Energy & Economics

Americans leave a huge chunk of change at airport security checkpoints − here’s what it means for the debate over getting rid of pennies.

Image Source : Shutterstock

Subscribe to our weekly newsletters for free

If you want to subscribe to World & New World Newsletter, please enter

your e-mail

Energy & Economics

Image Source : Shutterstock

First Published in: May.20,2024

Aug.05, 2024

Should the U.S. get rid of pennies, nickels and dimes? The debate has gone on for years. Many people argue for keeping coins on economic-fairness grounds. Others call for eliminating them because the government loses money minting low-value coins. One way to resolve the debate is to check whether people are still using small-value coins. And there’s an unlikely source of information showing how much people are using pocket change: the Transportation Security Administration, or TSA. Yes, the same people who screen passengers at airport checkpoints can answer whether people are still using coins – and whether that usage is trending up or down over the years. Each year, the TSA provides a detailed report to Congress showing how much money is left behind at checkpoints. A decreasing amount of change would suggest fewer people have coins in their pockets, while a steady or increasing amount indicates people are still carrying coins. The latest TSA figure shows that during 2023, air travelers left almost US$1 million in small change at checkpoints. This is roughly double the amount left behind in 2012. At first glance, this suggests more people are carrying around and using coins. But as a university researcher who studies both travel and money usage – as well as a keen observer of habits while lining up at airport checkpoints – I know the story is more complicated than these numbers suggest.

More than 2 million people fly each day in the U.S., passing through hundreds of airport checkpoints manned by the TSA. Each flyer going through a checkpoint is asked to place items from their pockets such as wallets, phones, keys and coins in either a bin or their carry-on bag. Not everyone remembers to pick up all their items on the other side of the scanner. About 90,000 to 100,000 items are left behind each month, the TSA estimates. For expensive or identifiable items such as cellphones, wallets and laptops, the TSA has a lost-and-found department. For coins and the occasional paper bills that end up in the scanner bins, TSA has a different procedure. It collects all that money, catalogs the amount and periodically deposits it into a special account that the TSA uses to improve security operations. That money adds up, with travelers leaving behind almost $10 million in change over the past 12 years. The amount of money left varies by airport. JFK International Airport in New York City is consistently in one of the top slots for most money lost, with travelers leaving almost $60,000 behind in 2022. Harry Reid International Airport, which serves Las Vegas, also sees a large amount of money left behind. Love Field in Dallas, headquarters of Southwest Airlines, is often near the bottom of the list, with only about $100 lost in 2022. People lose money while going through security for a few reasons. First, some cut it close getting to the airport, and in their rush to avoid missing their plane, they don’t pick up everything after screening. Second, sometimes TSA lines are exceptionally long, leaving people to again scramble to make up time. And finally, TSA checkpoints are often confusing and noisy places, especially for new or infrequent travelers. Making it more confusing is that some airports have bins featuring advertisements, which distract travelers who only quickly glance to check for all their items.

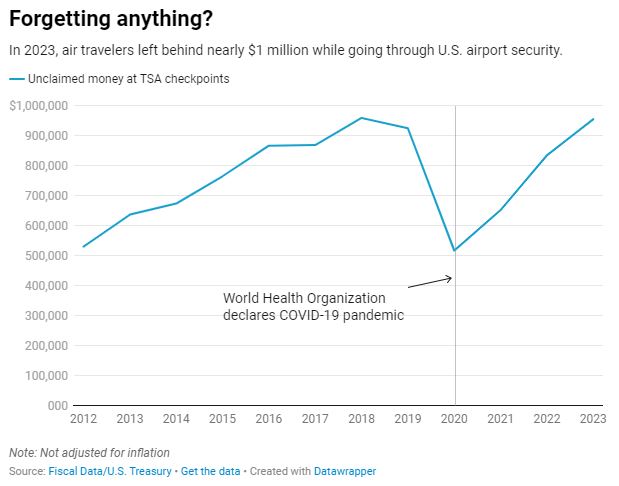

TSA keeps careful track of how much is lost because the agency is allowed to keep any unclaimed money left behind at checkpoints. TSA records show people left behind half a million dollars in 2012. This rose to almost a million in 2018. The drop in travel due to the COVID-19 pandemic reduced the figure back to half a million in 2020. In 2023, people left $956,000.

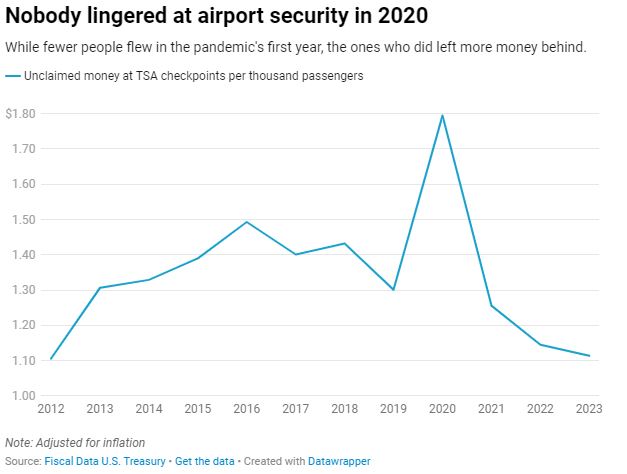

These raw figures need two adjustments to accurately track trends in coins lost. First, the numbers need to be adjusted for inflation. From 2012 to 2023, the consumer price index rose by 33%. This means a dollar of change in 2012 purchased one-third more than it did 12 years later. Second, the number of people flying and passing through TSA screening has changed dramatically over time. In 2012, about 638 million people went through the checkpoints. By 2023, that had risen to 859 million people, which is about 1,000 people every 30 seconds across the entire U.S. when airports and checkpoints are open. Adjusting for both inflation and the number of people screened shows no change in the amount of money lost. My calculations show back in 2012 about $1.10 in coins was lost for every 1,000 people screened. In 2023, about one penny more, or $1.11, was lost per 1,000. The peak year for money being lost was 2020, when $1.80 per 1,000 people was left behind. This was likely due to people not wanting to touch objects out of misplaced fear they could contact COVID-19. During the pandemic, people in general carried less money.

The world is increasingly using electronic payments. The data from TSA checkpoints, however, clearly shows people are carrying coins at roughly the same rate as back in 2012. This suggests Americans are still using physical money, at least for making small payments – and that the drive to get rid of pennies, nickels and dimes should hold off a while longer.

First published in :

I teach at Boston University's Questrom School of Business. From 1988 to the present my teaching has spanned a wide range of levels from senior executives taking intensive classes to high school students encountering economic theories for the first time. I have taught giant lectures of over 450 students, classes of fifty, and small seminars with fewer than ten people. From 1995 to 2018 I held the position of Research Scientist at The Ohio State University, where I collected data as part of the National Longitudinal Surveys on income, wealth, and life experiences of thousands of Americans. My personal finance research has been widely quoted in the media and has been highlighted in the Wall Street Journal, USA Today, Fox News, Good Morning America, Scientific American and numerous other news outlets. Besides publishing numerous scholarly articles I wrote the book ""Business Information: Finding and Using Data in the Digital Age"" for McGraw-Hill/Irwin and ""Business Macroeconomics: A Guide for Managers, Traders and Practical People."" More information on the macroeconomics book can be found at http://businessmacroeconomics.com/. My personal blogs are found here https://blogs.bu.edu/zagorsky/ and https://u.osu.edu/zagorsky.1/

Unlock articles by signing up or logging in.

Become a member for unrestricted reading!