Energy & Economics

The Economic Effects of Blockage of the Strait of Hormuz

Image Source : Shutterstock

Subscribe to our weekly newsletters for free

If you want to subscribe to World & New World Newsletter, please enter

your e-mail

Energy & Economics

Image Source : Shutterstock

First Published in: Jul.07,2025

Jul.07, 2025

I. Introduction

On 13 June 2025, Israel attacked more than a dozen locations across Iran in the largest assault on the country since the Iran-Iraq war of the 1980s. Beginning on the evening of 13 June, Iran retaliated by launching ballistic missiles and drones at Israel. Conflicts between the two countries have intensified. Amid intensified conflicts between Israel and Iran, the US attacked Iran by bombing three Iranian nuclear sites on 22 June 2025.

In retaliation for these attacks from the US and Israel, Iran may consider closing or blocking the Strait of Hormuz. In fact, Iran’s parliament has reportedly approved of the closing of the Strait of Hormuz on 22 June 2025. However, on 24 June 2025, President Trump announced a ceasefire between Iran and Israel, thereby reducing the possibility of the blockage of the Strait of Hormuz by Iran. Nonetheless, there is still a possibility that conflicts between Iran and Israel continue and then Iran may reconsider the closing of the Strait. This is because the ceasefire is so fragile that the conflicts between Israel and Iran can take place at any time. If the closing of the Strait of Hormuz happens, it will have significant impacts on global economy, in particular on Asian economies, because 84% of the crude oil and condensate and 83% of the liquefied natural gas that moved through the Strait of Hormuz went to Asian markets in 2024. This paper analyzes the impacts of Iran’s closure or blockage of the Strait of Hormuz on the global economy with a focus on Asian economies.

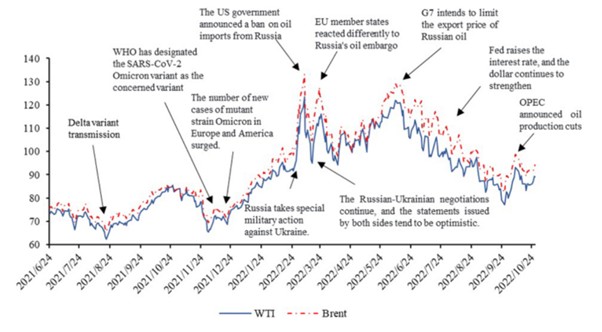

II. Examples of Geopolitics Impacting Energy Prices

Crude oil remains the world's most geopolitically charged commodity. Despite robust supply growth and growing energy transitions, as Figure 1 shows, turmoil in oil-producing regions such as Russian invasion of Ukraine in 2022 continues to ripple through prices.

Figure1: Examples of Geopolitics Impacting Crude Oil Prices

As Figure 2 shows, in June 2025, global oil price surged into the mid‑$70s per barrel amid escalating Iran–Israel tensions and threats to the Strait of Hormuz. In mid‑June 2025, Israeli airstrikes on Iranian nuclear infrastructure led to an immediate 7–11% increase in the Brent crude oil price. The market reacted swiftly to the geopolitical risk, particularly over fears of supply disruption through the Strait of Hormuz. Iranian lawmakers, who threatened to close the Strait of Hormuz, finally approved of closing the Strait on 22 June 2025. While tanker traffic continued, the Brent crude oil price briefly climbed to $79.50 and then dropped to $74.85.

Figure 2: Movements of crude oil (WTI) and Brent oil prices

III. The importance of the Strait of Hormuz

1. Location of the Strait of Hormuz

As Figure 3 shows, the Strait of Hormuz, located between Oman and Iran, connects the Persian Gulf with the Gulf of Oman and the Arabian Sea. The strait is deep enough and wide enough to handle the world's largest crude oil tankers, and it is one of the world's most important oil chokepoints.

