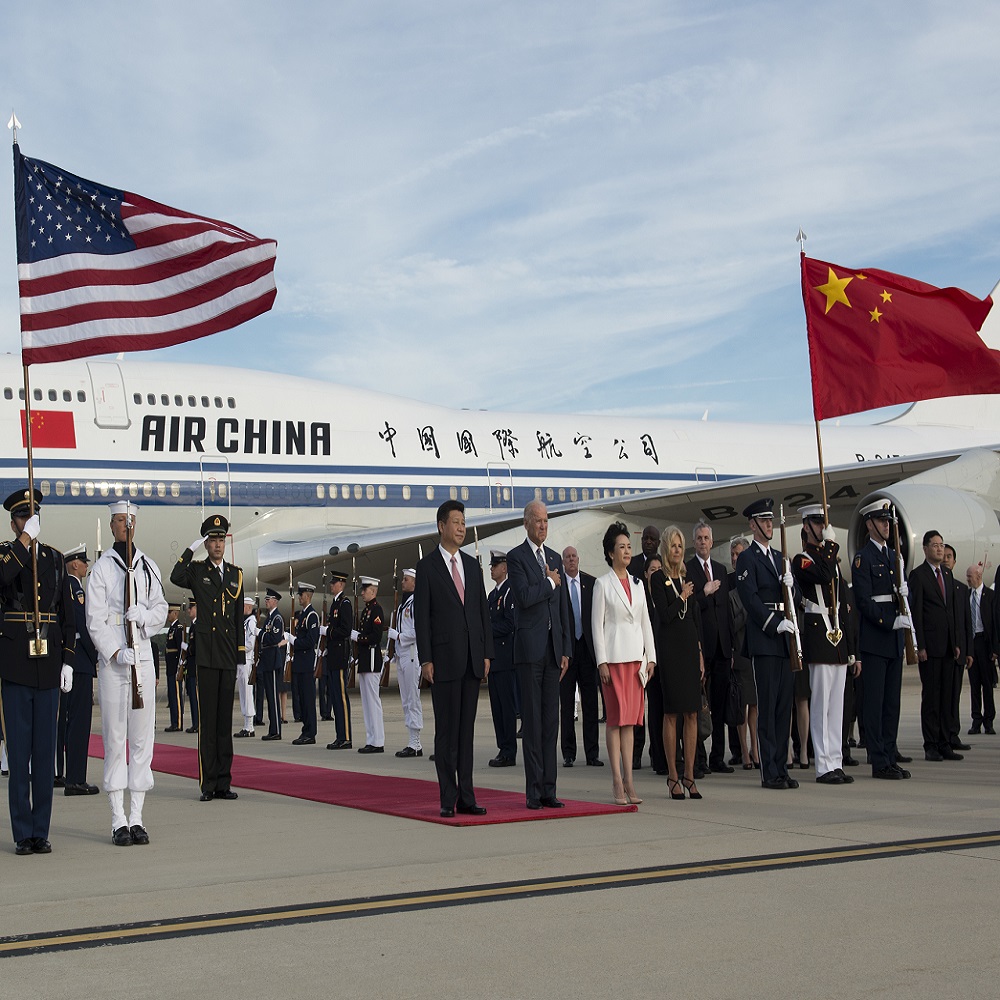

한국어로 읽기 Читать на русском Leer en español Gap In Deutsch lesen اقرأ بالعربية Lire en français When U.S. President Biden and Chinese President Xi met in November 2023, Biden remarked that the countries must “ensure that competition does not veer into conflict.” A recent ODI report Hedging belts, de-risking roads: Sinosure’s role in China’s overseas finance illustrates the scale of the competition and reveals how one of China’s less-known institutions – Sinosure – has been giving China the edge. This blog offers some thoughts about how the U.S., through its U.S. International Development Finance Corporation (DFC) can better compete. Competing requires resources, but really not as much as you think Competing credibly requires money, dedicated staff, and creativity. It requires studying the competition. Infrastructure development requires low-cost financing, capacity-building, and getting everyone aligned. As Sinosure has demonstrated again and again, deploying guarantees and insurance – particularly from official financing – can de-risk overseas investment, reducing costs of finance and mobilising commercial investment from the private sector. When it comes to infrastructure, China has a far more robust, albeit imperfect, track record when compared to others. The U.S. and its G7 partners have not been much of a match for China in financing infrastructure worldwide. The G7 could successfully compete with China, and doing so does not have to cost hundreds of billions of dollars. The U.S. Congress, despite its strong desire to counter BRI, has yet to appropriate the resources necessary to compete credibly in a battle of influence against China in developing countries. There’s been plenty of rhetoric, repurposing of existing programs and resources into initiatives like the Partnership for Global Infrastructure and Investment (PGII) and the Global Gateway. Each time the U.S. launches a new overseas economic development initiative, however, it rarely dedicates sufficient resources to help it scale – examples include the Partnership for Growth, Power Africa, Prosper Africa, and PGII. When it was fully funded, Power Africa, which coordinated the efforts of 12 U.S. government agencies, helped 120 power projects in Africa get across the finish line in just a few years, building a strong brand for the U.S. in Africa for economic development for the first time in decades. Then the U.S. cut Power Africa’s budget by 75% because of political shifts. The initiative stalled in its progress on new infrastructure, while still helping 200 million Africans get access to more reliable electricity. PGII, which has no dedicated budget, involves a handful of smart people working hard to deliver on a G7 promise of $600 billion in global infrastructure by 2025. Other than the Lobito Corridor project, it has not been clear to date what PGII is able to deliver at scale in Africa without additional resources. That could be about to change, though. The State Department just requested another $4 billion from Congress to up its game against China, which should help tremendously if that funding is secured to support PGII. Why Sinosure has been such an effective tool for China, despite its low margins BRI has not been particularly innovative, but it’s been steady. Sinosure, along with other Chinese export credit agencies, offers highly favorable terms and longer-term finance – this approach has well suited Global South governments in advancing their development and political objectives. While some projects have been problematic, Chinese creditors have provided the low-cost, patient capital at scale that many countries need for long-term productive infrastructure investment. But as the report shows, this approach has challenged established regimes governing the use of public money (link to blog 2). Sinosure insurance covers non-payment up to 95% of the insured equity or debt for up to 20 years, but most OECD Export Credit Agencies (ECAs) only provide 85% coverage for up to 10 years – though this policy soon will soon change [link to blog 2] Sinosure can work anywhere, except where there’s a live conflict or in cases of repayment arrears. By contrast, the U.S. International Development Finance Corporation (DFC) has a list of over 100 countries where it cannot do business. Sinosure’s premiums max out at 7% of the total debt servicing cost of a project, making it relatively cost-effective. In this aspect, it is surprisingly transparent. DFC’s fees and costs are numerous and opaque, with DFC passing some of its own costs on to its clients. By the end of 2022, Sinosure had provided over $1.3 trillion-worth of insurance on export and investment, with a quarter of this going only to BRI countries. In 2022 alone, it supported a total portfolio of $900 billion through its insurance for over 170,000 clients, of which $80bn went to overseas investment and long-term finance, which mostly supports