Energy & Economics

Kenya’s economy: how is the government tackling the big challenges?

Image Source : Shutterstock

Subscribe to our weekly newsletters for free

If you want to subscribe to World & New World Newsletter, please enter

your e-mail

Energy & Economics

Image Source : Shutterstock

First Published in: Nov.25,2024

Dec.16, 2024

Kenya’s government faces the challenge of meeting its debt obligations, while avoiding further unrest. President William Ruto must find ways to raise money, manage the economic recovery from Covid-19 and respond to the threat of climate change.

William Ruto was elected as Kenya’s fifth president in September 2022. He had previously served ten years as deputy president and came into office with broad international support. In May 2024, Ruto embarked on the first state visit to the United States by an African leader in 16 years.

That same month, his government proposed a raft of taxes designed to reduce Kenya’s budget shortfall – the fiscal deficit is projected to be 4.3% of GDP in 2024/25. The measures were encouraged by the International Monetary Fund (IMF), which had loaned Kenya $2.3 billion to meet the financial obligations resulting from Covid-19 and existing debt-servicing costs.

The taxes were drafted into a bill comprising mostly VAT measures, which would place a disproportionate burden on poorer Kenyans. As a result, thousands of citizens, led by the younger generation, took to the streets in protest. This culminated in them storming the parliament buildings on 25 June, with around 50 protesters being killed.

The next day, the president declined to sign the bill. Two weeks later, he dismissed his entire cabinet.

What are the roots of Kenya’s debt crisis?

In the last 15 years, Kenya’s debt has risen significantly. Government debt totalled a manageable 39% of GDP in 2010; by March 2023, it stood at 68% of GDP.

This rise in debt is the result of a surge in borrowing between 2013 and 2022, under Uhuru Kenyatta’s administration. Following strong growth rates in the early 2000s, Kenyatta took out large loans to pay for infrastructure projects. Many of these did not result in enough economic growth to cover their costs.

One often-cited example of this excessive borrowing is the $5.3 billion loan from China to pay for the Standard Gauge Railway (SGR) project linking the port city of Mombasa and the capital, Nairobi.

Many of these infrastructure projects were victims of corruption, which siphoned money away from large loans. In particular, significant allegations of embezzlement have been levelled over the allocation of the Eurobonds (large international loans) secured by the Kenyan government in 2014 and 2018.

The government lost at least 567.4 billion Kenyan shillings ($4.4 billion) to corruption between 2013 and 2018 alone, according to estimates from consulting firm Odipo Dev. Over the last ten years, Kenya has consistently ranked between 120th and 140th out of 180 countries in Transparency International’s corruption perception index.

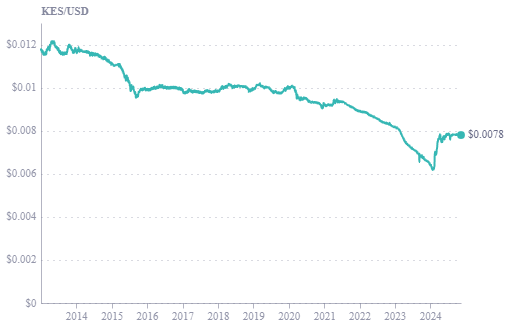

During this period, the Kenyan shilling has also lost 31% of its value against the US dollar. This has helped Kenyan exporters, particularly those that export to the United States (9.8% of exports). The dollars that Kenya receives from exporting have been vital to its debt repayment, especially because the country imports more than it exports. Its trade deficit sat at around $18 billion, according to 2022 figures.

The shilling’s drop in value poses a significant problem for the treasury. Kenya’s $80 billion debt pile is mostly denominated in dollars, and the depreciation of the shilling has made these repayments significantly harder.

Figure 1: Kenyan shilling ten-year exchange rate with the US dollar

Source: xe.com

The Kenyan government is not solely at fault for the accumulation of debt. IMF managing director Kristalina Georgieva called Kenya an ‘innocent bystander’ to external shocks after visiting in May 2023. She was referring primarily to the pandemic, which had caused dramatic short-term rises in unemployment and food security, and to the drought and inflation that followed.

Where there is a country in debt distress, such as Kenya, there is often an irresponsible lender as well as the borrower. Campaign group Debt Justice points out that Kenya’s credit dried up after the pandemic, when developing countries were generally seen as riskier lending options. As a result, it had to turn to World Bank and IMF loans, and eventually bonds with double-digit interest rates.

In the words of the African Forum on Debt and Development (AFRODAD), Kenya’s debt was the result of ‘a combination of irresponsible lending by developing partners… and an unsatiable appetite to borrow by the government of Kenya.’

In May 2020, the World Bank upgraded Kenya’s risk of debt distress from moderate to high. The pandemic depressed Kenyan exports and economic growth, and the government’s strong fiscal response magnified the existing budget deficit. At this point, both the World Bank and the IMF still viewed Kenya’s debt as fundamentally sustainable.