Figure 3: Picture of the Strait of Hormuz

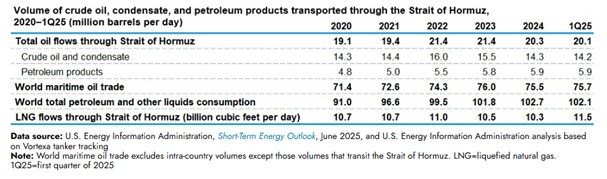

2. Oil flows through the Strait of Hormuz

As Table 1 shows, large volumes of oil flow through the Strait of Hormuz, and very few alternative options exist to move oil out of the strait if it is closed. In 2024, oil flow through the strait averaged 20 million barrels per day (b/d), or the equivalent of about 20% of global petroleum liquids consumption. In the first quarter of 2025, total oil flows through the Strait of Hormuz remained relatively flat compared with 2024.

Table 1: volume of crude oil, condensate, petroleum transported through the Strait of Hormuz

Although we have not seen maritime traffic through the Strait of Hormuz blocked following recent tensions in the region, the price of Brent crude oil (a global benchmark) increased from $69 per barrel (b) on June 12 to $74/b on June 13, 2025. This fact highlights the importance of the Strait to global oil supplies.

Chokepoints are narrow channels along widely used global sea routes that are critical to global energy security. The inability of oil to transit a major chokepoint, even temporarily, can create substantial supply delays and raise shipping costs, potentially increasing world energy prices. Although most chokepoints can be circumvented by using other routes—often adding significantly to transit time—some chokepoints have no practical alternatives. Most volumes that transit the Strait of Hormuz have no alternative means of exiting the region, although there are some pipeline alternatives that can avoid the Strait.

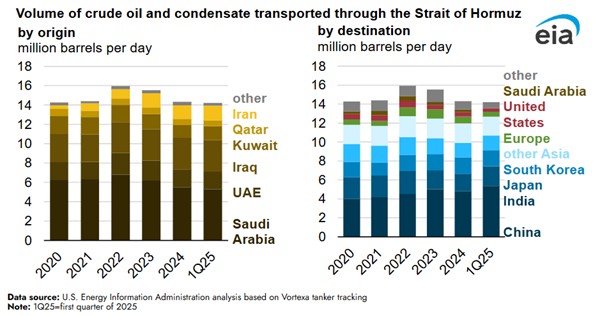

3. Destinations

Flows through the Strait of Hormuz in 2024 and the first quarter of 2025 made up more than one-quarter of total global seaborne oil trade and about one-fifth of global oil and petroleum product consumption. In addition, around one-fifth of global liquefied natural gas trade also transited the Strait of Hormuz in 2024, primarily from Qatar.

Based on tanker tracking data published by Vortexa, Saudi Arabia moves more crude oil and condensate through the Strait of Hormuz than any other country. In 2024, exports of crude and condensate from Saudi Arabia accounted for 38% of total Hormuz crude flows (5.5 million b/d).

As Figure 4 shows, 84% of the crude oil and condensate and 83% of the liquefied natural gas that transported through the Strait of Hormuz went to Asian nations in 2024. China, India, Japan, and South Korea were the top destinations for crude oil moving through the Strait of Hormuz. Asia accounted for a combined 69% of all Hormuz crude oil and condensate flows in 2024. These Asian markets would likely be most affected by supply disruptions at Hormuz.

Figure 4: volume of crude oil and condensate transported through the strait of Hormuz

In 2024, the United States imported about 0.5 million b/d of crude oil and condensate from Persian Gulf countries through the Strait of Hormuz, accounting for about 7% of total U.S. crude oil and condensate imports and 2% of U.S. petroleum liquids consumption. In 2024, U.S. crude oil imports from countries in the Persian Gulf were at the lowest level in nearly 40 years as domestic production and imports from Canada have increased.

IV. Economic Effects of the Blockade of the Strait of Hormuz

Iran has repeatedly threatened to block the Strait of Hormuz, notably during crises with the United States in 2011, 2018 and 2020. So far, these threats have never materialized into a total closure, but the mere mention of them is enough to provoke crude oil price rises.