projects in infrastructure such as power, transportation, construction, telecoms and shipping. It received a total net insurance premium of $1.9 billion and paid out $1.5 billion in insurance claims. Despite its significant payouts, however, Sinosure continues to earn a modest profit of $102 million – not much of a margin, but enough to propel China’s global leadership on trade and infrastructure development. By contrast, DFC’s current total portfolio-wide exposure is $41 billion, with just over $9.3 billion committed in fiscal year 2023 for 132 transactions – of which only around $3.5bn of this was for guarantees and risk insurance. DFC has many of the same tools available to it as the Chinese government, and DFC is not even legally required to earn a return on its investments. Yet DFC has not made full use of its capital resources and has not deployed its capacity for risk-mitigation finance in the same way. An unleashed DFC could make the U.S. more competitive It’s not too late for the U.S. and others to compete. The U.S. has an opportunity to further change how it conducts business to compete with China, while promoting sustainable development. DFC is starting to flex its competitive muscles with its own insurance product, recently using political risk insurance to support a $1.6 billion debt-for-nature swap in Ecuador and another $500 million debt-for-nature swap in Gabon, which support broader debt relief efforts, as well as channelling money towards climate and conservation goals. Moreover, those deals come at a very low cost to the U.S. government given DFC’s pricing models. DFC is up for reauthorisation in 2025. It has both foreign policy and development mandates. In a previous blog, we laid out 10 recommendations about how DFC could be more effective in achieving its development mandate. Here are 9 recommendations to help DFC be more effective in competing with China and achieving its foreign policy mandate: 1. Spend some money and spend it right All it took for Sinosure’s expansion in the early 2010s was a capital injection of $3 billion. To make its financial institutions just as competitive, the U.S. only needs to commit a few extra billion dollars of appropriated resources per year, just as State Department has proposed, not hundreds of billions. Sinosure, with its somewhat loose investment criteria, still managed to earn over $100 million profit on a $900 billion portfolio in 2022. Even if DFC were to spend $1 billion/year of additional budgetary resources – for the purpose of leveling the playing field with China and providing developing countries with the type of inexpensive financing they need – that could be money well spent for the U.S. taxpayer. That money could cover legal fees that DFC currently passes on to clients. It could be deployed through innovative instruments: to take on some of the currency risk on strategic transactions, to cover first loss on strategic investments, or to provide technical assistance that does not need to get repaid–comparative advantages that Chinese financial institutions still sorely lack. That funding also could be used, simply, to reduce interest rates and fees, at a time when borrowing costs for lower-income countries have risen astronomically. 2. Structure deals to outcompete China Encourage DFC to structure transactions to use its funding to maximize competition with China in a way that promotes a more level playing field. DFC should not crowd out competitively tendered and transparent private sector investment, but where inexpensive or even concessional DFC co-financing might help the private sector out-compete opaque Chinese investment, DFC should be equipped to support those projects. 3. Don’t obsess over returns Even though DFC is not legally required to earn a return on a portfolio-wide basis, most members of Congress expect DFC to be revenue neutral to the U.S. Treasury. If members of Congress would adjust their return expectations even slightly, DFC could significantly advance its development and foreign policy goals. Effective development and foreign policy are not free – especially when competing with China. Even earning back $.95 on the dollar on a portfolio-wide basis would be a significant leverage of 1:20 of appropriated resources to private investment – giving DFC broad flexibility to structure deals that prioritise development impact and foreign policy. 4. Remove DFC’s limits Eliminate ceilings on DFC financing – including the $1 billion transaction limit, the $10 billion annual portfolio limit, and the $60 billion total portfolio exposure. It really doesn’t cost anything to do this. It’s like raising its credit card limit. 