What role has China played in Kenya’s debt burden?

Since the Kenyatta administration started borrowing vast sums of money from China in 2013, the Asian giant has been accused of indulging in ‘debt-trap diplomacy’. Many Kenyans fear that the collateral for China’s $5.3 billion loan for the SGR is the strategic Mombasa port.

Specifically, if Kenya is forced to default, it has been argued that China will seize the port. Similar accusations have dogged Chinese projects in Uganda and Zambia. In the last financial year, Kenya has repaid China $1.18 billion, a third of which comprised interest payments.

Nonetheless, China’s role in Kenya’s debt crisis has probably been overstated. Kenya owes China approximately $6 billion, out of a total of $70 billion of debt. The World Bank and the IMF have judged the $2 billion Eurobond to be the more decisive factor in Kenya’s default risk. While Kenyatta’s government did borrow excessively from China, those loans at least resulted in completed infrastructure projects.

The challenges that Kenya faces with Chinese loan repayments are mostly representative of its wider debt struggles. Chinese loans are dollar-denominated, and repaid at 3% above the benchmark global interest rate.

What happened in 2024?

In 2024, Kenya faced a looming June deadline to repay a $2 billion Eurobond issued in 2014. The IMF stepped in with a $941 million loan in January, bringing the organisation’s total exposure to Kenya to $4.4 billion. To cover the rest of its shortfall, Kenya issued an international bond of $1.5 billion, with an interest rate of 10.4%. The second loan was met with relief by international markets, which no longer feared an immediate Kenyan debt default.

Many observers see this level of interest payment as a stark warning of financial ill health. Indeed, six of the 15 countries to issue bonds at 9.5% or higher interest rates since 2008 have eventually defaulted, according to Morgan Stanley analysts.

In return for the low-interest loan from the IMF, Ruto’s government agreed to raise taxes. It introduced a finance bill in May 2024, outlining plans to raise 346 billion Kenyan shillings ($2.68 billion). It was these proposals that triggered the country’s mass protests.

In the end, the president refused to sign the bill into law after these protests, which had culminated in the storming of Kenya’s parliament on 25 June. At least 50 demonstrators were killed in the violence, bringing worldwide attention to Kenya’s political and economic struggles.

Who is protesting and why does it matter?

Debt repayment is a controversial topic in many developing countries. Since the so-called ‘third world debt crisis’ in the 1980s, many have been mired in debt.

The IMF provided emergency loans to affected countries throughout the 1980s. But these loans were conditional on austerity measures being implemented, privatisation programmes introduced and the countries’ economies opened to foreign capital. As a result, the IMF is frequently accused of seeking to influence the economic strategy of poor countries.

Many Kenyan protesters took this line, decrying the IMF programme for tax rises and spending cuts in order to finance Kenya’s debt to the West as colonial. Many debt specialists around the world have sympathised with this view.

Binaifer Nowrojee, president of the Open Society Foundations, noted that Kenyans make up just some of the three billion people living ‘in countries that are spending more on servicing their debt than public spending on education or health’.

The Ruto government faces the challenge of overcoming the debt crisis and convincing the population to accept measures needed to do so. The protesters are predominantly urban, young and poor – the Kenyans who feel squeezed in the current economy. One study indicates that youth unemployment could be as high as 67%.

For example, to buy a motorbike – often critical for employment – young people are forced to turn to microloans, which often leave them in inescapable debt.

Kenya’s biggest cities have been at the heart of the anti-tax protests since the movement escalated on 18 June – 57 of the 215 protests took place in just seven cities. Many of the protesters left rural areas in search of economic opportunity and better government services but were left disappointed with the opportunities available.

The demonstrators generally see themselves as existing outside civil society. One study finds that the wave of African protests since 2010 have typically been led by ‘political society’ (Branch and Mampilly, 2015). These are the most impoverished urban workers, who have little interaction with the state and tend to accomplish their aims through direct demonstration rather than the electoral system.

Where does Kenya go from here?

The IMF’s communications director has apologised to Kenyans, but maintains that an austerity programme is critical for the country’s economic health. So long as Ruto’s government seeks to avoid a default, the IMF is likely to insist on its measures being passed.

Ruto responded to the 25 June events by branding the demonstrations as ‘treasonous’. He later moderated his position, dismissing almost his entire cabinet on 11 July. The new cabinet includes four members of the opposition Orange Democratic Movement (ODM), led by political opponent Raila Odinga.

Demonstrations continue against the government, albeit to a lesser extent than in June. In order to address these, Ruto will have to accept that the ‘political society’ behind the protests is not allied to the ODM. Thus far, protesters have not shown themselves to be wedded to a party political or ethnic identity. Their demands – to bring down inequality, introduce measures against corruption and end police brutality – will require political will. Ignoring the protests, on the other hand, risks another crisis.