According to many economists and energy experts, a blockade of the Strait of Hormuz would have significant economic impacts, including sharp increases in oil prices, disruptions to global supply chains, and potential economic sanctions. These effects could ripple through various sectors, affecting businesses, consumers, and global economies alike. The 2021 Suez Canal blockage provides a relevant, if smaller-scale, precedent. The six-day disruption in the Suez Canal caused approximately $9.6 billion per day in global trade delays according to Lloyd's List Intelligence. A Strait of Hormuz closure would likely generate significantly larger economic impacts given the strategic importance of the energy resources involved.

1. Short-term Impacts of the blockade of the Strait of Hormuz

Main short-term effects of the blockage of the Strait of Hormuz are as follows:

· Increased Oil Prices:

A blockage would likely lead to temporary spikes in global oil prices, potentially above $100 per barrel, due to supply disruptions and increased demand.

· Disrupted Supply Chains:

The Strait of Hormuz is a vital transit point for oil and LNG, and any disruption could cause significant delays and disruptions to global supply chains.

· Higher Shipping Costs:

With increased demand and reduced supply, shipping costs, including insurance premiums, would rise.

· Energy Costs:

Higher oil prices would translate to higher energy costs for consumers and businesses, impacting various sectors.

2. Long-term Impacts of the blockade of the Strait of Hormuz

Main long-term effects of the blockage of the Strait of Hormuz are as follows:

· Reduced Oil Production:

Oil exporters might reduce production to conserve resources or diversify export routes, potentially leading to long-term supply shortages.

· Economic Sanctions:

In response to a blockade, major oil buyers might exert pressure on oil-producing states to increase supply, potentially leading to economic sanctions against Iran.

· Diversification of Trade Routes:

Oil-producing states and major oil importers might explore alternative trade routes to reduce reliance on the Strait of Hormuz, potentially shifting trade patterns.

· Geopolitical Instability:

The Strait of Hormuz is a strategic chokepoint, and any disruption could lead to increased geopolitical tensions and conflicts.

3. Overall Economic Consequence

Overall economic effects of the blockage of the Strait of Hormuz are as follows:

· Increased inflation:

Higher energy costs would contribute to inflation in various countries, impacting consumers and businesses.

· Global economic slowdown:

Disruptions to supply chains and increased costs could lead to a slowdown in global economic growth.

· Regional economic instability:

The Strait of Hormuz is a key economic artery for the Middle East, and any disruption could lead to significant economic instability in the region.

V. Analysis of Economic Effects of the Blockade of the Strait of Hormuz

According to several Western banks, a complete closure of the Strait could cause crude Oil prices to soar above $120 to $150 a barrel, or even more if the conflict between Israel and Iran is prolonged.

According to Deutsche Bank, the scenario of a total closure of the Strait, causing an interruption of 21 million barrels a day for two months, could push oil price to over $120 a barrel, or even beyond if global supplies are permanently disrupted.

Analysts from Rabobank, a Dutch multinational banking and financial services company, even mention a spike towards $150 a barrel, recalling that in 2022, after Russia invaded Ukraine, the Brent crude oil price briefly touched $139. But the difference here is major: Persian Gulf oil is geographically concentrated and trapped in a single access point, they note.

TD Securities, a Canadian multinational investment bank, points out that the oil market is currently in a situation of oversupply, but if the Strait of Hormuz are blocked, even temporarily, no production capacity - neither from OPEC nor the United States - can immediately compensate for a shortfall of 17 to 20 million barrels/day.

According to analyses from these Western banks, consequences of the shutdown of the Strait of Hormuz are below:

• Energy inflation: Crude oil and gas prices would soar, affecting household bills, industrial costs and overall inflation. An oil price surge above $120 would trigger a drop in global growth, similar to 1973, 1990 or 2022, claims Deutsche Bank.

• Energy shock in Europe and Asia: Europe is still largely dependent on Qatari LNG, which transits through Hormuz. And for Asia, the closure of the Strait would be a major blow, particularly for China, India and South Korea, according to ING, a Dutch multinational banking and financial services corporation.

• Disruption of supply chains: Beyond energy, Hormuz is also a key axis of global maritime trade. A prolonged closure would increase marine insurance premiums, impacting the prices of imported goods, and delaying many imports.

According to JP Morgan, the situation remains fluid, and the magnitude of potential economic impact is uncertain. However, the impact is likely to be uneven globally.