5. Let DFC work anywhere when necessary Give DFC the authority to determine the countries where it can do business on a case-by-case basis, depending on what the foreign policy and development priorities are. DFC should be required to continue to prioritize investments in low and lower-middle income countries, but it should have flexibility to respond quickly and selectively anywhere that doing so will credibly advance a compelling U.S. national security interest, such as financing a strategic port or lithium processing. To prevent DFC from sliding into becoming just a national security tool, abandoning its development mandate, DFC should be required to clearly articulate the compelling national security interests of projects and should provide a detailed report to Congress each year on its investments in upper-middle income and high-income countries to explain these interests (even classified, if necessary). 6. Empower DFC to support “nearshoring” DFC can help the U.S. diversify its supply chains and reduce dependencies on China. To encourage companies to move operations out of China and into the Americas (if operating in the U.S. is not commercially viable), give DFC broader authority to support strategic transactions in the region. 7. Make it easier for DFC to support equity investments in strategic infrastructure When DFC takes an equity position in a company or an investment fund, it gets a seat at the ownership table. That allows DFC to drive decisions regarding sourcing of goods and services (i.e., making sure contracts do not always go to Chinese companies). Investing in equity funds that develop and finance a portfolio of infrastructure projects is an effective way for DFC to increase and spread its strategic influence -- except that DFC often struggles to make these types of investments because U.S. legal requirements make DFC a slow and clunky, and hence, an unattractive investment partner. DFC needs flexibility to bypass some of these requirements. 8. Help DFC scale its risk insurance instrument For years, DFC has been hugely innovative in deploying its insurance products to leverage capital from others. DFC used its political risk insurance tool to crowd in private investment in Ukraine, and to catalyze pioneering debt-for-nature swaps worth hundreds of millions of dollars in Ecuador and Belize. But according to recent reports, the U.S. Office of Management and Budget has been threatening to start treating insurance investments like guarantee instruments from a budgeting standpoint. This will make it more expensive for DFC to deploy this tool. If it ain’t broke, why fix it? As we’ve shown, one of the main factors behind China’s competitiveness abroad is through Sinosure’s expansive use of its insurance tool: OMB’s changes will make it more expensive and difficult for the U.S. to scale its own. OMB needs to read the room. We’re not going to suddenly balance the U.S. budget by tinkering with a formula that has worked for decades. Let DFC do more of what it does well. 9. Help speed DFC up Before committing any transaction over $10 million, DFC is required to notify Congress in advance. This “Congressional notification” requirement provides a valuable extra level of oversight to ensure that DFC does not doing anything out-of-whack with Congressional priorities. But the process slows DFC down, when Chinese financiers are known for their speed. Even though DFC only is required to “notify” Congress of its deals, and not seek “approval,” practically and politically speaking nobody wants to run afoul of any one of the 535 members of Congress. Consequently, DFC rarely moves forward on a project until it can resolve the concerns of members of Congress. DFC needs to work with Congress to come up with a reasonable alternative to the Congressional notification process that balances speed with continued close collaboration with Congress. In addition, DFC’s Board can help speed things up by focusing its efforts on high level policy guidance instead of individual transactions. The Board should delegate more decision making on individual deals to DFC’s CEO. It makes no sense for the Secretary of State, who chairs DFC’s Board, to dig into a $20 million investment into a healthcare fund, not to mention the hundreds of State Department staff with little development finance experience who review the documentation before it goes to the Secretary with a recommendation for a vote. U.S. taxpayers probably would prefer to have the State Department focus on resolving the Middle East conflict. From the perspective of many Global South countries, this competition between the G7 countries and China is not inherently bad if it brings them more desperately needed resources and improves the quality of their infrastructure. The U.S. could be more competitive if it empowered its development finance professionals to use DFC’s tools the way they were designed to be used. DFC must be properly resourced with enough people and enough money to allow it to grow its portfolio. While development impact remains the key priority for DFC, delivering for the needs of partner countries is what also will deliver long-term influence. That is how the U.S. can compete – and all at relatively low cost to the U.S. taxpayer.