Energy & Economics

Malaysia: Between economic opportunities and political challenges

Image Source : Shutterstock

Subscribe to our weekly newsletters for free

If you want to subscribe to World & New World Newsletter, please enter

your e-mail

Energy & Economics

Image Source : Shutterstock

First Published in: Jun.07,2024

Aug.26, 2024

In recent years, Malaysia has become a key node in the global production chains of electronic components, especially in the semiconductor sector. The nation can also rely on abundant natural resources, such as oil and natural gas, of which it is an important exporter. Along with other Southeast Asian countries like Vietnam and Indonesia, Malaysia presents itself as an attractive destination for foreign investors looking to relocate their manufacturing plants. The trend towards de-risking, in the context of the geoeconomic competition between China and the United States, sees multinationals and governments committed to diversifying their supply chains and strengthening domestic production to minimize dependence on Beijing. Malaysia is a dynamic and complex country. Its society is composed of numerous ethnic groups whose diversity sometimes makes it more difficult for the government to satisfy their different interests. This social complexity is also reflected in the intricate state system, which combines a monarchical aspect with a federal system, where citizens elect their representatives at both the state and federal levels. Despite the multiparty system, for over six decades, Malaysia was governed by a single party, the United Malays National Organization (Umno), which dominated the political landscape [1]. However, this continuity was interrupted in 2018, with four different governments taking turns in power due to corruption scandals and internal political struggles: an unprecedented upheaval in Malaysian history, which from independence in 1957 until then had only seen six prime ministers. The establishment of a new administration in November 2022, under the leadership of Anwar Ibrahim, has not brought the hoped-for stability, and tensions remain in the country, risking the exacerbation of internal divisions and undermining the confidence not only of citizens but also of foreign investors.

Malaysia is a federal constitutional monarchy, where power is distributed among the monarchy, the federal government led by the prime minister, and the central bicameral parliament, as well as the state governing bodies. The political landscape of the country is characterized by strong multiparty politics, meaning that coalitions rather than a single majority party tend to govern, leading in recent times to the formation of fragile alliances and frequent shifts in alignments among parliamentary groups. Malaysia is composed of thirteen states, nine of which are kingdoms led by a sovereign (or sultan), and three federal territories. Each state has its own constitution, an executive council, and a legislative assembly elected by the citizens. The nine sultans, gathered in the Conference of Rulers, every five years appoint the head of state of Malaysia, or Yang di-Pertuan Agong [2]. The core of the country's democratic life is the central Parliament, composed of 70 members of the Senate (26 members elected by the state assemblies and 44 appointed by the head of state, also on the advice of the prime minister) and 222 members of the House of Representatives (elected every five years during the general elections) [3]. Another element of complexity in the country's structure is the dual legal system: a state system, which has jurisdiction over the entire population, and a Sharia-based system for the Muslim community. In fact, Islam is the state religion, and the majority ethnic group of Malays (also known by the English term ‘Malays’) is constitutionally Muslim; therefore, about two-thirds of the population are subject to Sharia. The Islamic authority has jurisdiction over the Muslim population on religious issues, matters of morality, and family affairs [4]. Despite the complexity of its political system, Malaysia, as mentioned, had a stable government from 1957 to 2018 under the Barisan Nasional (BN) coalition, composed of parties representing ethnic groups and conservatives such as Umno, the Malaysian Chinese Association (MCA), and the Malaysian Indian Congress (MIC). However, in 2018, the BN was defeated by the multi-ethnic opposition coalition Pakatan Harapan (PH), which brings together more progressive and liberal parties [5]. The downfall of the BN government was partly due to an internationally resonant corruption and financial fraud scandal related to the sovereign wealth fund 1 Malaysia Development Berhad (1MDB), involving key figures of the ruling coalition, including then Prime Minister Najib Razak [6]. After Pakatan Harapan's victory in 2018, Mahathir Mohamad, who had previously served as Prime Minister with Umno from 1981 to 2003, returned to office. However, internal conflicts and changes in parliamentary alliances within PH led Mahathir to resign [7]. He was succeeded by Muhyiddin Yassin, one of the parliamentarians who had defected from the PH, leading the newly formed coalition Perikatan Nasional (PN). However, Muhyiddin also lost the majority after 17 months, handing over the reins to seasoned politician Ismail Sabri Yaakob of Umno in August 2021 [8]. Ismail Sabri, leading a government with a fragile majority, was compelled to call for early elections driven internally by his party's push and with the aim of securing a stronger mandate [9]. The succession of these governments through internal political maneuvers in parliament has further eroded public trust in the political class, already damaged by corruption scandals. Moreover, the timing of the political system crisis did not favor government officials, who also had to simultaneously manage the pandemic period and the disastrous economic and social consequences that ensued. In this climate of dissatisfaction and growing political polarization, the 2022 elections resulted in Malaysia's first ‘hung parliament’, where no party managed to secure enough seats to govern outright. The Pakatan Harapan, Anwar's coalition, secured 82 seats out of 222, surpassing the PN – which includes the nationalist Malaysian United Indigenous Party (PPBM) and the conservative Pan-Malaysian Islamic Party (PAS) – which garnered 74 seats [10]. Meanwhile, the BN managed only 30 seats, demonstrating Umno's struggle to rebuild its image after corruption scandals [11]. The Islamic-inspired PAS, however, won the most seats as a single party, with 41. After lengthy negotiations, the head of state tasked PH with forming a unity government, with cooperation from Umno. Anwar, a key opposition figure for decades, succeeded in obtaining the position of prime minister [12]. Since November 2022, Anwar has been leading the country, but political uncertainties have not ceased with the establishment of his government. Anwar is not seen as a leader capable of forcefully imposing his political line, due to the breadth of his coalition which relies on coexistence and compromise among different political factions within the majority, threatening the government's stability. The need to find broad consensus within his coalition has so far prevented Anwar from implementing significant reforms in the country, especially those that could affect the protections guaranteed to the Malay majority. Umno, with which he governs, despite losing some support from the Malaysian electorate in the recent elections, has historically represented the interests of this segment of the population and does not seem inclined to support Anwar's more liberal and inclusive policies [13]. Furthermore, Muhyiddin's PN coalition, and particularly the PAS party, are proving to be formidable opponents for Anwar's unity government, confirming the positive trend of the 2022 elections. This was evident in the recent state elections where PAS reaffirmed its government in three Malaysian states [14].

