Energy & Economics

Bridges or bargains? Examining India and China’s infrastructure expansion in South Asia

Image Source : Presidential Press and Information Office Kremlin

Subscribe to our weekly newsletters for free

If you want to subscribe to World & New World Newsletter, please enter

your e-mail

Energy & Economics

Image Source : Presidential Press and Information Office Kremlin

First Published in: May.11,2025

May.26, 2025

India races to match China’s growing influence in South Asia

In recent decades, South Asian nations have emerged as pivotal destination points for major infrastructure investments from both India and China. Stretching from the shores of the Indian Ocean to the Himalayan foothills, the growing footprint of these two regional powers is reshaping the landscape of development. While many projects share similar outcomes, they have also raised concerns about their impact on local economies and everyday life.

China’s Belt and Road Initiative: Initiation and controversy

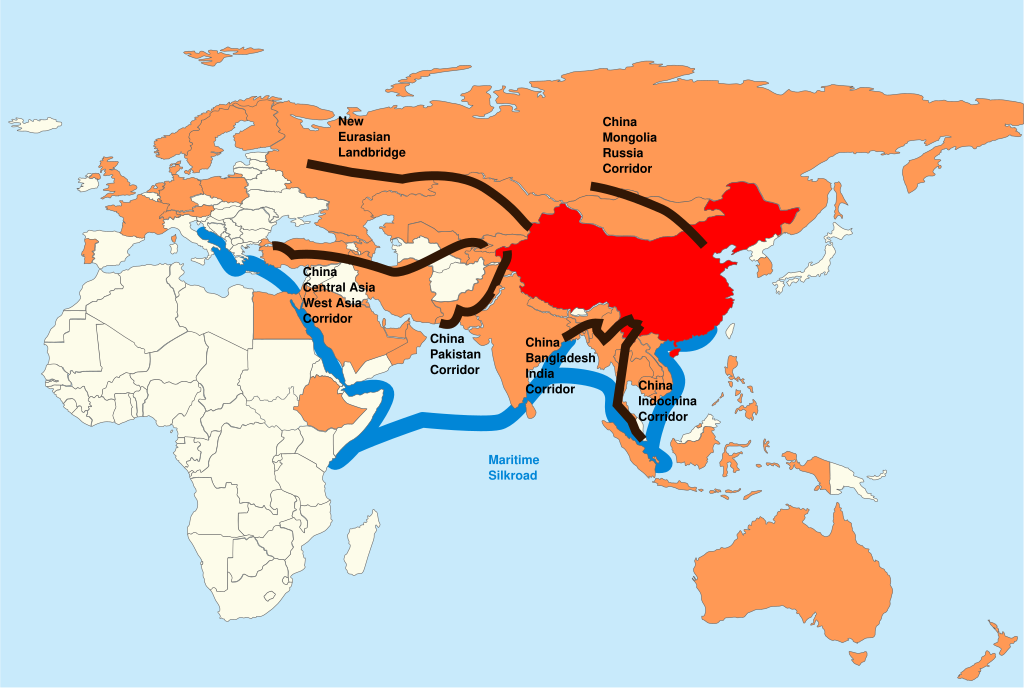

Credits: Proposed Belt and Road Initiative. Illustrated in 2017 by Lommes, via Wikimedia Commons. CC BY-SA 4.0.

First initiated in 2013, China’s Belt and Road Initiative (BRI) is considered one of the most ambitious international infrastructure endeavours in recent history. Spanning more than 150 nations and involving over USD 1 trillion in investments, the BRI has supported the development of ports, railroads, highways, and energy networks throughout Asia, Africa, and Latin America. As per the Green Finance and Development Center, there has been a revival in BRI financing after the COVID-19 pandemic, largely driven by Chinese policy banks and state-owned companies.

In Sri Lanka, however, the BRI has become a cautionary example. The Hambantota Port, built with loans from the Export-Import Bank of China, failed to generate the expected revenue. In 2017, the Sri Lankan government granted a 99-year lease to China Merchants Port Holdings, raising concerns over sovereignty and economic vulnerability. Critics, particularly in Western media, have pointed to this as evidence of what they describe as China’s “debt-trap diplomacy” — a claim that Chinese officials strongly deny.

However, some scholars argue that the term “debt-trap diplomacy” is misleading. Deborah Brautigam of Johns Hopkins University argues in her 2020 article “A critical look at Chinese ‘debt-trap diplomacy’: the rise of a meme” argued that debt crises in countries such as Sri Lanka are mainly caused by domestic mismanagement, aggressive infrastructure spending, and global economic pressures — rather than coercion by China.

In Bangladesh, foreign initiatives have significantly influenced the country's infrastructure and energy landscape. A key example is the Payra Power Plant, a USD 2.48 billion coal-fired project constructed under the BRI framework with Chinese funding and technical expertise. The plant, operational since 2020, has helped alleviate chronic energy shortages but has been criticized for its environmental footprint and reliance on imported coal. Moreover, concerns have emerged regarding its long-term sustainability and alignment with Bangladesh’s climate commitments under the 2015 Paris Agreement.

