Defense & Security

Military Production in Russia: Before and After the Start ofthe War With Ukraine. To What Extent has it Increased and how hasThis Been Achieved?

Image Source : Shutterstock

Subscribe to our weekly newsletters for free

If you want to subscribe to World & New World Newsletter, please enter

your e-mail

Defense & Security

Image Source : Shutterstock

First Published in: Aug.29,2024

Sep.16, 2024

In February 2022, Russia began a full-scale invasion of Ukraine that has to date continued for more than two years. In response, Western countries imposed increasingly strict sanctions. The Russian Armed Forces lost a significant quantity of armaments and by the autumn of 2022, the government faced the challenge of increasing sharply the production of weapons and munitions. Julian Cooper analyses the extent to which the challenge has been met, reviewing the available quantitative evidence in detail. His analysis confirms that there have been significant increases in the output of systems and munitions used extensively in the war. The author explores the means by which defence industry output has been increased and draws conclusions as to the nature of the Russian economic system and the institutional legacies of Soviet times. On 24 February 2022, Russia launched a ‘special military operation’ against Ukraine and this has been ongoing for over two years. In response, Western countries imposed increasingly severe sanctions in an attempt to constrain the development of the Russian economy and limit the ability of its industry to produce weapons. This is done by restricting access to imported high technology and dual-use goods, production equipment, components and materials. It soon became evident that the invasion had not gone according to Russia’s original expectations of a rapid operation. Instead, a protracted conflict developed with heavy losses in both human and material terms for both sides. The Russian Armed Forces lost a significant quantity of armaments, in particular tanks and armoured vehicles, artillery and air defence systems, fixed-wing aircraft and helicopters. By the autumn of 2022, the Russian government faced the challenge of increasing sharply the production of weapons and munitions vital to the successful completion of the operation which, though not acknowledged in Russia, had become a war. This article explores the extent to which Russia has been able to meet this challenge at a time when its defence industry is experiencing sanctions and a range of economic constrains, not least a shortage of labour exacerbated by a partial mobilisation of personnel to serve in the armed forces. The article comprises four parts. The first looks at the methods of measuring the output of the Russian defence industry. The second examines the available quantitative data in physical terms. The third section seeks to explain how it has been possible for Russia to increase significantly the output of some types of weapons and munitions in a relatively brief period of time. Finally, some conclusions are drawn as to Russia’s ability to adapt its defence industry to wartime conditions, and prospects for the future.

In Soviet times, the production of weapons, munitions and other military-related goods was shrouded in almost total secrecy. This relaxed to some extent after the end of the Soviet Union, but to this day, Russia’s official statistical agency, the Federal Service for State Statistics, generally known as Rosstat, does not openly publish data on the military output of the country’s defence industry. However, this secrecy has its limits as the defence minister and other senior officials of the Russian Ministry of Defence (MoD), in particular the deputy minister responsible for arms procurement, do release data on the output of some weapon systems, annual targets for the state defence order, and information on implementation, as will become clear later in this article. However, since 2014 and the annexation of Crimea, the volume and level of detail have diminished and even more so since February 2022. In addition, President Vladimir Putin, the prime minister, the minister for industry and his deputies also reveal details from time to time, as do the heads and other leaders of corporate structures producing military goods, such as Rostekh, Roscosmos, the United Aircraft Corporation (OAK) and the United Shipbuilding Corporation (OSK). A study of the data covering many years indicates that on the whole, the data released is reliable, with misrepresentation but no evident falsification. But one has to be alert to changes in the definitions employed, in particular whether the figures given apply to the output of new systems only, or to the total procurement of new, modernised and repaired older systems, an issue that has become significant since the Russian invasion of Ukraine. Earlier works of the present author have sometimes focused on detailed analyses of quantitative data of this nature.1 In recent times, some observers have questioned the reliability of this type of information. An April 2024 CSIS report on Russia’s defence industry declared that, ‘While … the official data and statements from the Russian MOD are most likely exaggerated, and therefore should be taken with a grain of salt, they demonstrate the Kremlin has placed renewed emphasis on strengthening the domestic defence industrial sector’.2 While exaggerated statements are indeed often made, the degree of scepticism expressed is overstated in relation to the data. Undoubtedly, great care is needed in its analysis, but it still provides, as accepted by the authors of the CSIS report, a good overall picture of the general trend of development of military production. There is also an additional check on this, namely Rosstat’s regular reports of changes in the output of the manufacturing industry in rouble terms.3 Again, careful analysis is required with an informed knowledge of the industrial classification used, but the overall trends revealed reflect those provided by the quantitative data available from other sources. At a time when quantitative data on various aspects of the Russia economy is being strictly limited by the Russian authorities, not least on budget spending and foreign trade flows, it is better to have imperfect and fragmentary data than none at all.

