Energy & Economics

Are tariffs, of all things, the salvation of free trade?

Image Source : Shutterstock

Subscribe to our weekly newsletters for free

If you want to subscribe to World & New World Newsletter, please enter

your e-mail

Energy & Economics

Image Source : Shutterstock

First Published in: May.27,2024

Jul.15, 2024

During Chinese party leader Xi Jinping's visit to Europe in May, there was once again a lot of talk about economic dependencies. They are seen as a threat to the "economic security" of Germany and Europe. What often seems to fade into the background is that the arguments for a global division of labor remain valid: it enables general prosperity precisely because certain countries and regions concentrate on the production of individual goods and consequently do not produce others themselves. On the other hand, it is also true that the economic damage more than compensates for these advantages if a state such as China uses economic dependencies as political leverage and, in the worst case, stops supplying goods for which it has a monopoly. In principle, China has achieved such a monopoly for refined rare earths and some other smelted metals.1 However, this clearly does not apply to electric cars, steel or solar cells. The reason for such quasi-monopolies is simple: Chinese companies export the products in question so cheaply that production elsewhere in the world is not worthwhile. If this were solely due to the fact that Chinese companies produce better, the only correct response would be to roll up our sleeves and become better ourselves. In the case of rare earths from China, however, the advantage of Chinese manufacturers is largely due to direct and indirect subsidies. In such an environment, in which Chinese producers have massive cost advantages due to politically granted benefits, it is not worthwhile for private companies outside China to build up their own capacities for the production of rare earths, for example. Even if prices were to rise and economic production were possible, this would not be rational; state-supported Chinese companies can easily survive periods of low prices. The usual market mechanism, whereby companies with the most competitive solutions survive, does not apply here. Even technologically superior production methods do not prevail due to Chinese subsidies.

The best economic solution is undoubtedly for the state not to react at all and to see the availability of very cheap products that are available for domestic consumption or for further processing as an advantage. The fact that the products in question have been made cheaper by Chinese taxpayers' money can be gratefully accepted. It would be a genuine and courageous system competition not to respond with the same instruments, but to maintain a market economy system and thus exploit the weaknesses of the counter-design. Shaping the economic framework conditions politically in such a way that innovations that provide alternatives to the use of the raw materials in question can be developed more easily would be a reaction that is still justifiable within the framework of the social market economy. This would be, for example, favorable recycling processes. In most cases, such innovations are possible. However, their introduction and application is significantly more expensive than importing standard products from China. If dependence on China is really not justifiable in individual cases,2 there are two possibilities for state intervention in the form of subsidies or tariffs, which may be justifiable in rare individual cases, but are not provided for within the framework of the World Trade Organization (WTO). Important indicators for the assessment of dependencies are, for example, the lack of substitutability of the imported good, the degree of concentration of supply in a country and the relevance of the good in question for the domestic economy. However, state intervention to protect domestic production sites, such as is being discussed for electric cars or steel, appears to be explicitly unjustifiable. There is a sufficiently diversified supply of such products on the global market and there is no dependency on just one country.