S&P Global projects substantial economic consequences across multiple regions if disruptions through the Strait of Hormuz take place:

· Middle East: Direct production and export disruptions would immediately impact regional economies dependent on energy revenues.

· Asia-Pacific: The region’s high energy dependency creates a multiplier effect, where initial price shocks trigger broader economic impacts.

· Europe: While less directly dependent on Gulf oil than Asia, Europe would face secondary supply chain bottlenecks and inflationary pressures.

The Asia-Pacific region faces severe vulnerability, with approximately 84% of its crude oil imports transiting through the Strait of Hormuz according to International Energy Agency data from 2025. This dependency creates a significant economic exposure that extends far beyond immediate energy price effects. For example, nearly 90% of Iran’s oil exports go to China. China has relatively diversified oil import sources and large reserves. However, markets such as India, South Korea, Japan, and Indonesia, which rely heavily on Middle Eastern oil, will be more vulnerable.

Higher sustained oil prices would have far-reaching economic consequences in Asia, including China. India, South Korea, and Japan. Even China, with their high dependence on Middle Eastern oil, would see their inflation rates accelerate, their economic growth drop and the price of goods rise because of an increase in energy prices. If rising fuel costs continue, they could be even more devastating for emerging markets in Southeast Asia.

Specifically, India is highly exposed to Middle East energy. More than 60% of its oil comes via Hormuz. A $10 hike in global crude will cuts India’s GDP growth by 0.3% and raises inflation by 0.4%, according to India’s Ministry of Finance. Shipping insurers have already raised premiums by 20%. Cargo rerouting around the Cape of Good Hope adds 15–20 days and significant costs. Indian refiners are holding prices for now, but margins are tightening.

According to Brig Rakesh Bhatia, an India security expert, it’s not just about energy. India’s trade with Iran, especially Basmati rice exports worth ₹6,374 crore in FY 2024–25, faces disruption due to insurance issues and port uncertainty.

According to Amitendu Palit, a Senior Research Fellow and Research Lead (trade and economics) in the Institute of South Asian Studies (ISAS) at the National University of Singapore, the impacts of closing of the Strait of Hormuz or its disruptions on India are below:

• India, which imports about two-thirds of its crude and nearly half of its LNG through the Strait of Hormuz, stands to lose significantly in case of disruption. A closure or disruption in the Strait of Hormuz would spell trouble for India. Nearly 70% of its crude oil and almost 40% of its LNG imports pass through this route, with Qatar alone supplying nearly 10 million tonnes of LNG in 2024. Any blockage could severely impact energy security and prices.

• Energy prices: Surging oil and gas costs could spike domestic inflation, especially in transport and food.

• Currency pressure: Rising import bills would widen the current account deficit and weaken the rupee.

• Sectoral impact: Aviation, logistics, tyres, and manufacturing sectors could face cost surges.

• Though India holds strategic oil reserves, experts caution these are built for short-term supply shocks—not sustained disruption from a regional war.

According to Palit, the major impacts on India result from the escalation in crude oil prices. India is one of the largest importers of crude oil in the world after China, Europe and the United States (US). However, unlike China, which is the largest global buyer of Iranian crude oil, India’s main sources of crude oil are Iraq, Saudi Arabia and Russia, followed by the United Arab Emirates and the US.

Crude oil price rises will impact India’s overall import bill. Though many Indian refiners have long-period forward contracts to purchase crude oil at previously agreed prices, future such contracts entered into now will have to factor in the prevailing higher prices. Needless to say, spot purchases of crude oil, based on immediate requirements, will be at much higher prices.

Higher crude prices will impact domestic prices across the board. Refiners are unlikely to absorb these prices and will pass them on to consumers. Liquefied petroleum gas, diesel and kerosene – all of which are refined petroleum products for common household use, including by low-income families – will become costlier. The multiplier effects of higher prices will be noticeable as energy demand is high during peak summer. Higher prices will also be experienced by civil aviation. Air travel is set to become more expensive as aviation turbine fuel prices go up.