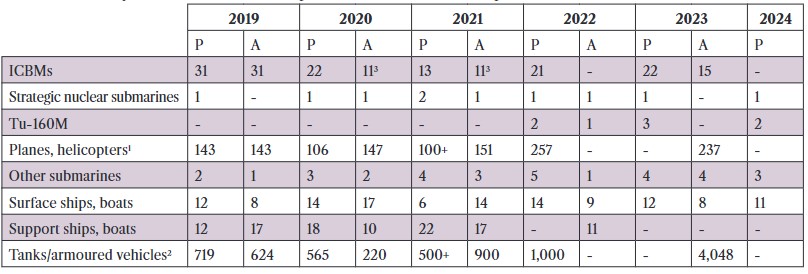

Reports of the output of military goods often appear in Russian media, though the data tends to be fragmented, often lacking precise definition and timescales. There are also similar reports of the output of civilian goods manufactured by defence industry companies. This section examines this evidence in detail from 2019, three years before the start of the Ukraine war, until the end of 2023, and plans for 2024, paying particular attention to the types of military goods that have played a significant role in the current combat. Every year in December, the Russian MoD reports on some of the new weapons procured during the year and plans for the following year. This evidence is presented in Table 1, in the Appendix section at the end of this article. From the table, it can be seen that since 2020, plans for the deployment of new intercontinental ballistic missile (ICBMs) have not been fully implemented, probably because of the failure to develop the Sarmat heavy missile to a point when it can be put into service. The acquisition of Borei-class strategic nuclear submarines has proceeded fairly smoothly and modernised/new Tu-160 strategic bombers are gradually entering service. These developments and the MoD’s procedure for reporting plans and outcomes leave no doubt that in Russia, the development and procurement of strategic nuclear systems remains the highest priority regardless of the war. Taking into account the military technology priorities of the war, it is probably best to consider the production of weapons on a sector-by-sector basis. Clearly, the war has given rise to a greatly increased demand for equipment and munitions for the ground forces, some types of combat aircraft and UAVs, certain types of missiles, air defence systems and electronic warfare systems. Demand for new naval vessels has been less urgent with the exception of nuclear submarines.

For the aircraft industry, the trend is clear. The production of some types of planes and helicopters found to be of value in the war has increased. However, data from 2020 onwards refers to both new aircraft and modernised older ones, making it very difficult to establish the number of the former. In the case of combat systems, the evidence indicates increased production of a few models, for example the Su-35S and Su-34, considered vital to the war and in one case, the Su-57, considered important for status reasons. Table 2 summarises the available data for 2019–23. The Su-57 is Russia’s first ‘fifth’ generation aircraft, although all serially built examples so far have an engine that is not really one of that status. It is a matter of great pride to the Russian leadership, although it has played only a modest role in the war. In the view of a leading Russian military specialist, the very costly and complex fifth generation aircraft ‘as yet are still absolutely not suited to real combat use …. The loss of a fifth-generation plane is on the one hand, a large financial loss, and a significant reputational loss’.4

As for helicopters, it is very difficult to establish the number built for use by the armed forces in recent years. The building of civilian helicopters has been quite seriously affected by sanctions but this appears not to be the case for the main combat systems, the Ka-52/52M and the Mi-28NM. The Russian Air Force signed a contract for the former in August 2021, with 15 to be delivered in 2022 and another 15 in 2023. A new contract for an undisclosed number was signed in the summer of 2022. In July 2023, then Russian Defence Minister Sergei Shoigu said that the volume of production of the Ka-52/52M had doubled compared with the preceding year, suggesting there were 30 planned for 2023.5 Serial production of the Mi-28NM started in 2020 and in that year a contract was signed for 98 units under the state armament programme to 2027.6 Shoigu also said in July 2023 that production of the Mi-28NM had increased three-fold from 2022, which in the view of a leading specialist on Russian aviation, Piotr Butowski, probably meant a target of up to 50 in 2023.7 One analyst concluded after a detailed study of the evidence that the armed forces received a total of 110 helicopters in 2022 against a plan for the year of 71, and actual deliveries of 48 in 2021, with a possible total of up to 125 units supplied in 2023.8

The evidence for the number of drones built is not easy to interpret as it depends on the type and scale of UAV that is being counted. There is no doubt that the number produced has increased sharply since 2020 when less than 1,000 were made. It appears that in the year 2022 the number increased to only a modest extent but then surged in 2023, reaching more than 20,000.9 This total almost certainly excludes the small first-person-view (FPV) type drones, now in large-scale use at the frontline on both sides and being assembled at quite a few locations in Russia, with components mainly imported from China. The two main types of Russian UAV that have had an impact on the battlefield are the Orlan family of reconnaissance drones, developed and built by the Special Technology Centre in St Petersburg, and the Lancet loitering system of Zala Aero, part of the Kalashnikov Concern. Both companies have been active in acquiring a range of Western components for their UAVs. The widely used Orlan-10, for example, has a small petrol engine built by Saito, a Japanese company.10

The production of new naval equipment has not been a priority during the war apart from the building of nuclear submarines, the output of which is shown in Table 1. The handover of new naval vessels has been somewhat erratic, with the tendency to bunch in certain years. This has been partly because the building of surface ships in recent years has been disrupted to some extent by problems of engine supply. The building of Project 11356 frigates was abandoned when Ukraine stopped supplying power units. Ukrainian engines were also to be fitted to Project 22350 frigates, but in this case Russia managed to replace the engine and reduction gearing, permitting the hand over in 2023 of the Admiral Golovko.11 Project 21631 small missile ships originally had German engines but the supply ended in 2014. It was first decided that a Chinese engine would be used instead, but it was not suited for a naval ship, resulting in long delays before a domestically built alternative was developed.12 Similar problems appeared for Project 22800 Karakurt-class small missile ships, and at one point it appeared that they could end up with Chinese power units. However, those proved not to be adequate and a Russian replacement was found but not before there were delays in completing ships under construction.13 Project 22160 patrol boats were originally designed to have German MAN diesel engines and the first boat handed over in 2018 was fitted with one, but later ones, with some delay, had new Russian-built power units.14

Turning to the production of weapons and munitions for the ground forces, the availability of reliable quantitative evidence is more problematic, as it is often fragmentary, lacking definition and with growth figures between periods without adequate specification of dates. Table 3 summarises the available evidence.