Disillusionment towards traditional political parties has accentuated political, ethnic, and religious fractures in Malaysia, which have long undermined social cohesion and contributed to the persistence of economic inequalities in the country. One of the major challenges for the government is to mitigate economic disparities among ethnicities and promote social harmony in a country where bumiputera or bumiputra (indigenous populations, including the Malay majority, comprising over two-thirds of the total population), Chinese ethnicity (approximately 20%), and Indian ethnicity (around 6%) coexist [15]. Economic differences between indigenous populations and foreign-origin citizens became more pronounced after independence: during this period, the most prosperous economic activities were predominantly controlled by the Chinese community, which was also gaining increasing political prominence. This led to heightened tensions with Malays, culminating in ethnic riots on the streets of Kuala Lumpur in 1969 [16]. To address these disparities, the government has instituted a regime of preferential policies to promote the prosperity and economic empowerment of bumiputera, which have expanded and evolved over the years. For instance, the New Economic Policy (NEP) of 1971 introduced quotas for ethnic representation in public institutions and universities, along with increased support for bumiputera businesses [17]. While these policies have improved the social conditions and historical economic disparities of bumiputera, the regime of ethnic-based affirmative action has also led to economic inefficiencies and social tensions, fostering patronage and clientelism practices by parties seeking political support from the broader Malay population [18]. Another factor of increasing division in the country is the tension between the Muslim majority and religious minorities (Buddhist, Christian, Hindu) [19]. For instance, the strict implementation of Sharia law has often clashed with civil laws, creating tensions among different religious communities. In recent years, there has also been a rise in religious conservatism at the social level, manifested in the strong electoral performance of PAS, a party that advocates for Malay interests and promotes further Islamization of society, absorbing much of Umno's electorate [20]. To counter this phenomenon of Islamic conservatism, known as the "green wave" [21], Anwar's PH politicians leverage the fear that a more Islamized society may erode civil liberties, resonating particularly among more liberal or non-Malay segments of the population. Conversely, the PN seeks support by accusing Anwar and PH of aiming to limit rights and the preferential system that protects Malays [22]. As a consequence of these socio-economic tensions, Malaysian politics has become increasingly fragmented and polarized, with voting reflecting a radicalization of ethnic and religious identities. Balancing the promotion of socio-economic equity among the country's diverse ethnic groups on one hand and building a more competitive and inclusive social fabric on the other, remains a crucial challenge for Malaysia. The country continues to seek policies that effectively address the needs of all citizens regardless of ethnicity or religion.

