Latin America and the Caribbean: outlook to 2024 and its potential impact on sustainable development

by Javier Surasky

Introduction

The year 2024 will present new windows of opportunity and obstacles to the acceleration of the Sustainable Development Goals (SDGs) in Latin America and the Caribbean (LAC). Below we analyze some trends in the region for 2024 in each of the three dimensions of sustainable development, to which we add consideration of governance elements to help understand a framework that does not look easy and in which critical decisions will have to be made for the future.

The social dimension

In 2024 we will have presidential elections in six countries in the region. Polls indicate that the incumbent party will remain in power in Mexico, where Claudia Sheinbaum could become the first woman president in its history; El Salvador will renew the mandate of Nayib Bukele despite doubts about the constitutionality of his new candidacy. In Uruguay and the Dominican Republic, where Luis Lacalle Pou and Luis Abinader will seek to renew their mandates, the high levels of approval of their administrations point to a possible reelection.

At the other extreme, polls point to a possible defeat of the ruling party in Panama, where former president Ricardo Martinelli (2009-2014) leads in voting intentions despite having been convicted in 2023 for a corruption and money laundering case, a sentence that is currently under appeal.

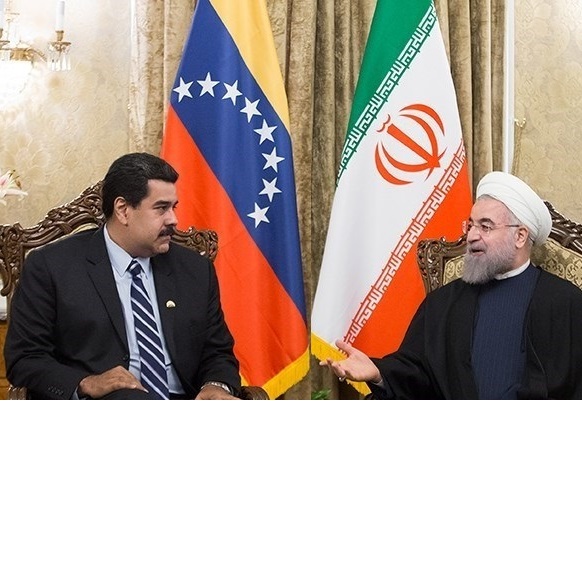

In Venezuela, the only country on the list without a date for its electoral process, the controversies surrounding the government of Nicolás Maduro and the lack of transparency in information, added to the imprisonment of opposition leaders, prevent any analysis.

The escalation towards an armed confrontation with Guyana over the border region of the Essequibo, rich in oil, minerals and gas, should be closely followed. The result of a long diplomatic and legal dispute between the two countries, its last chapter had taken place in 2018, when Guyana, with the backing of the current UN Secretary General, went to the International Court of Justice to request the reaffirmation of the international arbitration that fixed the border between the two countries in 1899. Maduro's government responded by ignoring the Court's authority to hear the case.

Then, in 2020, the court declared itself competent to hear the case, but has not yet rendered its final judgment. The Community of Latin American and Caribbean States (CELAC), almost absent from the regional political map in recent years, reappears to mediate between the two countries, the end of which is now uncertain.

All these processes are framed in a high level of citizen distrust towards the political sector, accompanied by weakened democracies, as reflected in The Economist's Democracy Index 2022.

On the other hand, the arrival of Javier Milei, a political outsider, to the presidency of Argentina raises questions about its future regional positioning and will have far-reaching regional effects with changes in alliances on sensitive issues, from support for regional environmental policies to the redesign of the country's insertion in international trade, with potential major impacts on the Southern Cone.

All of the above, together with the low growth and economic difficulties described in the following section, pose challenges for accelerating regional trajectories of poverty reduction, the fight against labor informality and unemployment, and the implementation of public policies to promote equity and gender equality, among others. For these reasons, there will be more pressure on regional environmental resources, which could lead to new protests and social unrest.

The economic dimension

Implementing actions to promote sustainable development requires financial resources. LAC has long been a low-priority region for international cooperation and foreign investment is limited, so generating its own resources, in a context of global economic restrictions, is essential.

The average projected growth for the region in 2024 is 1.5%, distributed by subregion as follows: the Caribbean (excluding Guyana, which is in a special situation due to its recent entry into the "club" of oil-exporting countries), 2.8%; Central America and Mexico, 2.1%; and South America, 1.2%. As a result, employment growth is expected to slow down.

In an attempt to recover employment growth, the countries of the region seem to be turning to flexible monetary policies to increase exports. Countries such as Brazil, Chile and Peru, for example, reduced rates in the third quarter of 2023 and Colombia and Mexico are expected to do so at the beginning of 2024, but the slowdown in growth in countries such as the United States and China is resulting in lower demand for primary products, the main export of LAC countries, in international markets. In addition, there are deficiencies in infrastructure for the transportation of goods throughout the region, creating an obstacle to its export capacity.

The possible fall in demand for basic goods is accompanied by a forecast that their prices will continue to fall in 2024, with the exception of energy commodities, which will increase pressure on the trade balances of LAC countries.

In terms of minerals, the boost to the extractive industry could lead to foreign currency inflows in countries such as Argentina, Chile and Bolivia (the lithium triangle), although the uncertainty regarding the arrival of investments is due to doubts about economic and business policies in those countries and the growing public demand for the regulation of mining activity to reduce its effects on the environment.