The data on the output of tanks has not been easy to assess. There are three categories: newly built ones, in recent times the T-90 and a few T-14 Armata; modernised older tanks, T-72 and T-80; and old tanks removed from storage, the T-54, which have undergone what the Russian MoD calls ‘capital repair’. Since the start of the war in 2022, any total given by the MoD is an aggregate figure covering all three. Main tank producer Uralvagonzavod (UVZ) builds the T-90 and Armata, plus the modernised T-72, while modernised T-80 tanks are built by Omsktransmash, an affiliate of the UVZ holding company. Work on the renovation of older tanks is undertaken by Russian tank repair works, the output of which is hardly ever revealed.15 The Russian MoD said that in 2021, its ground forces were to receive more than 240 new and modernised T-72B3M, T-80BVM and T-90M Proryv tanks.16 The number of new T-90M was reported to be set at 70 units, with the remaining 170 tanks being modernised.17 This provides a base for assessing more recent data. In 2023, a total of 1,530 new, modernised and refurbished tanks were produced, which, according to the MoD, is a 3.6 times increase from the preceding year. This suggests an output of about 425 units in 2022, 1.8 times the 240 of 2021. Interestingly, in March 2023, deputy chair of the Russian Security Council, Dmitry Medvedev, declared that 1,500 tanks would be made in that year,18 followed a few days later by Putin, who said over 1,600 new and modernised tanks would be produced.19 Observers were quick to note that the total must include older tanks withdrawn from reserves, but were puzzled as to how many new tanks would be built. Military specialist Roman Skomorokhov, in a review of potential industrial manufacturers of tanks, concluded that in the short term, UVZ was the only manufacturer able to build new tanks, with a possible output of 500–600 a year at best.20 It is unlikely that UVZ has managed to build such a large number of tanks, especially when part of its production shop for tanks is being used to build small volumes of complex Armata systems. According to one anonymous source within Rostekh, the capacity of UVZ in October 2022 was 200–250 tanks.21 The work of Omsktransmash building modernised T-80s must be taken into account as well. In 2017, the factory received a contract to modernise 62 units of T-80BV to T-80BVM level and delivered 31 in 2018 and another 31 in 2019.22 In August 2020, there was a new contract for the modernisation of more than 50 T-80BVM tanks but no information has been revealed on its completion date or on the scale of additional contracts.23 However, in the autumn of 2023, Aleksandr Potapov, general director of UVZ, to which the Omsktransmash factory belongs, revealed that the MoD had called for the resumption of the serial production of T-80 tanks from scratch, an activity not undertaken since the 1970s.24 It is not known whether that has been implemented. Meanwhile, there have been several reports of the delivery to the front of batches of modernised T-80BVM. This suggests that in 2023, Omsktransmash and UVZ may have produced around 350 new and modernised tanks out of the total output of 1,530, meaning around 1,200 old tanks have undergone capital repair. This accords well with an IISS estimate of 1,180–1,280 units based on it monitoring the work of storage bases in Russia using commercial overhead imagery.25 As for the new T-14 Armata, Aleksei Krivoruchko, MoD deputy defence minister, said in August 2021 that the army would get 20 of them by the end of the year, with serial production set to start in 2022.26 There were reports in 2023 that it had been sent to the front to see action but there was little visible evidence to support this.27 There was speculation that it was found too complex and costly to risk using in real combat conditions and this was confirmed in early 2024 by the general-director of Rostekh, Sergei Chemezov, who said that it was not being used in the ‘special military operation’ zone because of its high cost and noted that it was cheaper for the army to buy T-90 tanks.28 Not surprisingly, this generated some scathing press comment about Russia’s preference for costly ‘parades’ and ‘white elephant’ tanks of no use in combat.29

There are similar difficulties in assessing the output of armoured vehicles. The term usually covers infantry fighting vehicles (BMP) and armoured personnel carriers (BTR). However, sometimes it is extended to include armoured vehicles of the airborne forces like the BMD-4M and older Soviet systems such as the MT-LB. Many of these vehicles have been accumulated in the reserve stores of the MoD. Before the war, the annual output of armoured vehicles appears to have been modest, but it was stepped up quite rapidly in the second half of 2022 and more intensively in 2023, when, according to Shoigu, a total of 2,518 units of new, modernised and repaired machines was acquired. The new ones will have been BMP-3s built by the Kurganmashzavod company, which also produces modernised BMP-2 and now batches of repaired BMP-3. From the late summer of 2022, the factory has been working a six-day week in 12-hour shifts. It claimed that in the first half of 2023, it produced 95% of the total armoured vehicle output achieved in 2022 and planned to increase output by another 30% in the second half of 2023.30 New BTR-82A armoured personnel carriers are produced by the Arzamas Machine-building Factory of the Voennaya-Promyshlennaya Kompaniya (also known as Military Industrial Company). The earlier model, the BTR-80, is modernised by a repair factory to become the BTR-82AM. In 2020, the MoD ordered a total of at least 460 of both types, including 130 new BTR-82A. In addition, it planned to repair and refurbish 330 old BTR-80 units from reserves.31 In 2021, another order was made for more than 300 BTR-82A and BTR-82AM.32 In late 2021, it was announced that in spring 2022, state testing was to begin for the Bumerang armoured transporter first seen in 2015. It is not known if this happened, but in March 2023, there were sightings of a few Bumerang being transported to near the warzone. However, there were no reports of its use in combat and it may well be that this new system, like the Armata tank, was considered to be too complex and costly to be put into service in the war.33