Another flagship BRI project is the Dhaka Elevated Expressway, a 20-kilometer-long project linking the capital’s airport to major industrial areas. Executed by the China Major Bridge Engineering Company, the project was structured as a public-private partnership under a 25-year build-own-transfer model. While it is expected to ease traffic congestion and boost logistics efficiency, experts have flagged the lack of competitive bidding and limited transparency in financial arrangements.

In March 2025, during an official visit to China, Bangladesh's Chief Adviser, Muhammad Yunus, successfully secured a pledge of a total of USD 2.1 billion in investments, loans, and grants for Bangladesh, marking a significant step in strengthening bilateral cooperation between the two countries.

In the Maldives, Chinese loans under the BRI supported major housing projects and the Sinamalé Bridge, an important link between Malé and Hulhulé Island. In 2018, reports indicated that the Maldives’ total public debt rose to 72 percent of its GDP, reaching around USD 3.8 billion.

By early 2024, worries have resurfaced as the Maldives’ total debt rose to approximately USD 8.2 billion — 116.5 percent of its GDP in the first quarter, up from 110.4 percent during the same period the previous year. About half of that is external debt, with a big portion owed to China, which has extended loans totalling USD 1.37 billion to the country. The growing debt burden has sparked concerns regarding autonomy and repayment conditions.

However, Maldives President Mohamed Muizzu has described China as “one of the Maldives’ closest allies and development partners.” He has pledged to deepen cooperation under the Belt and Road Initiative (BRI), with a focus on infrastructure development. In January 2025, the China Machinery Engineering Corporation (CMEC) signed a deal with the Maldivian Ministry of Construction, Housing, and Infrastructure to build major infrastructure on Gulhifalhu Island in the Malé Atoll, further expanding China’s footprint in the country.

India’s rise: Neighbourhood First and Act East

India, long seen as a regional power, is increasingly using infrastructure as a tool of foreign diplomacy. However, with the exception of Bhutan, most of India’s South Asian neighbors have joined China’s Belt and Road Initiative (BRI), leading to a significant rise in Chinese investments across the region. Since 2018, China has invested more than USD 150 billion in the economies of Bangladesh, the Maldives, Myanmar, Nepal, and Sri Lanka.

China’s expanding influence has raised concerns in India, and in response, Prime Minister Narendra Modi has strengthened India’s regional outreach through the “Neighbourhood First” policy, aimed at deepening ties between South Asian countries. Complementing this is the “Act East” policy, which focuses on building closer partnerships with Southeast Asia and the broader Asia-Pacific region. Unlike China’s debt-driven mega-projects, India’s approach emphasizes three core principles: transparency, respect for sovereignty, and people-centric development.

India’s infrastructure engagement in Sri Lanka has largely focused on strategic support, including over USD 4 billion in credit lines during the country’s 2022 economic crisis. This assistance covered essential imports such as fuel and food and played a key role in stabilizing the Sri Lankan economy. India has also contributed to energy cooperation, particularly through projects like the Trincomalee Oil Tank Farm and renewable energy initiatives in the north. However, these efforts have drawn criticism regarding transparency and local impact. For instance, a USD 442 million wind energy project awarded to India’s Adani Group without a competitive bidding process sparked concerns over environmental oversight and national sovereignty.

India’s flagship initiative in the Maldives — the USD 500 million Greater Malé Connectivity Project (GMCP) — faced backlash from the “India Out” movement, led by opposition figures in 2022 who claimed the project threatened national sovereignty and enabled a foreign military presence. The protest underscored the fragile balance between development and concerns over external influence.

In an effort to rebuild trust, India launched a USD 110 million sanitation project in 2024, covering 28 Maldivian islands. Construction on the GMCP resumed in February 2025 following diplomatic negotiations. As a goodwill gesture, India introduced visa-free travel for Maldivian citizens in March 2025 to help repair bilateral ties.

The Maitree Super Thermal Power Project, a joint venture between India and Bangladesh with equal stakes, currently provides 1,320 MW to Bangladesh’s grid through its coal-fired facility in Rampal, Khulna, financed under India’s special financing program. A number of projects, such as the Bangladesh-India Friendship Pipeline, have been indefinitely suspended due to the August 2024 change of government in Bangladesh.

On April 4, 2025, Modi met with Muhammad Yunus on the sidelines of the BIMSTEC Summit in Bangkok, holding talks for the first time since 2024. The meeting opened up opportunities for reconciliation and restarting the paused projects.

The road ahead

Despite a history of tension, China and India are key players in South Asia, each with different strategies. China focuses on large-scale BRI projects, while India prioritizes connectivity and capacity building. However, there are areas where India’s and China’s interests overlap, which creates room for cooperation. With South Asia’s infrastructure needs reaching into the trillions, both countries’ initiatives are complementing each other, expanding their influence through trade and investment. While India gains from improved connectivity and trade with its neighbors, it will need to strengthen its economic diplomacy to keep pace with China’s growing influence in today’s geopolitical landscape.

First published in :

Interested in politics, law, and global issues. Colaborator in GlobalVoices.

Unlock articles by signing up or logging in.

Become a member for unrestricted reading!