However, a boost to mineral processing activity to accompany its extraction could come from the global competition between China, the United States and the European Union, as the latter two seek to reduce China's global weight in mineral processing.

Finally, it should be noted that the relocation of supply chains that followed the Covid-19 crisis will bring income to only a few LAC countries, such as Mexico and Panama.

The environmental dimension

Climate change is already being felt strongly in the region: the average temperature in LAC for 2021-2040 is expected to be about 1°C higher than in the period 1985-2014.

At the same time, LAC is key to finding solutions to the challenges of climate change: it is home to 40% of the planet's biodiversity and more than 25% of its forests. The region also plays a central role in the sustainable production of food and energy, where more than 30% of the energy production matrix is made up of "green energies", a percentage that for some countries exceeds 90%, and an export profile that is closely linked to potentially polluting extractive activities.

Although it contributes less than 10% of global greenhouse gas emissions, LAC causes damage whose cost already exceeds 2% of its combined annual GDP as a result of the worsening and greater recurrence of extreme weather and environmental catastrophes. The region is the second most vulnerable to natural disasters, which have affected approximately 190 million people since 2000.

The expected climatic effects of the "El Niño" current in the region, with increases in rainfall in some sectors paired with droughts in others, will translate into differentiated opportunities and risks for different countries in the region in 2024. In perspective, Argentina and Paraguay could benefit from more rainfall that will benefit the crop, while Colombia and Central America will be exposed to droughts and the Caribbean to extreme weather effects.

It will be precisely the intensity of the climatic extremes that "El Niño" reaches that will define its impact on the production of basic goods, energy generation and transportation, but in any case it could contribute to the inflationary pressures that already exist in LAC.

A key issue for the region is what happens at the 28th Conference of Parties to the United Nations Framework Treaty on Climate Change (COP 28), where the aim is to establish a "Loss and Damage Fund" to address the costs of climate change and increase funding for climate change mitigation. However, the central concern of the region will be the adoption of a new "global goal on adaptation to climate change" to guide and finance the actions required to adapt to the changes that climate change has already produced, and to accompany the mitigation goal established in the Paris Agreement.

Defining that goal and creating channels to finance its achievement is one of the most complex issues at COP 28 and it is uncertain what the outcome will be. Chile, together with Australia, have been designated as co-facilitators of this negotiation.

At the same time, what happens at the COP and the discussions on climate and financial issues that will take place in 2024 should find LAC as a leader around the Bridgetown Initiative, presented by Barbados in 2022, to modify the international financial system and urgently curb climate change, combining two concerns of deep regional significance

Governance of sustainable development

In 2024, two countries in the region, Jamaica and the Dominican Republic, are expected to adopt new national development strategies:

In the case of Jamaica, the Medium-Term Socioeconomic Policy Framework 2021-2024 is coming to an end and work is already underway to prepare the document that will give it continuity. This framework guides the implementation, monitoring and evaluation of the country's main national planning instrument, Vision 2030 Jamaica, and should ensure its alignment with the SDGs.

In the Dominican Republic, the National Multi-Year Public Sector Plan 2021-2024 defines the country's development policies and their financing, along with international cooperation priorities.

Brazil, for its part, will once again have its commission for the implementation and monitoring of the SDGs active as of December 2023, after it was deactivated by the Jair Bolsonaro administration and replaced by the current government.

In addition, the following countries in the region will submit Voluntary National Reports on SDG implementation: Argentina, Belize, Brazil, Colombia, Costa Rica, Ecuador, Honduras and Peru. It is possible, however, that the position of the recently elected president of Argentina, Javier Milei, against the 2030 Agenda, will lead the country to withdraw its offer.

On the other hand, in 2024 the sixth forum of Latin American and Caribbean countries will be held in the city of Santiago de Chile, a meeting that will be of special importance for the region given that it will not only serve, as it traditionally does, as a regional preparatory meeting for the follow-up and evaluation process of the 2030 Agenda that concludes at the United Nations High Level Political Forum, but will also be a key moment in the regional path towards the Summit of the Future, which will meet in New York in September 2024.

It is important to keep in mind that next year will find LAC countries and officials occupying positions of high capacity to influence global debates on the future of multilateralism:

-The presidency of the UN General Assembly is held by Trinidad and Tobago, and that of the Economic and Social Council is held by Chile.

-Brazil will chair the G21.

-Colombia will host the World Data Forum.

-Uruguay's Felipe Paullier has been appointed as the first Under-Secretary-General for Youth Affairs in the history of the UN.

-The government of Mexico will be working with its Spanish counterpart in preparation for the Fourth United Nations -Conference on Financing for Development, to be held in 2025.

In addition, there is growing activity surrounding the appointment of the person who will succeed the current UN Secretary General. In accordance with the practice of geographical rotation in the exercise of this responsibility, a person from LAC would occupy the position. However, Eastern Europe has pointed out that, in its opinion, its turn was "skipped", given that it was the Secretary General of the organization when Guterres, from Western Europe, was appointed for his first term.

Should LAC's position prevail over that of Eastern Europe, we may see the first bids for candidates for the post in 2024. The pressure to have a woman head the UN for the first time in history was scorned when the current Secretary General was chosen, but it is unlikely that the same thing will happen again.

Although it is too early to advance names, the current Prime Minister of Barbados, Mia Amor Mottley, appears to be an unavoidable reference, although there are several candidates in the running.