Unfortunately, detailed information on the volume of production of artillery systems is not available. Occasionally, the MoD does report a total figure for missile systems and artillery (raketnye kompleksy i artilleriya). In 2018, a total of more than 120 units was reported, which included Kornet and Khrizantema-SP anti-tanks systems, Msta-SM howitzers, Iskander-M, and Kalibr and Oniks cruise missiles. In 2020, the number increased to 551 units and in 2023, showed a very significant increase to more than 4,250 units.34 There are large stocks of old artillery systems so this total probably includes many that were restored for use during the year. The production of artillery is undertaken by several enterprises, with the largest producers consisting of: Perm Motovilikhinskiye Zavody, making a range of systems including 152-mm howitzers Msta-B and D-20, and 120-mm self-propelled systems Nona-S, Nona-SVK, Vena and the 240-mm Tyul’pan; and Volgograd Titan-Barrikady, making launch systems for the Iskander-M and the Bereg and Bastion shore naval artillery complexes.35 In addition, there is the Ekaterinburg Factory No. 9 imeni Kalinina, under Rostekh, producing barrel artillery systems, including the Soviet-era towed D-30A howitzer and guns for T-72 and T-90 tanks; Uraltransmash making the Msta-S 152-mm self-propelled howitzer widely used in the war; and UVZ making the 152-mm self-propelled Malva, developed by the Burevestnik Central Scientific Research Institute.36

A final category of systems produced for the armed forces is munitions and missiles, sometimes summarised in Russian sources as means of destruction (sredstva porazheniya). This includes explosives, cartridges for small arms, artillery shells of various calibres, bombs, mines, missiles for multiple rocket launchers (MLRS), anti-tank systems, air defence systems and operational systems such as the Iskander-M. Given the wide range of products made by different branches of the defence industry, assembling data is extremely difficult, but munitions are clearly of such importance for Russia’s war effort that the topic merits treatment in some detail. To begin, it is probably easiest to start with the branch usually termed in Russian as munitions and special chemicals (boepripasy i spetskhimiya), which produces cartridges, shells, explosives, fuel for missiles and other chemicals. The munitions industry in Russia has been problematic since 1992. During the 1990s and early 2000s, there was little investment in the sector, and production volumes shrank rapidly, resulting in some enterprises closing down. Production equipment aged steadily, and many experienced personnel left the sector. A fundamental problem has been the vast spare capacities maintained in order to rapidly expand production in the event of a war. This appears to have been the case until recent times. According to the specialist on defence matters, Viktor Murakhovskii, more than 70% of capacity was for mobilisation. If state support for this was inadequate, enterprises would become loss making.37 For this reason, quite a few munitions plants were made so-called federal ‘treasury’ (kazennyi) enterprises, with guaranteed budget support regardless of their economic performance, thereby enabling them to keep reserve capacities. Many munitions enterprises are under the state corporation Rostekh and its holding Tekhnologiya Mashinostroeniya (Tekhmash), with its management company Tekhnodinamika. In late 2021, Rostekh had more than 30 enterprises and institutes engaged in the development and production of a wide range of munitions.38 In late 2022 and early 2023, there was mounting evidence of official concern that the domestic munitions industry was not adequately meeting the demand of the armed forces engaged in the war. Then Minister of Trade and Industry and Deputy Prime Minister Denis Manturov acknowledged that for a long time the munitions branch of the defence industry had been producing in limited quantities simply to top up stocks. He claimed, however, that in 2022, the volume of output of some munitions had increased from three to 10 times but more needed to be done.39 This prompted a number of military journalists to openly discuss the fact that very high rates of use of some munitions, notably those for artillery systems, had run down stocks necessitating prompt action to maintain supplies.40 At the end of December 2022, there was some decisive action to bring order to the munitions industry. A presidential edict was issued for 14 of the most prominent companies of the branch, including several treasury enterprises, to be transferred to the Rostekh state corporation for conversion into joint stock companies with 100% federal ownership. This was followed by a government order for its implementation. The list included the Kazan, Perm and Tambov (Kotovsk) powder factories and leading munitions producers such as the Kazan factory of precision machine building, Samara Kommunar works, Dzerzhinsk Zavod imeni Sverdlova and Avangard of Sterlitamak, Bashkortostan.41 The aim was clearly to improve their management and modernise them as quickly as possible, drawing on the considerable experience of Rostekh in turning round failing enterprises. Whether this move will enhance the industry’s ability to meet the urgent needs of the war remains to be seen. In May 2023, it was reported that Tekhmash had more than 50 enterprises, suggesting a quite sizeable expansion to meet increased wartime needs.42 From about September 2022, there were reports of factories switching to multi-shift work and hiring additional workers including at the Perm powder works. It is probably significant that soon after, it was also reported that the military production division (the Special Design Bureau (SKB)) of the nearby Motovilikhinskie Zavody, which builds MLRS, was doing the same.43 A major concern has been the production of large-calibre artillery shells, in particular 152 and 122mm shells for artillery systems, 125 and 115mm for tank guns and 120 and 82mm for mortars. The production of artillery shells involves division of labour, with some enterprises producing explosives or shell casings and others doing both. Leading producers include Dzerzhinsk Zavod imeni Ya M Sverdlova, with a branch in Biisk united with Biissk Oleumnyi Zavod. The factory is a basic producer of large calibre fragmentation munitions and also a leading producer of HMX (octogen) and hexogen. The Kopeisk Zavod Plastmass builds munitions as its basic activity, while the casings for them are made by Kirov Zavod Sel’mash, a large multi-product enterprise of Tekhnodinamika. Some enterprises involved in the production of large-calibre shells underwent enlargement in recent years. The Verkhneturinskii Mekhanicheskii Zavod (VTMZ) of Tekhnodinamika built a new shop to make artillery shell casings for field and tank artillery. It was estimated that it would result in a 150% increase in production for the state defence order after the shops were in full operation by the end of 2021.44 Kopeisk Zavod Plastmass created a new automated shop for the assembly of 100 to 152mm munitions for tank, field and ship guns before the war started, which was designed to secure a 150% increase in output. The plan was for the shop to be completed and put into action by 2023.45 Both these cases raise an interesting question: did Rostekh receive signals prior to the war that some expansion of capacities was desirable? Another type in high demand has been missiles for MLRS. The main developer and manufacturer of MLRS has long been the Tula NPO Splav imeni A N Ganicheva, which also produces missiles for them. Its products include the Grad, Uragan and Smerch systems and modified variants, the Tornado-G and Tornado-S. In July 2020, the CEO of Rostekh opened a new shop at Splav for the production of munitions for MLRS, but reports did not indicate its capacity.46 In early 2024, the factory was visited by Defence Minister Shoigu and it was reported that new capacity introduced into service in 2023 had made possible a fourfold increase in the production of munitions for MLRS.47 Another class of munitions is those for the mobile ballistic missile system Iskander-M (9K720). This operational–tactical system, which has a range of warheads including a nuclear option, was developed by the Kolomna Scientific Production Corporation Design Bureau of Machine Building. Missiles for it are developed by the Ekaterinburg OKB Novator and produced by the Votkinsk Machine-Building Factory. Sources did not indicate the volume of production of the Kalibr sea-launched cruise missile, also developed by OKB Novator. Russia has a distinct class of equipment for the Radiation, Chemical and Biological Defence Troops (RChBD). In 2023, this amounted to 150 units of equipment, including the TOS-1A Solntsepek heavy thermobaric rocket launch system produced by Omsktransmash.48 When visiting the factory in April 2024, Shoigu was informed that the volume produced in 2023 had grown by 2.5 times by increasing capacity and round-the-clock work.49 According to Shoigu speaking in February 2024, the volume of production of munitions for it has been increased by 12 times.50 The producer has not been identified. In April 2024, a new longer-range system, the TOS-3 Drakon, was reported to be on the eve of final testing prior to serial production.51 Another class of munitions often used in Ukraine are bombs launched from aircraft. Data is lacking on the volume produced but developments are sometimes discussed in the media, including the work of certain enterprises, although their identity is not always revealed. In March 2024, Shoigu visited enterprises in Nizhegorodsk Oblast producing bombs and shells for artillery and tanks. One factory, clearly distinguishable as Dzerzhinsk Zavod imeni Y M Sverdlova, a very large producer of shells and bombs, was producing the heavy aviation bomb FAB-500 and reported significant increases in the scale of output, a doubling of the FAB-1500 output, and, in February 2024, the start of ‘mass production’ of the three-tonne high-explosive FAB-3000 which dates back to Soviet times and is intended for destroying highly protected targets, both industrial and military.52 The Dzerzhinsk factory is also bringing back into use from reserves the most powerful of all Soviet/Russian conventional artillery shells, the Tyul’pan 240-mm mortar, in use in the war against very heavily fortified structures.53 It was claimed in March 2024 that the enterprise, which in 2023 was taken into Rostekh, had over the past year achieved a fivefold increase in the volume of production of artillery shells and aviation bombs by bringing conserved capacities back into use and installing new equipment.54