Apart from domestic air travel, international air travel will also become costlier. Air India and other Indian carriers are already taking longer routes by avoiding the Pakistani airspace. Now, more international airlines, particularly the Middle Eastern carriers, will be rerouting their flights to avoid Israeli and Iranian airspace, leading to longer routes and higher prices. This is certainly not good news during the peak tourist season, with Indians travelling to the West, especially to holiday spots in Europe. Apart from flying costs, there are major disruptions for travel agents and tour planners as they will be forced to rework itineraries.

Domestic inflation prospects in India will be aggravated by the sharp escalation in gold prices. Geopolitical volatility never fails to trigger the urge to invest in ‘safe havens’. The tendency is visible through a sharp rise in the prices of the US dollar, and gold and silver. Unless there is a quick resolution of the Iran conflict, precious metal prices will remain high into the festive season, which commences in India in about three months. Consumer pockets and household budgets will feel the squeeze from the cumulative higher costs. For much of India, high prices from exogenous shocks such as the Iran conflict, is clearly not great news in a year when the overall prospects for economic growth are more subdued than in the previous years

Unlike India, China appears more insulated. China has been over-importing crude for months, building strategic reserves of more than 1 billion barrels. Its diversified supply lines from Russia, Venezuela, and the Gulf provide flexibility. However, China has significant Belt and Road investments in Iran and Iraq, including infrastructure and power plants, thereby damaging China.

Taiwan Minister of Economic Affairs Kuo Jyh-huei estimated on 23 June 2025 that if Iran moves to block the Strait of Hormuz, it would cause crude oil prices to rise and subsequently impact Taiwan's fuel prices and consumer price index (CPI). Currently, less than 20 percent of Taiwan's crude oil and natural gas import pass through the Strait of Hormuz. If the strait were to be blocked, ships would be forced to take longer alternative routes, delaying deliveries, causing oil prices to rise, Kuo claims that a 10 percent increase in oil prices would raise the CPI by approximately 0.3 percent.

The ripple effects are already hitting Southeast Asia. As Al Jazeera reports, energy-importing nations like Indonesia, Malaysia, and Vietnam are facing higher shipping costs and insurance surcharges. Bangladesh and Sri Lanka, already under economic strain, are especially vulnerable to energy supply delays and inflation.

For Southeast Asia, this situation would result in escalating costs across various sectors. Energy-dependent industries, including manufacturing, transportation, and logistics, would face soaring operational expenses, which could reduce output and increase consumer prices. The manufacturing sector in Southeast Asia, a pivotal component of regional economic growth, would be particularly adversely affected by rising fuel costs, thereby diminishing its competitiveness in the global market. Additionally, inflationary pressures would undermine consumer purchasing power, dampening domestic consumption and subsequently slowing GDP growth throughout the region.

Iran itself would not escape unscathed. Closing the Strait would choke its own oil exports, which account for 65% of government revenue, risking economic collapse and domestic unrest for Iran.

On the other hand, Europe’s demand for LNG has increased since the Russia-Ukraine Conflict, although reliance on the Middle East has fallen as Europe imported more from U.S. However, Europe remains highly sensitive to energy prices.

Conversely, the U.S., as a net energy exporter, could be less impacted compared to previous oil crises when it relied more on oil imports. However, the U.S. is entering this period from a vulnerable state of increasing risks of inflation and an economic slowdown. It is estimated that a USD 10 increase in oil prices could add 0.3-0.4% to inflation, exacerbating current stagflationary risks given the surge in tariffs. This also complicates the Federal Reserve's (Fed) decision-making. Economic experts still expect the Fed to be slow to cut interest rates, as inflation risks remain larger than unemployment concerns for now.

VI. Conclusion

This paper showed that the blockage of the Strait of Hormuz will increase oil & other energy prices, inflation, and shipping costs, while it reduces economic growth in the world. This paper claimed that these negative impacts will be largest in Asian countries because 84% of the crude oil and condensate and 83% of the liquefied natural gas that transported through the Strait of Hormuz went to Asian markets in 2024.

First published in :

World & New World Journal

Unlock articles by signing up or logging in.

Become a member for unrestricted reading!