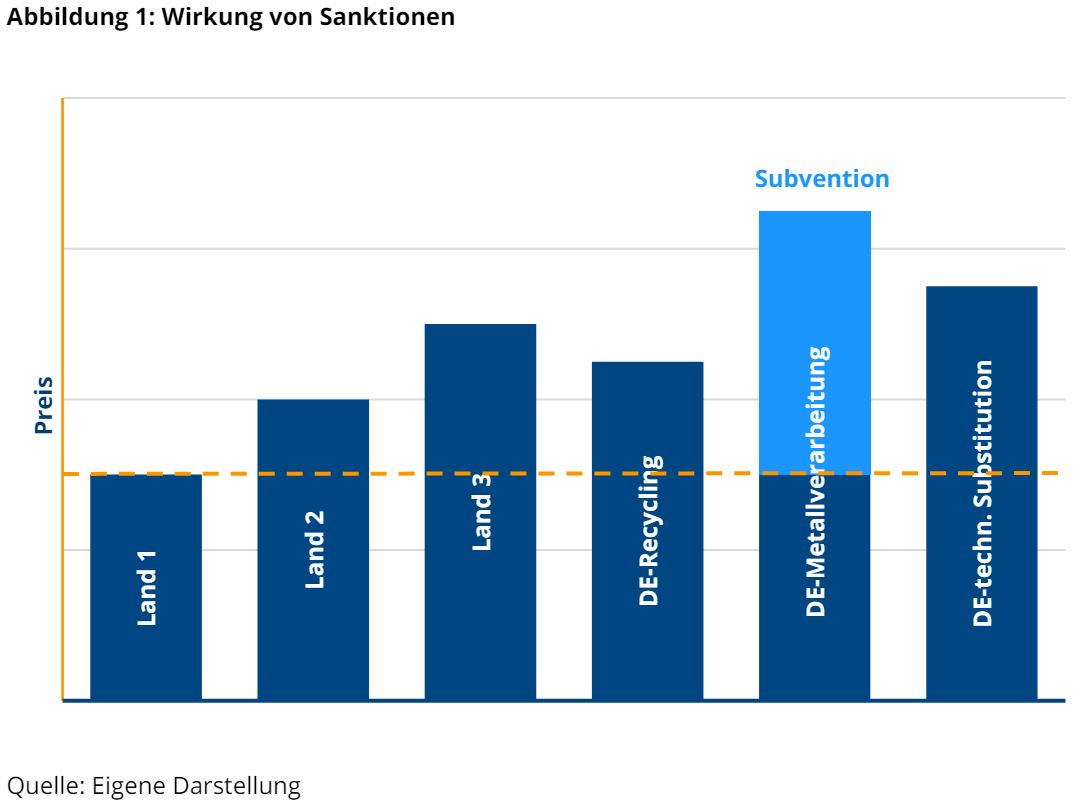

Tariffs and subsidies both aim to compensate for the price difference to cheaper foreign competitors. Tariffs make imports more expensive, while subsidies make domestic production cheaper through state subsidies. Both have a negative welfare effect, but the correlation is more harmful in the case of subsidies. Figure 1 uses a schematic example, which is not based on empirical data, to illustrate the effect if the costs of producing rare earths in Germany were reduced to the level of the import price from China (country 1) through subsidies.