Finally, a brief look is taken at the output of civil and dual-use goods of importance to the economy during the war, some manufactured by companies of the defence industry. Table 4 presents evidence of the changing output of some important civilian goods from 2019–23. The table shows the impact of sanctions in 2022 and 2023 but also perhaps in some cases the fact that priority for military production has caused diminished focus on civil goods or, in the case of rail freight wagons built by UVZ, reduced output because of the transfer of some capacity to basic military goods, tanks and armoured vehicles. The building of civilian passenger aircraft has been very seriously affected by sanctions which have deprived almost all aircraft that were built earlier of their power units. To some extent, the same applies to helicopter and ship production. Sanctions probably also account for the reduced output of trucks, excavators and also integrated circuits, the production of which is to some extent dependent on imported materials and gases. But the machine tool industry that was already reviving after the sanctions imposed in 2014 has shown new growth, with increased output of both metal-cutting and metal-forming machines in both 2022 and 2023. Russia remains dependent to a significant extent on imported machine tools, but now these are supplied mainly by Chinese companies rather than those of Europe, Japan, South Korea, Taiwan or the US. In 2021, 69% of imported metal-cutting and - forming machine tools came from ‘unfriendly’ countries, which dropped to 39% in 2022, while China’s share increased from 22% to 46%.55