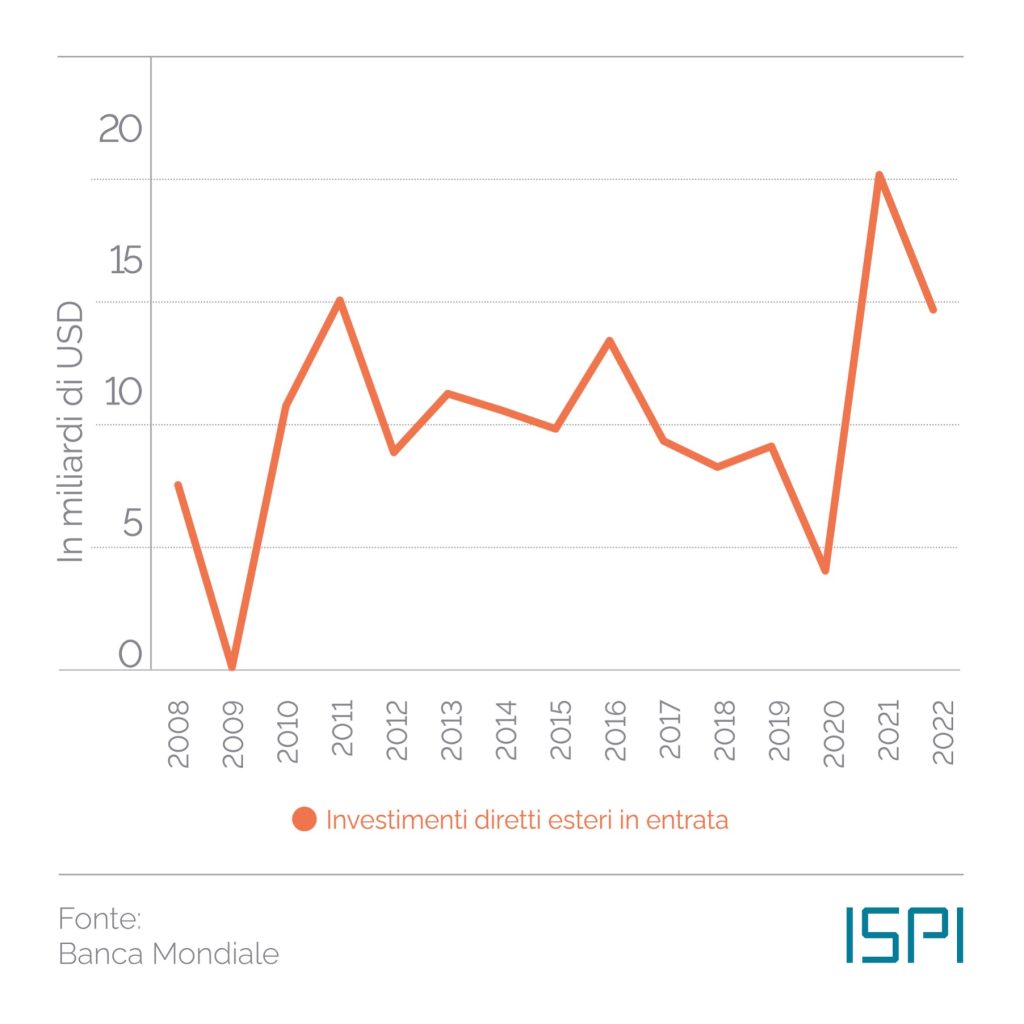

While Malaysia's political and social situation remains uncertain, the country's economic prospects appear more promising, albeit with some challenges. Thanks to targeted industrial development policies and facilitation of foreign investment, the country has transitioned in a few decades from an agriculture-based economy to an industrialized economy. Particularly, the services sector drives the country's economic growth, accounting for approximately 50% of Malaysia's GDP in 2022, followed by the manufacturing sector at about 23% [23]. The mining sector is also pivotal to the country's economy, alongside the extraction of oil and natural gas. Malaysia is rich in commodities such as tin, bauxite, and copper, which help diversify the Malaysian economy. However, oil and natural gas remain among the most valuable natural resources for Kuala Lumpur, enabling Malaysia to be nearly self-sufficient in energy production. Petronas (Petroliam Nasional Berhad), Malaysia's national oil company, is one of the largest players globally in the energy and oil sectors. As a state-owned entity, Petronas significantly contributes to Malaysia's fiscal revenues, in addition to providing employment and training to the population [24]. In this regard, given the centrality of gas and oil in the country's energy mix, one of the challenges Malaysia will face in the coming decades is transitioning towards renewable energy sources [25]. To advance the country's development, the government is outlining measures to transform Malaysia into a leading production hub, while also fostering growth in the domestic industrial ecosystem. This direction is reflected in the New Industrial Master Plan (NIMP) 2030 introduced in September 2023, which aims to boost the nation's manufacturing sector, targeting an annual GDP growth of 6.5% in this sector. Specifically, Kuala Lumpur is focusing on technology with a specific emphasis on the semiconductor sector. As early as the 1970s, Malaysia was an important hub for semiconductor production, but in the subsequent decades, other players such as Samsung from Korea and TSMC from Taiwan took over the sector. However, the recent geopolitical competition between China and the United States has once again made Malaysia an attractive destination for microchip multinationals, with significant investments revitalizing the sector in the country. Currently, Malaysia holds a significant position in the final stages of microchip production — namely ‘packaging’, assembly, and ‘testing’ — with a 13% share of the global market. Recently, several leading companies in the industry have announced new investments in the country [26]. For instance, Intel has announced $7 billion investments in facilities for microchip packaging and testing, while the U.S. giant Nvidia is planning to invest over $4 billion in collaboration with Malaysian company YTL Power International to create infrastructure for artificial intelligence and ‘supercomputing’ [27]. Additionally, the government has announced the ambitious construction of one of the largest ‘integrated circuit design parks’ in Southeast Asia, aiming to transform the country from a critical hub in the final stages of the value chain to a powerhouse in semiconductor design as well [28]. However, competition with other Asian countries such as Vietnam and Indonesia, requires Malaysia to continue investing to attract capital and strengthen the national industrial ecosystem. To this end, on May 28, 2024, Anwar announced the National Semiconductor Strategy, which plans to mobilize approximately $5.3 billion in fiscal support over the next ten years to drive sector growth. Kuala Lumpur aims to mobilize domestic and foreign investments totaling over $100 billion under the new strategy. The government also aims to train more than 60,000 highly skilled engineers to help the country become a leader in the semiconductor supply chain [29]. However, there are additional critical factors for the development of Malaysia's economy, such as its dependence on exports and the presence of multinational corporations and foreign capital, which make the economy vulnerable to external factors. Global demand and fluctuations in international markets can significantly influence Malaysia's economy, as evidenced by the slowdown in GDP growth from 8.7% in 2022 to 3.7% in 2023, primarily due to weaker external demand and a decline in commodity prices. Exports, crucial for the country's economy, declined by 7.8% in 2023, with contractions also seen in Malaysia's key export sectors such as palm oil, petroleum, and electrical and electronic products. The reduced demand for Malaysian products is also attributed to economic uncertainties in major trading partners such as the United States and China – the former dealing with uncertain monetary policy and the latter seeking new stimuli for economic growth while addressing the real estate sector crisis [30]. Malaysia must also be cautious not to overly rely on the presence of foreign companies to drive its economic development. So far, Malaysia, along with other Southeast Asian neighbors like Vietnam and Indonesia, has been among the beneficiaries in the geo-economic competition between China and the United States. Many multinational corporations, especially in the tech sector, have set up manufacturing facilities or initiated partnerships in Malaysia. However, the resurgence of current conflicts and geopolitical tensions could lead to fragmentations along value chains and further relocations. In an increasingly polarized international system, excessively relying on economic development from the presence of foreign firms could become a risky choice. Despite these challenges, the Malaysian economy has benefited from foreign investments and domestic consumption, supported by government subsidies and price controls to contain inflation [31]. Economic growth for 2024 is projected at 4.5%, driven by increasing domestic demand and higher export demand [32].