Now that indirect tax rises are too politically toxic, the government must find other ways to increase its revenue. The obvious pivot is to raise direct taxes, particularly income tax and corporation tax.

Kenya has a GDP per capita of $1,949, ranking 17 out of 48 countries in sub-Saharan Africa. The treasury has historically struggled to convert this into revenue. A recent study finds that Kenya’s tax revenue is equivalent to just 16.5%, down from a high of 17.5% in 2017 (OECD, 2023; KRA, 2024). This puts Kenya below the African average in both tax and non-tax revenue, and far below the Western average of 30-40%.

Increasing direct tax revenue in sub-Saharan Africa is easier said than done. Prior to independence, colonial governments built tax bases that relied on controlling the movement of goods in and out of the territory (Cooper, 2002). Modern African states – many of which are poor and sparsely populated – have also relied on indirect taxes (Herbst, 2000).

The IMF’s encouragement of Kenya to move away from indirect taxes on trade (that is, tariffs) towards taxing consumer expenditure (VAT) has damaged the government’s ability to collect taxation on a natural source. In common with some other African countries, state infrastructure is generally more effective at taxing trade since it is more regulated and accessible to the public authorities than domestic consumer spending.

A short-term return to tariffs on foreign goods would be risky. It would be likely to result in higher consumer prices and increased costs of production for Kenyan companies. In the longer term, the government may need to expand formal employment and seek to bring in higher-wage jobs in order to expand the tax base (Cheeseman and Griffiths, 2005).

For the time being, Kenya has averted a default. IMF loan interest rates are minimal, and the country won’t have to start repayments on its $1.5 billion bond until 2029. There are also some positive indicators. Kenya’s tax revenue in 2023/24 was $18.8 billion, an 11.1% increase on the previous year (at $16.4 billion). Economic growth rates are stable, at around 5.5% year-on-year.

Nonetheless, Kenya is still spending 60% of its revenue on debt servicing, half of which goes to interest repayments alone. The situation is close to unsustainable and, without changes, the country could be facing a negotiated default in the coming years.

What about inflation?

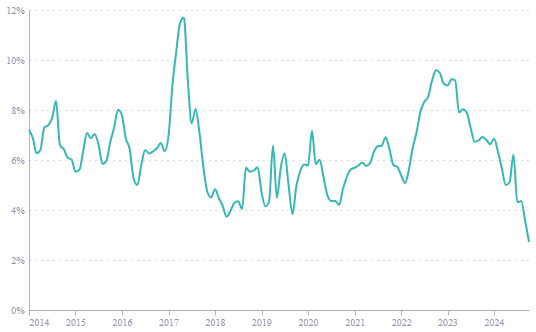

Central Bank of Kenya (CBK) has a mixed record of managing inflation. The country has seen inflation averaging 6.5% over the last decade. The impact of Covid-19 and Russia’s invasion of Ukraine brought further rises, but this has been contained at 7.7%, broadly in line with the sub-Saharan average of 7.1%.

Figure 2: Inflation in Kenya, 2014-24

Source: World Bank

The rise in the value of the shilling in 2024 may begin to translate into a further reduction in inflation, but this is is unlikely to be sustainable. Kenya’s foreign exchange reserves have seen significant volatility, as the country has repaid and subsequently issued large bonds.

The CBK’s reserves total around $7 billion – enough to cover less than four months’ worth of imports. If these reserves fall further, then foreign investors may withdraw from Kenya, depreciating the shilling and inducing higher inflation.

What about climate change in Kenya?

Kenya has suffered repeated droughts over the last decade, with that of 2021-22 being particularly severe. In late 2022, 4.3 million people faced severe food insecurity, as a result of the country’s worst drought for 40 years.

Approximately 2.6 million livestock deaths were attributed to the drought. Food prices jumped temporarily by 60-90%. In a country where agriculture comprises 33% of production and exports are predominantly horticultural, food insecurity is widespread.

Climate change poses a major challenge to Kenya and its neighbours. Kenyan farmers are vulnerable to increasingly variable rainfall – 98% of agriculture in the country does not use irrigation. The economic damage from droughts – which interrupt work, school and medical appointments and thus have knock-on effects on health and education – is costing Kenya 2-2.8% of GDP every year.

By 2050, the crop yields of staples such as maize, rice, coffee and tea are likely to drop by 40-45%. By 2055, food prices are expected to be between 75-90% higher in relative value (World Bank, 2022). Kenya’s ability to develop climate resilience, through effective land and water management, will be vital for its economic health in the next few years.

First published in :

Seth Weisz is a masters student at Cambridge University. He is currently studying for an MPhil in International Development, and has an BA in History. His undergraduate dissertation is on the assassination of Patrice Lumumba and the origins of the Congo Crisis. His MPhil dissertation will explore how governments in low-income countries have responded to social media radicalisation.

Unlock articles by signing up or logging in.

Become a member for unrestricted reading!