The data assembled raises an interesting question: how has it been possible for the Russian defence industry to increase the output of some weapons and munitions to a significant extent in a relatively brief period of time? This is a topic that requires additional research but a number of paths can be identified. One factor has clearly been the policy turn in the autumn of 2022 to change the institutions responsible for leading and managing the work of the defence industry. Before that, fulfilling the state defence order for new weapons and the modernisation and repair of older systems had been the responsibility of the Ministry of Industry and Trade, working with Rostekh, Rosatom, Roskosmos and other corporate bodies involved in military work, and with the MoD as the principal customer, actively monitoring the implementation of contracts. Overall responsibility for policy was in the hands of the Military-Industrial Commission (VPK) with the president of Russia as its chair. Since the war, there have been significant changes. In 2022, there was not a single VPK meeting with Putin as chair; indeed, he has not chaired a VPK meeting since 2017. Instead, Putin had three meetings with representatives of the defence industry, the first in September 2022 with a number of enterprise leaders, the second in December of the same year, and the third in May 2024 with some enterprise leaders and new ministers.56 The focus of the VPK has always been the state defence order for weapons, not other aspects of supplies to the armed forces, such as uniforms, food, fuel, lubricants and medicines. With the adoption of partial mobilisation, it quickly became clear that the rapid build up of deliveries of these non-weapon items presented a serious challenge. This almost certainly accounts for the decision by Putin in October 2022 to create a new structure to ensure that all necessary supplies for the special military operation were produced and delivered. A Coordination Council of the government was formed with the aim of meeting needs appearing in the pursuit of the war, including the delivery and repair of armaments, uniforms, medical–sanitary provision, repair and reconstruction work and logistics. The council is chaired by the prime minister and its participants are representatives of all the main ‘power’ ministries – MoD, Ministry of Internal Affairs, Ministry of Emergency Situations, Rosgvard, Federal Security Service, Foreign Intelligence Service, the Main Directorate of Special Programmes (responsible for ensuring the survival of the government in the event of war by creating and managing secure bunkers, so-called ‘special objects’), and some other federal ministries.57 The Coordination Council met six times in 2022, nine times in 2023 and once in the first two months of 2024. It discussed a wide range of issues relating to the production and delivery of equipment to the forces engaged in the war with the participation of the relevant government agencies and the leaders of departments of the government’s own central office.58 It appears to be a body that monitors production and deliveries and decides on prompt action if problems are identified. Another official monitoring the work of the defence industry and the implementation of the state defence order is Dmitrii Medvedev, deputy chairman of the Security Council and first deputy chair of the VPK. He was appointed to the post by Putin in December 2022 with the job of leading a working group to monitor the production and delivery of armaments to the armed forces. There have been visits by Medvedev and sometimes the working group to quite a few defence enterprises, including UVZ and Omsktransmash, to examine tank building. He has also visited producers of munitions and missile and in March 2024, visited Tambovskii Porokhovoi Zavod (Tambov Gunpowder Plant), a major producer of explosives, where the working group discussed investment plans.59 Given that Medvedev is independent of the government and the MoD, it is possible that Putin felt the need for another set of eyes and ears to check on both and report directly to himself. Not surprisingly, the monitoring of arms production is also a concern of the MoD and its minister, Shoigu (replaced in mid-May 2024), who has quite often visited companies considered vital to the war and national security more generally. In early 2024, he visited the Ekaterinburg Uraltransmash works for the production of artillery systems, where he sharply criticised the chief designer for delays in bringing new models into production.60 He also visited the Dubna Raduga design bureau of the Tactical Missile Corporation (KTRV) responsible for a range of air-launched cruise missiles. There, he called for longer-range missiles and increased production.61 In March 2024, it was clear Russia was concerned about the production of munitions. As noted above, Shoigu visited the Dzerzhinsk Zavod imeni Sverdlova and shortly after, as reported by the MoD, the ‘defence enterprises in Altai krai’.62 As is often the case, the local media were more forthcoming. They reported that in the same month, he also visited Biisk Oleumnyi Zavod, which produces explosives and is affiliated to the Dzherzhinsk works, and a major producer of munitions, Biisk Sibpribormash, a large volume supplier of a range of shells, bombs, cartridges and missiles for MLRS. At the former, he made clear his dissatisfaction with its rate of building new production facilities to double its capacity, and at the latter, he was informed that the volume of output had increased 3.5 times from 2022, about 300 new machine tools had been installed and an additional 1,600 workers taken on.63 In 2023, his visits included the Arsen’ev Progress works to check on the production of Ka-52M combat helicopters.64 While there has been some stability in the staffing of leading posts in the defence industry, the same cannot be said of the MoD in relation to logistics and securing the delivery of equipment and munitions to the front. Since the war started in February 2022, there have been four different deputy ministers for logistics, or ‘material and technical supply’ as it is known in Russia. First there was Dmitrii Bulgakov, in post for 12 years until dismissed in September 2022. He was replaced by Mikhail Mizintsev, the chief of the National Management Centre for Defence, but he resigned in April 2023 and was replaced by Aleksei Kuz’mentsev, appointed from the troops of the National Guard but with a background in logistics. He was in post for less than a year and in March 2024 was replaced by Andrei Bulygin, whose MoD career from 2011 was in logistics.65 When Russia decided to boost the output of certain weapons and munitions, some companies rapidly introduced multi-shift work and under the mobilisation conditions imposed on the defence sector, workers had little choice but to adapt to more demanding working regimes, often working weekends or during public holidays. At the end of 2022, workers in large enterprises of the defence industry of the Sverdlovsk region were working a six-day work week, of up to 12 hours per day, compensated by increased pay.66 This policy option is advantageous in that it probably required modest changes in the production equipment installed. It also appears that in quite a few cases, output was also increased by bringing into use spare capacities and making more intensive use of production shops. In addition, some civilian enterprises were engaged in supplying components to defence companies: according to Manturov, 850 companies are now participating in this.67 A path not often discussed openly but possibly very important in some branches of the defence industry is the bringing into operation of reserve mobilisation capacities. As this author has discussed in detail in a 2016 publication,68 Russia inherited from the Soviet Union a very elaborate system of mobilisation preparation in the event of war with the creation and maintenance of large reserve capacities at many industrial enterprises, stockpiles of materials and components and state mobilisation reserves of weapons, munitions, production equipment, fuel and other goods considered vital in a war or other national emergency. The system underwent reform in the 1990s and 2000s, to some extent reducing its scale and focusing it on a more limited set of defence-related companies considered essential to the country’s military capability. It has remained shrouded in secrecy. The evidence suggests that the enterprises most likely to retain mobilisation capacities were those producing munitions, missiles, ground forces equipment and certain types of aircraft and air defence systems. During the war there have been occasional explicit references to bringing mobilisation capacities into operation. In December 2022, at a meeting of the Coordination Council, Premier Mikhail Mishustin noted that during the previous two months, the government had adopted a number of normative acts for the introduction of ‘special measures’ in the economy for securing a steady flow of deliveries relating to the special military operation. They had opened up the possibility for the lead executors of the state defence order to use the entire production and technological potential, ‘including the partial or full de-conservation of mobilisation capacities and objects’.69 Another path of increasing the volume of deliveries to the armed forces is probably the release of so-called ‘emergency reserves’ (neprikosnovennykh zapasov). These reserves, part of the general mobilisation system, include many goods considered vital in a war or emergency, including foodstuffs, medicines, fuel and materials, but also materiel and systems of armament for the armed forces. The nature and volume of these reserves, managed by the Federal Agency for State Reserves, has always been a matter of extremely strict secrecy and those relating to the armed forces are rarely discussed openly.70 An exception was in 2022 when an issue of the MoD journal Vooruzhenie i ekonomika published an article on the role of the reserves, making it clear that they include stocks of weapons and other military equipment created in peacetime in order to secure the mobilisation and strategic deployment of the armed forces, especially during the early period of a war.71 It is stressed that older weapons, though often less effective than new ones, can still have military value, so keeping them in reserve, plus having munitions for them, remains important. The authors suggested that the funding of emergency reserves of armament and other material means should be at least one third of the amount of funding devoted to procurement under the state defence order.72 Interestingly, a January 2024 Ukrainian intelligence assessment of Russian missile and artillery ammunition production noted that ‘they are now trying to maintain a certain strategic reserve. As a rule this is about 30%’.73 After initial serious setbacks when the expected rapid success of the invasion of Ukraine failed to materialise, and once the Ukrainian counter-offensive also did not bring decisive results, Russia proved to be resourceful in adapting to a different form of warfare, attritional rather than a war of manoeuvre. Indeed, as has been argued by Alex Vershinin, Russia has probably adapted to a protracted war of attrition more successfully than Ukraine and its NATO allies.74 The Soviet Union produced, in the main, relatively simple, low-cost but rugged equipment in large quantities and maintained substantial stocks in the event of war. The Soviet leadership, civil and military, was well aware that Western countries, especially the US, produced more costly, higher technology conventional weapons. This thinking lived on in post-communist Russia and stocks were retained though on a smaller scale. The production of new weapons for a long time was focused on upgrades of Soviet systems but from about 2010, attempts to develop some new, higher technology systems began to increase and the country’s political, military and industrial leaders clearly took pride in these very expensive new developments as symbols of Russia’s regained status as a great power. At the same time, as discussed above, the basic elements of the Soviet system of mobilisation to prepare for war were also kept intact though reduced in scale. In Vershinin’s words, ‘Wars of attrition are won by economies enabling mass mobilisation of militaries via their industrial sectors. Armies expand rapidly during such a conflict, requiring massive quantities of armoured vehicles, drones, electronic products, and other combat equipment. Because high-end weaponry is very complex to manufacture and consumes vast resources, a high-low mixture of forces and weapons is imperative in order to win’.75 In May 2024, a new Russia government was approved, with significant changes in personnel concerned with defence and arms production. Sergei Shoigu was appointed secretary of the Security Council and Putin’s deputy leader of the Military-Industrial Commission, replaced as defence minister by Andrei Belousov, previously first deputy prime minister and a career economist with no direct experience of the military. He was replaced as first deputy premier by Denis Manturov, previously industry minister overseeing the defence industry; this position is now occupied by Anton Alikhanov, previously governor of the Kaliningrad Oblast. Putin gains two assistants in the Presidential Administration responsible for oversight of the defence industry: Aleksey Dyumin, previously governor of the Tula region, where the major concentration of defence industry companies is; and Nikolai Patrushev, formerly Security Council secretary, who will monitor the shipbuilding industry.76 Dyumin has been appointed to both the Coordination Council and the VPK.77 These changes indicate a determination to maintain the war effort, spend the military budget in a cost-effective manner, and ensure that needed weapons and munitions are produced and delivered to the forces in an effective manner. This is a government for a protracted war of attrition.