In recent years, Malaysia has emerged as a strategic economic center in Southeast Asia: the country has attracted investors due to its expanding manufacturing sector and has shown remarkable adaptability, becoming a key player in global production chains-especially in the semiconductor sector. To minimize uncertainties related to current global geoeconomic tensions, the country should continue to focus on a more robust and self-sustaining domestic industrial ecosystem. In addition, recent political instability, characterized by frequent changes of government and growing ethnic and religious tensions, is likely to undermine the confidence of investors and the population.

In sum, Malaysia's success will also depend on its ability to balance economic growth with social cohesion, while addressing challenges arising from economic disparities, ethnic tensions, and economic dependence on foreign markets.

[1] M.M.N. Nadzri, “The 14th General Election, the Fall of Barisan Nasional, and Political Development in Malaysia, 1957-2018”, Journal of Current Southeast Asian Affairs, vol. 37, n. 3, dicembre 2018, pp. 139-71. [2] ”List of The Yang Di-Pertuan Agong”, The Government of Malaysia’s Official Portal. [3] “Introduction”, Portal Rasmi Parlimen Malaysia – Pengenalan, 10 dicembre 2019. [4] Malaysia 1957 (Rev. 2007) Constitution, Constitute. [5] R.C. Paddock, “Malaysia Opposition, Led by 92-Year-Old, Wins Upset Victory”, The New York Times, 9 maggio 2018; “MalaysiaGE: full results”, The Straits Times, maggio 2018. [6] “Explainer: Malaysia’s ex-PRIMO MINISTRO Najib and the Multi-billion Dollar 1MDB Scandal”, Reuters, 23 agosto 2023; “Goldman Sachs and the 1MDB Scandal”, The Harvard Law School Forum on Corporate Governance, 14 maggio 2019; S. Adam, L. Arnold e Y. Ho, “The Story of Malaysia’s 1MDB, the Scandal That Shook the World of Finance”, Bloomberg, 24 maggio 2018. [7] S. Lemière, “The Never-ending Political Game of Malaysia’s Mahathir Mohamad”, Brookings, 30 ottobre 2020 [8] “The Rise and Fall of Malaysia’s Muhyiddin Yassin”, Reuters, 16 agosto 2021; Y.N. Lee, “Malaysia’s New Prime Minister Has Been Sworn in – but Some Say the Political Crisis Is ‘far From Over’”, CNBC, 3 marzo 2020. [9] A. Ananthalakshmi, R. Latiff e M.M. Chu, “Malaysian PM calls for early polls as ruling party seeks to rise above graft cases”, Reuters, 10 ottobre 2022. [10] A. Ananthalakshmi, R. Latiff e M.M. Chu, “Malaysia Faces Hung Parliament in Tight Election Race”, Reuters, 19 novembre 2022. [11] K. Ganapathy, “‘End of an Era’ for Malaysia’s Barisan Nasional, After Corruption Issues Hurt Candidates at GE15: Analysts”, Channel News Asia, 21 novembre 2022. [12] “Anwar Ibrahim: The Man Who Fulfilled His Goal to Lead Malaysia”, BBC News, 24 novembre 2022. [13] F. Hutchinson, “Malaysian Unity Government’s Power Was Retained but Constrained in 2023”, East Asia Forum, 28 gennaio 2024. [14] R.S. Bedi, “Analysis: Strong State Poll Performance by Perikatan Nasional Boosts Stock for Some PAS Leaders, but Obstacles Lie Ahead”, Channel News Asia, 16 agosto 2023. [15] Bumiputera Statistics 2022, Department of Statistics Malaysia Official Portal. [16] “Malaysia: Majority Supremacy and Ethnic Tensions”, Institute of Peace and Conflict Studies, 1 agosto 2012; N. Bowie, “Fifty Years on, Fateful Race Riots Still Haunt