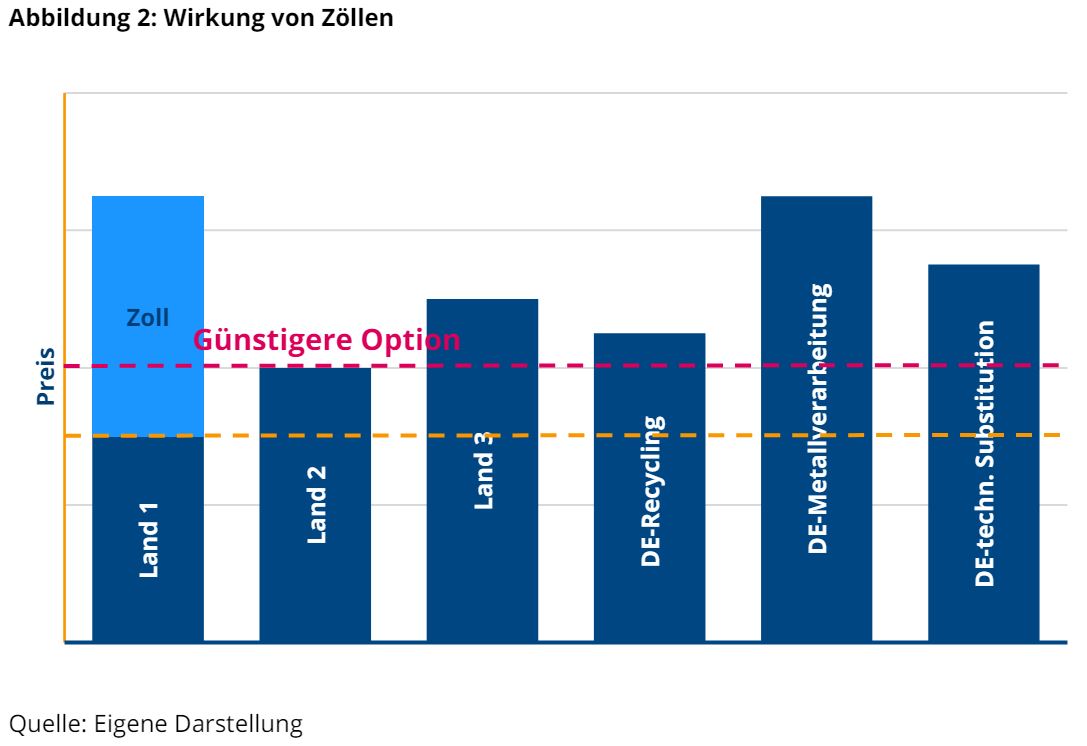

With the subsidies, it is now economically viable for the subsidized companies to produce the rare earths from ore in Germany. The actually cheaper ways of importing rare earths from alternative countries or using other technical solutions remain more expensive and would hardly be used. The goal of reducing dependencies would therefore be achieved in a very expensive way. Large sums of taxpayers' money would be spent on this. In this example, the most expensive possible route is discussed in order to clearly demonstrate the negative consequences. In reality, however, it is very unlikely that the cheapest route in economic terms will be subsidized. This is because there are always many different providers and technical solutions, which means that all the options are often not even known or can only develop in the long term. It is therefore very unlikely that the optimal subsidy recipients will be selected. A benefit is created for a specific, relatively arbitrarily selected application, but not for others. The effectiveness of the market is thus distorted and the competitiveness of the location decreases as a result. As the subsidies compensate for a competitive disadvantage, it is unlikely that high additional tax revenues will be generated. The funds spent are no longer available for other state investments. The result is a loss of welfare on this scale. Only the subsidized companies benefit from this. The price at which rare earths can be purchased in Germany does not change. It is also possible to subsidize production abroad in order to reduce dependence on one country. Such models are being attempted via "raw material partnerships", for example. Such an approach can be significantly cheaper than subsidizing domestic production. In the example (Figure 1), only the significantly lower import price from country 2 would have to be subsidized. However, the other disadvantages of subsidies listed above also apply in this case. In particular, it is even more difficult to obtain all the necessary information for projects abroad and therefore even less likely to choose the most cost-effective option. The targeted tariffs discussed here are intended to respond to dependencies on supplies from a specific country. They are therefore only imposed on imports from this country. Other imports are not affected. To stay with the example, the importer pays a surcharge on the imported rare earths. This makes his product, for which he processes rare earths, more expensive domestically. Manufacturers abroad who are not affected by the duty become more competitive in comparison.

If the tariff rate were set in the same way as above so that the competitive disadvantage for the most expensive option - metal processing in Germany - is compensated for in terms of price, the tariff rate on imports from China would be very high. However, consumers of rare earths in Germany would still have access to the significantly cheaper other options. Metal processing in Germany would therefore remain unprofitable, while imports - now no longer from China, but from country 2 - would continue to be significantly cheaper. However, the price difference to the cheapest processing variant in Germany, in the example (Figure 2) recycling, would no longer be so great, so that this variant would be easier to make economically viable by scaling up or using innovative technical solutions. In reality, the introduction of customs duties would not divert all procurement to a single country; there is no capacity for this anywhere. The result would be a mix of different suppliers, which would make it more worthwhile to drive innovation in Germany. Changes in the price structure between the different providers and processes over time can be tracked by customers in this model - the best process (or the second best, if the best is used in China) then prevails on the market. The welfare loss here arises from the fact that consumption or further processing of the imported products becomes more expensive by at least the difference to the second cheapest source of supply. However, the volume of the welfare loss is significantly lower than in the case of subsidies. It can be argued that tariffs make the prices of downstream products in the supply chain more expensive, whereas subsidies do not. While this is true, it overlooks the fact that the much larger group of companies and consumers who are not directly affected do not suffer any direct additional costs in the case of tariffs, but bear the costs of subsidies through their taxes.

In terms of their political and structural consequences, subsidies are more harmful than targeted tariffs. This is simply due to the procedure at the end of which individual companies receive a subsidy decision. An "objective" allocation is hardly possible here. On the contrary: the procedure is susceptible to personal relationships, political influence and direct corruption. Furthermore, subsidies that are only granted in one country of the European Union jeopardize the integrity of the European Single Market. Similar problems can arise with customs duties. This happens when they are used to protect certain domestic industries. In the case of targeted, selective tariffs, which are based on clearly defined, objective categories, such as the degree of dependence on a product from a country, there is little scope for political influence once the criteria have been established. Tariffs cannot harm the European single market either, as they can only be imposed at European level anyway.