Since the start of the war, Western perceptions of Russia’s capabilities have undergone gradual change. At first there was much talk of military incompetence, an economy likely to falter and perhaps eventually collapse as sanctions mounted, and armed forces rapidly losing equipment and facing a munitions famine. But as Ukraine’s counter-offensive failed to make much progress and Russia’s forces dug in for a long war, attitudes began to change, and this was accompanied by an awareness that Russia’s economy was performing with greater vigour than expected, notwithstanding sanctions, achieving 3.6% growth in 2023.78 By the second half of that year, it also became apparent that weapons and munitions were still being supplied to Russian troops at the front in increasing quantity, a reality confirmed by the analysis of this article. There should be no surprise that Russia has come through the war as it has. After all, as Clifford Gaddy and Barry Ickes wrote in June 2014 during the first round of Russian combat with Ukraine, Russia is resilient: ‘Much is made of the alleged weakness of today’s Russian economy. This notion that the Russian economy is somehow fragile is the backbone of the sanctions argument. But inefficiency – which definitely does characterize Russia’s economy – is not the same as fragility. The very features of the Russian economy that account for its inefficiency and lack of competitiveness in the global economy are also its strengths in term of robustness to shocks’. Rather than considering the country as ‘a cockroach of an economy’, they conclude, ‘perhaps a more appropriate metaphor is Russia’s own Kalashnikov automatic rifle – low-tech and cheap but almost indestructible’.79 But there is an additional dimension to the Kalashnikov economy that merits serious attention: it is an economy that can be quickly mobilised to increase military production if the country’s leadership decides that is what is required. This is precisely what happened when Putin and the military leadership realised that there would not be a rapid end to the fighting. The defence industry and its main suppliers in other branches of the economy were very quickly switched to a wartime regime, which in Russian conditions was relatively easy, as most of the companies are state-owned and can readily be ordered to increase production, adopt multi-shift regimes of work, and enlarge capacities with budget funding guaranteed. The administrative structures for managing military production were adapted to the new conditions and the implementation of orders was very closely monitored. If inputs were found to be in short supply, reserve stocks were drawn down and imports secured by one means or another. However, contrary to a view often expressed by observers, Russia does not have a ‘war economy’. In the words of Vladimir Inozemtsev, it has an economy ‘adapted to war’ – the state-controlled defence sector operates within the framework of a functioning market economy.80 The government and the military focused efforts on military hardware considered essential to the conduct of the war, with lower priority for equipment required by the forces but not seen as being in urgent demand. The only real exception appears to have been the ongoing modernisation of the country’s strategic nuclear capability. In principle, there would seem to be no reason why this mobilised defence effort cannot be maintained for quite a long period of time. Budget allocations to the military have sharply increased in 2024, a large part of this additional funding probably going to the defence industry and investment in additional capacities identified as essential. While provisional intentions for 2025 and beyond suggest reduced funding for the military, as argued elsewhere, this could easily change in the federal budget for 2025–27, the drafting of which has started in July 2024.81 It is not without irony that advanced Western economies may now find the need to look closely at Russia to understand how to adapt to an age when a style of warfare typified by attrition may become more common than previously expected.