Malaysia”, Asia Times, 29 maggio 2019; “Ethic Tensions Boil Over in Malaysia’s 13 May 1969 Incident”, Association for Diplomatic Studies and Training. [17] K.S. Jomo, Malaysia’s New Economic Policy and ‘National Unity’, Londra, Palgrave Macmillan, 2005, pp. 182-214; H. Lee. “Malaysia’s New Economic Policy: Fifty Years of Polarization and Impasse”, Southeast Asian Studies, vol. 11, n. 2, Agosto 2022; M.A. Khalid e L. Yang, “Income Inequality Among Different Ethnic Groups: The Case of Malaysia”, LSE Business Review, 11 settembre 2019; “2021/36 ‘Malaysia’s New Economic Policy and the 30% Bumiputera Equity Target: Time for a Revisit and a Reset’ by Lee Hwok Aun”,ISEAS-Yusof Ishak Institute, 25 marzo 2021. [18] H.A. Lee. “Perpetual Policy and Its Limited Future as Reforms Stall”, New Mandala, 17 aprile 2018. [19] M. Mohamad e I. Suffian “Malaysia’s 15th General Election: Ethnicity Remains the Key Factor in Voter Preferences”, FULCRUM, 4 aprile 2023. [20] “Buddhism, Islam and Religious Pluralism in South and Southeast Asia”, Pew Research Center, 12 settembre 2023. [21] K. Ostwald e S. Oliver, “Continuity and Change: The Limits of Malaysia’s Green Wave From a Four Arenas Perspective”, ISEAS-Yusof Ishak Institute, 27 ottobre 2023; O.K. Ming. “Debunking the Myths of Malaysia’s ‘Green Wave’ in GE15”, Channel News Asia, 28 giugno 2023. [22] D.A. Paulo, “Malaysia’s ‘Green Wave’: A Threat to the Country’s Politics and Religious Restraint?”, Channel News Asia, 10 giugno 2023. [23] “Manufacturing, value added (% of GDP) – Malaysia”, The World Bank Open Data, “Services, value added (% of GDP) – Malaysia”, The World Bank Open Data. [24] “Petronas’ Role in the Larger Economy”, The Malaysian Reserve, 30 agosto 2019; “Petronas Payout to Malaysia Govt Seen Higher at 55-59 Bln Rgt This Year”, Reuters, 22 luglio 2022. [25] G. Musaeva, “Greening Pains: Can Petronas Make the Leap to Renewables?”, The Diplomat, 15 settembre 2022. [26] T. Cheng e L. Li, “Malaysia Aims for Chip Comeback as Intel, Infineon and More Pile In”, Nikkei Asia, 28 settembre 2023. [27] R. Latiff e F. Potkin, “Nvidia to Partner Malaysia’s YTL Power in $4.3 bln AI Development Project”, Reuters, 8 dicembre 2023. [28] “Malaysia Plans Southeast Asia’s Largest Integrated Circuit Design Park”, Reuters, 22 aprile 2024. [29] N. Goh, “Malaysia to train 60,000 engineers in bid to become chip hub”, Nikkei Asia, 28 maggio 2024; D. Azhar, “Malaysia targets over $100 bln in semiconductor industry investment”, Reuters, 28 maggio 2024. [30] Asian Development Outlook April 2024: Malaysia”, Asian Development Bank, aprile 2024, pp. 218-24. [31] Ibid. [32] Ibid.

First published in :

"Paola Morselli is a Junior Research Fellow at ISPI. She holds a Bachelor’s degree in Language, Culture and Society of Asia and Mediterranean Africa from Ca’Foscari University of Venice, with a specific focus on Korea, Japan and China, and a Master’s degree in European and International Studies at the University of Trento. As an exchange student, she also spent an academic year at Seoul National University in South Korea. Her research focuses on Asia, with a particular interest in Chinese and Korean political affairs and Southeast Asia, especially Myanmar, Thailand and the Philippines."

Unlock articles by signing up or logging in.

Become a member for unrestricted reading!