The reduction of tariffs and subsidies within the framework of the World Trade Organization (WTO) and the predecessor agreement GATT are a central reason for the reduction of global poverty in recent decades and one of the cornerstones of Germany's prosperity. It is therefore self-evident that tariffs and subsidies not only contradict the idea of the WTO. They also contradict its two basic principles: Subsidies for domestic production contradict the non-discrimination principle3, tariffs against individual countries violate the Most Favorite Nation Clause4. There are exceptions for both in the WTO rules. For example, WTO members must notify subsidies so that they can be examined and other countries can object to them if necessary. In principle, subsidies are only intended - and within a narrow framework - for developing countries, which still includes China. However, the notification of subsidies to the WTO hardly works any more. For example, 64 countries (around a third of members) have not even notified their subsidies for 20175. Nevertheless, some of China's subsidies may indeed be legal according to the letter of the WTO rules. But they are certainly not legitimate, as the aim of the WTO is to liberalize world trade and not to cement the opposite. And even if subsidies are known, the WTO cannot take legally binding action against them due to the dispute settlement mechanism blocked by the USA. Consequently, the USA has not reacted to the unresolved problem of China's subsidies within the WTO framework. Although tariffs have been imposed on some Chinese imports, the Inflation Reduction Act (IRA) is a huge subsidy program. If the dispute settlement mechanism were to work, the IRA would almost certainly have to be declared WTO-incompatible. However, as this path is blocked, many countries and regions of the world - including Germany and the EU at the forefront - are reacting with their own openly WTO-incompatible subsidy programs. The current subsidy race is constantly creating new reasons to impose subsidies in response to the subsidies of others. This will further damage the multilateral trading system, which has been very successful for Germany in particular. Targeted tariffs, on the other hand, which can be used to eliminate competitive disadvantages caused by subsidies and which are therefore only levied on goods from the subsidizing country, are in principle in line with the basic idea of the WTO. This is because it balances out a distortion of the world market created by subsidies. Therefore, tariffs are generally permitted as a reaction to dumping and subsidies6. A reaction to subsidies via tariffs within the strict WTO framework is currently hardly possible for the reasons mentioned above. In this situation, it should be actively communicated that in an unsatisfactory legal situation, the path of the least evil will be taken with tariffs. At the same time, serious efforts should be made to reform the WTO.

The argument: "We want to have the production of certain things in Germany because we believe that we would no longer be supplied with them in crisis situations" is not an economic argument. Production for strategic reasons is always a financially subsidized business. Because if there was money to be made, the private sector would do it. Politically, this line of argument is perfectly legitimate - as is the attempt to steer the economy directly in a politically acceptable direction through subsidies. However, this has nothing to do with a social market economy, but rather the opposite. However, if Germany and Europe are to remain committed to the social market economy and open multilateral trade, the only economically sensible response to problematic dependencies from abroad (if one has to respond at all) is to impose targeted, selective tariffs - but certainly not protective tariffs for domestic production sites. The German government should work within the EU to set a clear framework for this and at the same time work on a reform at WTO level to finally reduce the rampant subsidies. Because these - and not tariffs - are currently the biggest threat to the open global trading system that is so important to us.

1 Vgl. etwa die Darstellung der Abhängigkeiten von für die Energiewende nötigen Metallen in Cernicky (2022): https://www.kas.de/documents/252038/16166715/Energiewende+und+Protektionismus+-+Wie+gehen+wir+pragmatisch+mit+China+um.pdf/442ba770-d504-43cc-25f1-eaf7d970dfc1, genaue Zahlen vgl. etwa die Auflistung des BDI: https://bdi.eu/publikation/news/analyse-bestehender-abhaengigkeiten-und-handlungsempfehlungen/ 2 Zum Versuch einer entsprechenden Bewertung vgl. etwa die von der KAS und dem Ifo-Institut durchgeführte Studie zu Abhängigkeiten in Lieferketten, Flach et al (2021): https://www.kas.de/de/analysen-und-argumente/detail/-/content/globale-wertschoepfungsketten 3 Art. III GATT 4 Art. I GATT/ WTO 5 WTO | 2023 News items - Members reiterate concerns on lack of transparency with subsidy notifications: https://www.wto.org/english/news_e/news23_e/scm_02may23_e.htm 6 GATT Art VI, Dumping und Ausgleichzölle Publisher: Konrad-Adenauer-Stiftung e. V., 2024, Berlin Design: yellow too, Pasiek Horntrich GbR Produced with the financial support of the Federal Republic of Germany. This publication of the Konrad-Adenauer-Stiftung e. V. is for information purposes only. It may not be used by political parties or election campaigners or helpers for the purpose of election advertising. This applies to federal, state and local elections as well as elections to the European Parliament. The text of this work is licensed under the terms of "Creative Commons Attribution-ShareAlike 4.0 international", CC BY-SA 4.0 (available at: https://creativecommons.org/licenses/by-sa/4.0/legalcode.de).

First published in :

Head of the Economy and Innovation Department

Unlock articles by signing up or logging in.

Become a member for unrestricted reading!