1 See, for example, Julian Cooper, Russia’s State Armament Programme to 2020: A Quantitative Assessment of Implementation 2011-2015 (Kista: Swedish Defence Research Agency, 2016),

Table 1: Ministry of Defence Annual Reports of Intentions and Implementation, 2019–24 (units)

P: planned procurement A: actual procurement

1. Planned and actual procurement data for 2019 includes new aircraft only; from 2020, explicit from 2021, implementation includes both new and modernised aircraft.

2. Data from 2019–21 includes tanks and armoured vehicles, but for 2022, planned procurement adds ‘artillery arms’. It is not known whether this also applies for 2023.

3. For 2020, the source gives three divisions of Yars plus one Avangard, but the number of missiles in a division can vary. The MilitaryRussia.ru blog gives 11 divisions (9 Yars and 2 Avangard). For 2021, the source gives two divisions of Yars plus one Avangard, while MilitaryRussia.ru gives 11 divisions (9 Yars and 2 Avangard). See MilitaryRussia.ru, ‘RS-24 Yars / Topol-MR - SS-X-29 / SS-29 / SS-27 mod.2 SICKLE-B’, last updated 10 June 2024,

Table 2: Production of Combat Aircraft and Trainers, 2019–23 (units)

Sources: For data from 2019 to 2022, see BMPD, ‘Postavki boevykh samoletov v Vooruzhennykh Sily Rossii v 2022 godu’ [‘Delivery of Combat Aircraft to Armed Forces of Russia in 2022’], 11 January 2023,

Table 3: Production of Equipment for the Ground Forces, 2019–24 (units)

* New, modernised and repaired.

** Author’s estimate.

1. Artillery systems, self-propelled howitzers, MLRS, means of artillery reconnaissance and counter-battery struggle. These appear to include new, modernised and repaired arms.

2. All types, including means of remote mining and robot demining systems.

3. Small arms, grenade launchers, portable anti-tank and air defence systems.

4. Also know in Russian as sredstva porazheniya (means of destruction).

5. Includes Tsirkon, Kalibr and Uran cruise missiles and anti-ship missiles.

6. Grad and Uragan MLRS.

Sources: Tanks and armoured vehicles: For 2019 data, MoD RF, ‘Itogi deyatel’nosti Voruzhennykh Sil RF v 2019 godu’ [‘Results of Activity of Armed Forces of RF in 2019’],

Table 4: Output of Selected Civilian Goods in Unit Terms, 2019–23 (units)

Sources: For data from 2019–22 except civilian ships, see Rosstat, ‘Proizvodstvo osnovnykh vidov produktsii v natural’nom vyrazhenii (godovoi dannye) so 2017 god - v sootvestvii OKPD2’ [‘Production of Main Types of Products in Physical Terms (Annual Data Since 2017 – in Accordance With OKPD2)]’, 11 October 2023,

First published in :

Julian Cooper is Emeritus Professor at the Centrefor Russian, Eurasian and European Studies,University of Birmingham and Associate SeniorFellow at the Stockholm Peace Research Institute.He is the author of numerous publications on theRussian economy, military spending, the defenceindustry and arms exports.

Unlock articles by signing up or logging in.

Become a member for unrestricted reading!